Universidad Alberto Hurtado is a public, non-profit institution of higher education with its primary campus in Santiago, Chile. Member of AUSJAL and FLACSI, two large groups consisting of over 200 educational organizations in Latin America, the university has great prestige and offers undergraduate and graduate programs in more than 20 areas of disciplinary areas in the humanities and exact sciences, as well as exchange programs.

Throughout its structure, the institution employs around 500 teachers and serves a community of more than 6 thousand students across its multiple faculties located on two campuses. Confronted with the challenge of providing quality education by effectively managing the resources received from its benefactors, Universidad Alberto Hurtado was looking for a solution to identify the primary cost drivers and allocate investments to strategic areas of the institution.

MyABCM arrives at Universidad Alberto Hurtado at a very special moment. With a structured strategic plan consisting of 13 goals to be achieved by 2030, the institution has chosen our solutions to manage resource allocation and facilitate the achievement of its plans. The goals for the near future include topics in the educational and administrative spheres, such as:

In this context, comprehending the financial collection process and which of your activities consume the most resources “is the initial step in balancing investment distribution and achieving all the strategic objectives within the designated timeframe.

Using MyABCM, Universidad Alberto Hurtado will be able to have a clear view of how resources are utilized in each teaching and research activity. In this way, it can confidently make critical decisions and strategic allocations, investing in resource-needy areas that provide growth potential for the institution and its activities.

It will be possible, for example, to understand how much investment is needed to achieve the goals of new students and campus expansion and to eliminate or adjust possible deficit activities to reallocate resources to them and obtain better results. These resources are expected to support the institution in providing high-quality education while expanding its operations into essential areas.

The agricultural sector ranks among the top three segments contributing the most to the global Gross Domestic Product. According to data published on the Statista website, in 2021, the production of agricultural products came in second after the service and industry sectors, responsible for 4.3% of the entire GDP generated worldwide. In the year, global agricultural production surpassed 1 trillion dollars in the United States alone.

However, even with a large share in the generation of wealth, the sector has been facing increased challenges. Climate change, regulatory acts, high competition, more expensive inputs, and other factors have led to an increase in agricultural production costs all over the planet. According to data from the Food and Agriculture Organization of the United Nations (FAO), the costs of agricultural production worldwide increased by about 70% between 2000 and 2018.

In contrast, the world’s need for food production will continue to grow each year. According to the FAO’s Agriculture at a Crossroads report, the demand for food is projected to increase by around 70% by 2050. This pattern characterizes agribusiness as one of the sectors with the most challenging perspectives for the coming years.

An increase in demand associated with rising costs and the challenges imposed by environmental regulations and global competition requires that agribusiness companies bet on cost control tools and increase profitability, without losing space in the disputed commodities market.

The main sources of costs and the most underestimated costs in agribusiness

One of the most underestimated sources of costs in the sector is that of storage and transportation operations of the production. According to a study published in 2020 in the scientific journal Nature Food, which evaluated losses at various stages of the agricultural production chain, food losses during transportation and storage represent a cost of US$ 220 billion per year for companies in the sector.

This data reveals an important opportunity for agribusiness organizations that need to control prices and increase market demand. Understanding exactly what is the weight of the loss generated by storage and logistics operations within your production chain and in which stages of distribution it occurs is a crucial step to determine actions to mitigate the problem and thus expand your margins without necessarily increasing prices, which are already skyrocketing due to the high input costs.

The other cost centers of each company vary according to the products in its portfolio, the extent of its crops, climatic factors, labor, investment in mechanization, and many other aspects. It is up to each organization to develop methods to identify the different cost drivers and how each one of them impacts the profitability of the business.

As if the losses in the production chain and the rise in input prices were not to mention, agricultural production is facing a particularly complex scenario. As production must be expanded to meet demand in the coming years, food production is expected to become increasingly expensive and difficult.

The sustainability and environmental responsibility requirements will weigh increasingly on the sector, demanding that agribusiness take measures to reduce the negative impact of its activities. The agricultural sector currently accounts for 25% of global carbon emissions (FAO data) and is responsible for half of the world’s soil erosion annually, making 1.3 billion tons of soil unusable each year. For this reason, governmental pressures with new regulations for the sector must become ever greater.

In this context investing in technology and action to reverse these numbers is necessary not only to comply with the regulations but also to enable the continuity of the operations themselves in the long term and to position the companies in the sector competitively as allies of environmental causes. But this comes at a great cost. Adopting less destructive production techniques while maintaining productivity is neither simple nor cheap.

For this reason, we are living in a moment where it is now essential to invest in technologies that allow us to accurately track the various sources of production costs. Organizations that invest in technologies capable of tracking costs accurately and simulating scenarios based on reliable data will be better able to maintain their margins even in the face of rising production costs, taking advantage of opportunities generated by increased demand, and gain the financial flexibility to invest in actions and sustainable positioning without compromising business gains.

ChatGPT has become a topic of discussion, especially in the business world. Entrepreneurs and professionals from various segments tirelessly debate about how it will impact the labor market and how it can help organizations lower costs thereby increasing profitability.

But the truth is that ChatGPT is only the visible portion of a large and constantly developing field that has been already in operation among us for a long time. If we investigate the history of artificial intelligence as they are known today, we will find their origins in the mid-1950s, when technologies such as the Logic Theorist, developed by Allen Newell and Herbert Simon at RAND Corporation in the United States; and the Perceptron, created by psychologist Frank Rosenblatt in 1957.

While the first reproduced human reasoning and problem-solving, even proving mathematical theorems, the second was a network of artificial neurons capable of learning, being one of the main precursors of Machine Learning, which is now the driving force of mechanisms such as ChatGPT.

ChatGPT is a technology based on natural language processing (NLP), which enables it to understand text in multiple languages and generate natural language responses, without the need for specific programming to perform each task. In other words, it literally speaks our language.

And this is part of the reason it causes such a stir. Besides optimizing Web searches (posing a threat to powerful representatives of Big Techs, such as Google), promotes a conversational experience with the machine, without requiring the user to know any programming language. With the liberated access to its technology, those who are not feeling like the protagonist of a science fiction movie are living in the past.

But countless Ais work daily in other functions. In the financial market, for example, there are systems not only based on NLP but also on machine learning, fraud detection systems, as well as robo-advisors and trading algorithms. The latter two stand out because they act directly on transactions.

While robo-advisors offer automated investment guidance based on information provided by investors (being great allies for beginners in the financial market and for those who don’t have time to monitor the scenario), trading algorithms employ market data obtained in real-time to make critical decisions to buy and sell financial assets. This is possible because they are programmed to identify price patterns and market trends, enabling traders to make data-driven decisions and execute trades with much more agility and confidence.

And those who think this is new are wrong. The use of AIs in the financial market began in the 1970s, with systems like INGRES (Intelligent Graphic Reinvestment System). Developed by the investment company Dean Witter Reynolds (now part of Morgan Stanley, a world leader in financial services) it was a pioneer in the industry. By applying neural networks (in a Perceptron-like fashion), it analyzed transaction data and predicted market trends.

INGRA is no longer in use, but today systems like Sentieo, Kavout, Kensho, and Acorns are some of the AI technologies in application in stock buying and selling and investment advice.

Amidst so many fears about information security (and even a possible machine revolution), it is difficult to predict exactly where these technologies will go and what role they will play in our daily lives soon. However, the market expectation is that their use will become more and more massive, as a tool to boost results and reduce costs in the medium and long term.

According to research by Market Data Forecast, the AI market in the financial sector is expected to grow at a compound annual growth rate of 41.2% between 2020 and 2027, jumping from $6.7 billion to $15.8 billion over the period. This is in line with research by Tractica, whose estimate is that by 2025, AI-mediated e-commerce transactions worldwide will exceed $36 billion.

This growth is a result of the increased efficiency produced by these technologies. Nasdaq itself applies AI algorithms to accelerate and reduce trading costs, taking transactions to a new level.

Of course, such an advance would not be restricted to the financial market. Research indicates that the use of these technologies can also benefit companies and that this is why they will also play a greater role in the corporate environment.

According to Accenture, the AIs applied to business management can reduce costs by up to 30% and increase revenue by up to 38% in 16 different segments, such as Education, Food Service, Hospitality, Healthcare, Wholesale, Retail, and Manufacturing, among others. A true springboard of profitability for organizations that invest in these tools.

And businessmen are already keeping an eye on this trend. From a complementary perspective, data from Forbes indicates that by the end of this year, business process automation with AI systems is expected to grow by 57%.

Looking beyond ChatGPT, it is easy to note that the use of Artificial Intelligence has already become a giant competitive advantage aggregator for businesses across all industries. Thus, it’s up to CEOs and CFOs to be on the lookout for ways to get ahead in this race, investing in solutions that can make their businesses stand out from the competition.

With 90 years of history and six production lines in its two factories, Sevam is a world leader in glass manufacturing. To optimize cost management for its extensive portfolio, which caters to large industries in different countries, the Moroccan company chose MyABCM as the solution to replace the previous software, which was discontinued.

Throughout its 9 decades of consolidation in the market, Sevam has acquired customers from all over the world and today exports its products to 12 countries. Among the global organizations served by the products of the Moroccan industry are giants like Coca-Cola, Nestlé, and Pepsi.

To supply the glass packaging needs of these and other major brands, Sevam operates with a diversified portfolio and has one plant dedicated solely to producing this merchandise. This industrial plant alone produces 400 million items per year, including bottles, jars, and jugs, which are exported to different countries.

The second plant, on the other hand, operates exclusively in the production of domestic glassware, such as ornamented glasses, bowls, and lampshades. The production lines dedicated to these products manufacture produces 120 million items annually.

With a focus on excellent customer service and sustainable operations, managing the production of a diversified portfolio that is distributed worldwide is a challenge that requires sophisticated tools. For this reason, Sevam recognized MyABCM as a tool with the potential for profitability and continue growth.

Sevam needed not only a system that could provide optimal cost control functionality, but also an implementation process that would optimize the costing model and centralize its multiple sources of information.

MyABCM was chosen for its ability to provide detailed information for each business activity, while integrating with other company systems, offering consolidated reports and scenario simulation. With these features, among many others, the industry will be able to continue investing in new fronts of activity and safety solutions for its employees and sustainability for its region without compromising its results in the medium and long term.

Learn more about the features of MyABCM. Request a demo in the form below.

The last few months have been marked by high-interest rates and many uncertainties regarding the global economic scenario. The recent bankruptcy of two large American banks has increased tension and the expectation of a possible recession of worldwide proportions.

The bankruptcy of Silicon Valley Bank (SVB) and Signature Bank is for many one of the expected symptoms of an inevitable crisis. But it is necessary to understand what happened in order to assess the possible impact on the activities of other banking institutions.

Located in the Silicon Valley region of California, SVB was one of the leading institutions providing credit to startups and technology companies. It was considered the 16th largest US bank by the Fed (the US central bank) and in 2021 it declared that Silicon Valley Bank was the main financial institution for 50% of venture startups in the US.

According to Alexandre Cancherini in an interview with InfoMoney, the SVB had a large fundraising through deposits. And according to the expert, the response of a bank when there is a lot of liquidity is to give loans and invest in securities.

But as the Covid-19 pandemic slows down investments in many areas, and therefore on credit applications, the bank directed its management to buying bonds. Now, with the increase in interest rates, investors that used to make large deposits are now making large withdrawals.

Cancherini explains that in order to cover the turnover, Silicon Valley Bank was forced to sell many bonds with low returns. In this way, the deficit that led to its bankruptcy was formed. The same phenomenon of bankruptcy was repeated with Signature Bank, which suffered the same fate.

Two major bank failures in such a short time and in an unstable economic environment could trigger a cascading effect that worsens the situation in the markets. With the insecurity in the economic scenario, clients from banks all over the world have started a process of withdrawing their accounts and investments.

A possible massive movement of flight from the banking institutions would inevitably result in the bankruptcy of more banks, causing an implacable domino effect on the global economy. Not surprisingly, President Biden has spoken out on the matter, stating categorically that the deposits of US bank customers are safe.

As Biden put it: ‘The American people can trust that the banking system is safe. Your deposits will be there when you need them.”

In an effort to restore investor confidence in the American banking system, Biden indirectly referred to some of the safety measures implemented following the recession caused by the American housing bubble.

The 2008 housing bubble in the US, known as the Subprime Crisis, impacted countries across the world and had severe consequences for the US, which in 2012 still had a public debt of 103% of its GDP. Therefore, during the recovery the country instituted a series of actions to protect banks, customers, and investors, such as:

In summary, the American system is prepared with numerous instruments to prevent the spread of a crisis throughout its entire banking system. Hence Biden’s request that investors maintain confidence and not withdraw their assets from their banking institutions.

One of the moves that confirm the availability of instruments to prevent further bank failures was the injection of about 30 billion in resources into First Republic Bank. The bailout was provided by a group of 11 US banks, which issued a statement informing that the action reflected the confidence of the institutions in the American banking system.

On the same path, but on another continent, Credit Suisse received support that could reach 50 billion Swiss francs (equivalent to more than 53 billion dollars). The bankruptcy of the institution culminated in its sale, the result of which will be the formation of the largest banking conglomerate in Europe since the Subprime Crisis.

Assuming the scenario stabilizes, and investors keep their assets in the banks where they are deposited, the expectation is that the bankruptcy of Silicon Valley Bank, Signature Bank, and the injection of funds into other banking institutions should not trigger a global recession. should not trigger a global recession.

Providing sanitation and electricity to hundreds of thousands of people is no simple task. But it is the mission that Radees has taken on in Morocco, serving several communities with urban infrastructure solutions essential to the quality of human life.

Responsible for the distribution of drinking water and energy, Radees has just signed a contract to use the MyABCM solution in its cost and profitability management. Assisting in the software implementation process, the renowned consulting and auditing company BDO will be a strategic partner in the project.

With not only a corporate but a social commitment to provide quality drinking water and energy to over 300,000 people, the organization needed a tool to visualize the costs associated with managing miles of infrastructure equipment. Therefore, MyABCM is the chosen software to visualize the multiple sources of costs and the possible impacts of making decisions before subjecting hundreds of thousands of people to them.

The version of the software selected to serve the company offers features for flexible and intuitive multidimensional modeling with a relatively low implementation time. The system will allow allocations to be made through clear visual representations and with the application of business rules at various levels of complexity to allocate values from sources to destinations.

The organization will also benefit from advanced cost-tracking solutions that control resource consumption and pass-through to customers, as well as model summaries that allow potential distortions to be identified quickly and corrected before they damage business results.

To learn more about the solutions that serve Radees and other large companies distributed in more than 50 countries, contact us! Use the form below.

Crises often occur without warning. But this time the scenario is different. With an unprecedented economic and social context, experts predict a worsening instability in the world economy.

The expectation in 2020 was that economies would improve as we recover from the Covid-19 pandemic. However, the prognosis for the global economy through 2024 is not encouraging.

The projections reveal a slowdown in growth even in developing countries (which generally have better rates), with expansion well below expectations. The most recent Global Economic Prospects report from the World Bank indicates a probable global crisis in the face of high inflation, equally high-interest rates, and reduced investments.

World Bank projections indicate that the global economy will grow by 1.7% this year, and by 2.7% in 2024. These numbers reflect a generalized situation that will impact markets on all continents, with low growth expectations for 95% of the first-world economies and approximately 70% of developing economies.

It is estimated that the global economy in 2024 will grow 6% less than the forecasted rate for 2020, the year before the Covid-19 pandemic exploded. In a more alarming context, this data highlights a significant concern for companies around the world: with such a weakened outlook, any adverse event can start a recession.

An increase in Covid-19 cases, military tensions between countries, or banking fragility with the collapse of banks like Silicon Valley Bank and the bailout of Republic Bank and Credit Suisse could be the push that’s needed. Events such as these can cause GDPs to plummet, real incomes to fall, unemployment to rise, and industries to become idle, with companies in various segments experiencing severe crises or even going bankrupt.

Although on a downward trend by the end of next year, inflation will remain above the rates obtained before the start of the Coronavirus pandemic. High inflation, coupled with projections of low economic growth in 2024, is expected to lead to decreased demand for emerging economies’ exports and depreciation of their currencies. Advanced economies are expected to have their growth slowed from 2.5% in 2022 to 0.5% in 2023.

In the last 20 years, declines of this magnitude preceded global recessions (in 2009 and 2020). For the US in 2023, for example, the worst economic performance out of recession periods in 53 years is forecast.

However, some believe that the crisis is inevitable, with or without major global unforeseen events. Tom Simons, an economist specializing in the financial market, predicts that we are entering a period of classic recession.

According to Simons, the rise in inflation and interest rates should lead to a significant drop in organizations’ profit margins, resulting in cost cuts that should begin with a reduction in the workforce. Simons believes that this worsening of the crisis will start from the middle of this year, affecting both advanced and developing economies.

On the other hand, opinions are beginning to split among scholars. The abnormalities of the current economic context may imply a different market behavior, leading to unexpected developments. Mark Zandi, Head of Economics at Moods Analytics, states that the simple expectation of a recession can lead to unexpected results.

According to Zandi, with everyone foreseeing and preparing for the crisis, an unprecedented phenomenon, the picture may develop differently, leading to a cooling of inflation and even a possible drop in the unemployment rate.

The certainty we have is that the crisis is here, after all, levels of economic growth like the current ones historically point to the emergence of another global recession. However, it is difficult to say what the extent of the damage and the impact on the different markets will be.

Thus, managers can only watch interest rates and carefully analyze how economic instability will affect different aspects of their business: from supplier relations to customers’ purchasing power. Only then will it be possible to take specific actions to help preserve margins without compromising production and market positioning over the next two years.

Managing 230,000 hectares of agricultural land across 6 different business operations in 3 countries is no easy feat. This is why Adecoagro turned to MyABCM for solutions to optimize management, control costs, and increase profitability.

With over two decades of experience, Adecoagro cultivates more than just raw materials for different markets; it also cultivates a long history of growth. The company, which was founded in 2002, started its operations with 70,000 hectares of agricultural and livestock production in Argentina.

In 2004, it expanded its plantation by incorporating new lands outside its country of origin, reaching Brazil and Uruguay. In 2005, the company increased its product line by implementing the production of sugar, ethanol, and energy. With its great evolution, in 2011 Adecoagro was listed on the NY Stock Exchange (NYSE). A major achievement that reaffirms the company’s enormous value.

Today, Adecoagro’s main operations include sugar, ethanol, energy, milk, rice, and grain production. It produced 2.7 million tons of agricultural products and more than 1 million MWh of bioelectricity. Throughout its history, Adecoagro’s planting area has increased by over 200% and its focus on growth and excellence in management has led to 2021 revenues surpassing US$1 billion.

Adecoagro continues to surpass its expectations each year. To further drive its growth, the company’s management team has decided to invest in technology to achieve complete transparency and traceability of costs, advanced business simulation capabilities, and most importantly, independence and autonomy!

It is in this scenario that MyABCM will operate. Adecoagro chose our solution to enhance its cost management processes, which were previously performed with difficulty using another tool and could no longer keep pace with the complexities of such a dynamic organization. With full integration with corporate systems, MyABCM will bring several key benefits to the company, including:

This will provide management with a clearer understanding of how costs are distributed throughout the company’s complex operations, from suppliers and distribution channels to other critical aspects of its business. The result will be much greater decision-making capacity and reduced risks, as well as increased profitability of its operations, paving the way for new investments.

Want to learn more about how MyABCM can provide detailed cost control for companies with highly complex structures? Request a Demo today!

Samara Lima e Andrade

Captain Intendant

Head of the Production Division of the Pirassununga Aircraft Farm

This case study aims to present how the Pirassununga Aeronautical Farm (FAYS), a Military Organization based at the Air Force Academy (AFA), employed cost analysis as a beacon for the optimization of management and public spending. The entire project aimed to meet the organizational demand of maturing public management and had as its scope the knowledge of the historical unit cost of assets produced in the fiscal year 2019. The analysis used the ABC (Activity Based Costing) method to prepare the report and sought to serve as a subsidy to assist management in making more assertive decisions to improve public spending.

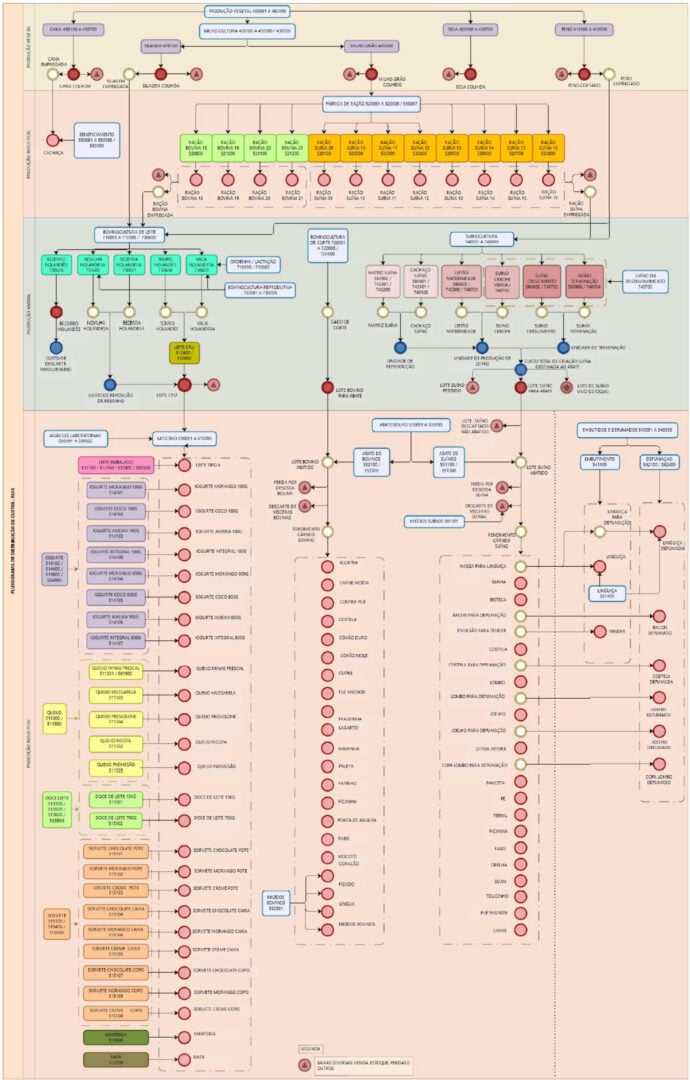

Founded in 1942, FAYS has an area of 6,502 hectares in the State of São Paulo. It is a Military Organization of the Brazilian Air Force, whose mission is the productive occupation of the lands of the Pirassununga Air Force Garrison with agricultural activities, which result in the production of food products sold internally and externally to the organization, according to the Strategic Planning in force.

Public opinion has become increasingly demanding as to the efficiency of public management and the optimization and improvement of public spending, culminating in the strengthening of the cost culture as a promising solution to achieve these goals. In this context, to meet the organizational demand for knowledge of the historical unit cost of assets produced by the Treasury, FAYS has engaged in a survey of the costs of processes and macro-processes developed within the OM, studying the possibilities of tracking indirect costs, to produce useful information to assist management.

The first decision to be made for the preparation of the report was what will be the focus of the cost accumulation system, considering that it can occur either by project or by activity. Project costs must be accumulated by order, and are those related to the provision of services or production of goods linked to specific projects, with scheduled start and end dates; whereas activity costs must be accumulated by process, and refer to activities of a typical nature, which occur continuously. In the case of the FAYS project, the accumulation system by process was applied, setting as the analysis scope date of the Plant Production Unit the period from 06/01/2018 to 05/31/2019 and as the scope date of the Animal and Industrial Production Unit the period from 01/01/2019 to 12/31/2019.

Considering that, unlike the legal practices in the private sector, the choice of the public sector costing method is not restrictive, it was necessary to choose which costing method would be used in the analysis. Taking into consideration that previous FAYS projects have already used the Activity Based Costing method, the ABC method was the most favorable for the execution of this project.

With the costing method defined, the organizational structure of FAYS was analyzed and it was established that the work would be dedicated to the analysis of the primary processes of the entire organization, these being considered those essential for the fulfillment of the institutional mission, i.e., the processes that relate directly to the farm’s production complex, which is divided into three Production Units: Plant, Animal and Industrial. Along with these three units, the commercial aspect of the mission, which is the distribution of goods produced or processed on the farm, makes commercial activities also included under the list of primary processes. For the other non-primary processes, such as personnel management and infrastructure activities, the costs were registered as expenses.

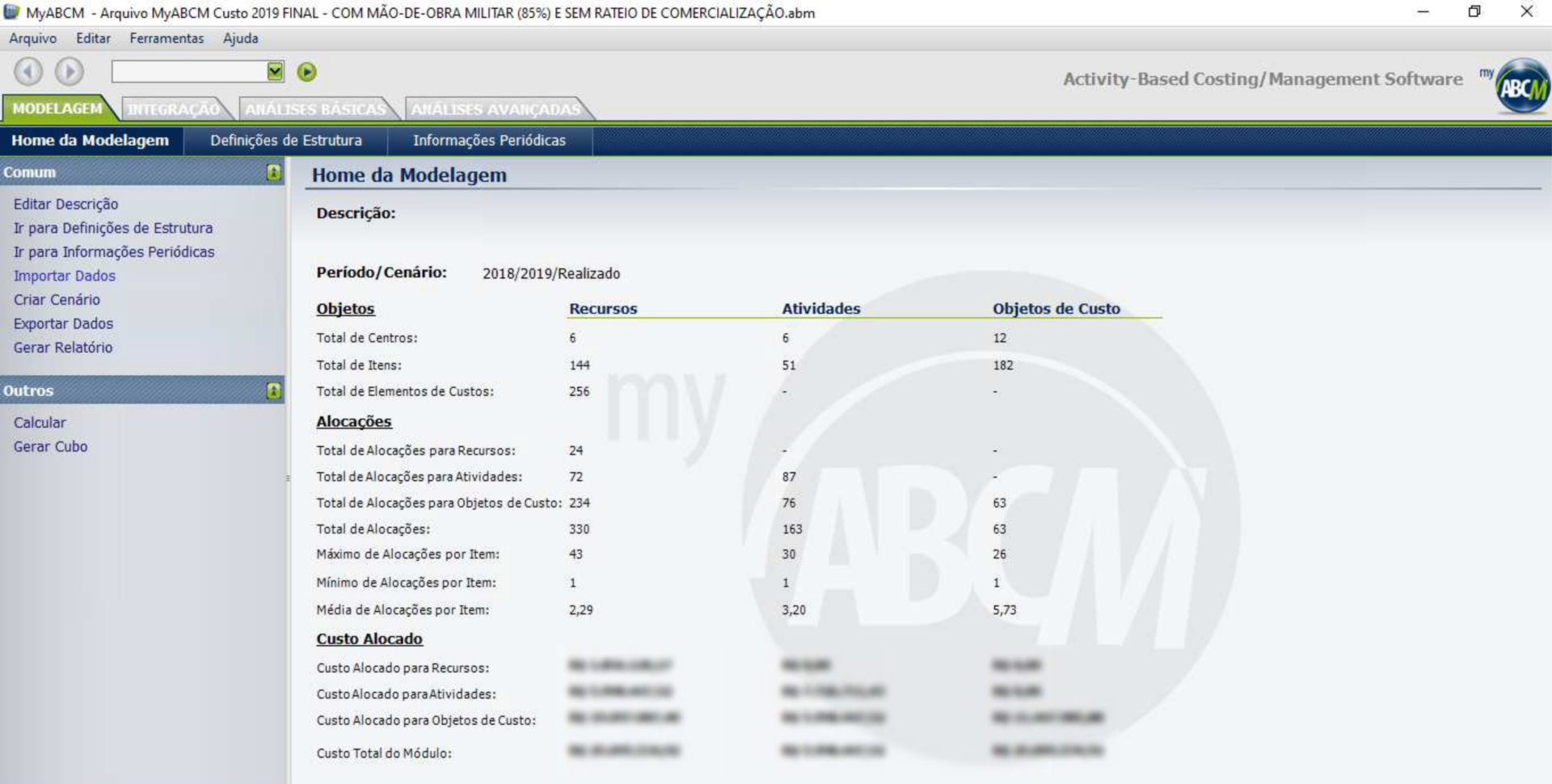

Under the optics of this approach, it became essential, to ensure the continuity of the engagement in the Cost Accounting area with the desired fluidity, the acquisition of a software that could optimize the work required for the project. In this search, a temporary license of the MyABCM software was hired.

As recommended by the Cost Information Manual of the Federal Government (MIC), it is from the development of their own modeling that organizations begin to advance in the cost culture. In this sense, to optimize the analyses and understand the logic of the calculations to be performed, it became necessary to elaborate cost flowcharts (with cost sub-centers) that reflected the interrelationship between the activities that comprised the processes of the FAYS Productive Complex in the referenced scope.

Once the Cost Sub-Centers that reflect the consumption of resources by activities were known and their interrelation understood, it became necessary to calculate the monetary values cumulatively spent in the processes to calculate the unit cost of the objects of interest.

Therefore, the following order of priority was considered for the allocation of costs to the activities and objects of interest: direct allocation (when there is an objective identification of the sacrifice of resources for the development of an activity or an activity for the delivery of a product); tracing (when a cause and effect relationship is sought through the use of drivers); and apportionment (a more arbitrary criterion that should be avoided from the management point of view).

After completing the preliminary steps, the desired result was obtained by processing the application itself. This has the parameter of calculating the Unit Cost by dividing the costs that were accumulated in the allocations, by the “Volume Entered” of each verification object, i.e., by the total quantity of units produced during the period considered.

In this context, to optimize the managerial analyses, “triggers” were created along the cost modeling to enable a certain roll of results based on the same input. Thus, it was decided to name the different compositions to improve the understanding of the coming analyses, which are Basic Cost, Budgeted Cost, Production Cost and Cost Price.

Basic Cost:

Comprised of the consumption of materials used in production, and the settlement of services applied in production activities.

Budgeted Cost:

Comprised by the consumption of materials used in production; the settlement of services applied in productive activities; and the depreciation of permanent assets allocated to productive sectors in the asset controls of SILOMS (Integrated System of Logistics of Material and Services).

Production Cost:

Composed by the consumption of materials used in production; the settlement of services used in productive activities; the depreciation of permanent material allocated to productive sectors in SILOMS; and the labor allocated in productive sectors in SIGPES (Personnel Management Information System).

Its main application is the optimization of the Organization’s horizontal vision, providing an opportunity for process analysis and improvement, using activity performance improvement, and it can also be used as a benchmark for pricing items intended for external sale and the Reimbursable Section.

Cost Price:

Composed of the consumption of materials used in production; the settlement of services applied in production activities; the depreciation of permanent material allocated to productive sectors in the asset controls of SILOMS; the military manpower allocated to productive sectors in SIGPES; and the commercialization expenses.

With this in mind, in addition to guiding public pricing, the valuation of production stocks, the retro-analysis of operational practices employed in the production chain, the promotion of improved performance by managers through benchmarking actions, product reengineering, waste reduction, as well as the feasibility of changes to the current portfolio, the practice of measuring unit costs of goods produced by the Treasury can certainly be employed as a continuous improvement tool for the organization.

From the theoretical approach and the analysis of the results obtained through the implementation of a cost management model using the ABC methodology, it is expected that the proposed objective has been achieved and it is suggested that FAYS continues to pursue continuous improvement in terms of Cost Accounting, focusing on the goals of quality public spending.

With 30 years of history, Quatá, a dairy products manufacturer, impresses with its potential and speed of growth. The company, founded in 1990 in the countryside of São Paulo, started its operations with only 16 employees and a processing capacity of 3,000 liters of milk per day. Today, the company is responsible for more than 1,600 jobs and has a production capacity of around 1.1 million liters of milk a day. The industrial plant has expanded and currently six factories are producing the various goods in the industry’s portfolio, which includes dry and refrigerated lines among cheeses, kinds of milk, creams, zero lactose options, and specialty cheeses.

Growth is undoubtedly one of the greatest goals of any business. However, it is a process that brings with it great challenges. And for Quatá it was no different. The company uses in its management one of the best ERPs available in the market, TOTVS. However, even with all its versatility, the platform proved to be insufficient to offer the level of detail required to control the indirect costs of such a complex industry. Thus, to support the cost management process, Quatá employed in its logistics and distribution areas a costing model partially by absorption and by activities, using Excel spreadsheets.

Even with the association of these resources, the company still had difficulty in visualizing the costs of all the processes accurately and productively. With a varied portfolio and different production methods, one of the biggest challenges was to efficiently measure profitable and loss-making products. In this context, the production of the industry’s refrigerated goods line proved to be particularly challenging. With an almost manual process for manufacturing their specialty cheeses, accurate costing was not an easy task, but it was a must.

MyABCM has provided Quatá with the possibility of implementing a new cost management model, capable of serving all sectors of the business, integrating smoothly with the ERP already in use. The cost modeling by activities (ABC/M) is now applied from the industrial plant, in the Production area, to the Commercial sector (covering delivery, logistics, and customer service) and also in the back office and the correct allocation of the indirect costs of the business.

The company, which does accounting and management closing every 5th business day, uses MyABCM to extract various dimensions of analysis, which are then published at a very high level of detail. Through integration with Power BI, the findings are quickly made available for viewing by the entire company, which can use the data provided to improve the decision-making process.

Quatá is a company that is growing a lot and it is essential to understand where it is making and losing money, so one of the company’s greatest gains was in the diversity of the performance information and its analysis. And the outcome of this process is the empowerment of the management teams, who now have much more control over the business performance, since strategic decisions are taken based on the data provided by the software. Among them, it is worth highlighting the contribution margin analysis, which is now performed by Product, Channel, Customer, Management, Salesman, Representative, and Region.

With this detailed vision, Quatá has gained an important competitive advantage. The tools of the MyABCM solution are also used for Planning and Budgeting, in addition to providing historical budget data and solutions for scenario simulations that are fundamental in pricing studies and in obtaining sophisticated forecasts.

This is another benefit of great prominence for the organization. With the agility of the market transformations in the dairy segment, being ready for all the possible unfolding of the sector facing economic and supply chain fluctuations put Quatá ahead of the competition. And it is not only in preparing for market fluctuations that the resources for costing, simulation, and scenario forecasting have optimized Quatá’s operations. The industry launches several products every year. As such, the previous studies with the application of target costing techniques produced with the support of MyABCM are a fundamental pillar in the decision-making process regarding these new launches.

According to the Controller Manager, Jullian Soares, who was responsible for the implementation of costing in Excel and later led the MyABCM project at Quatá, “The model has to make conceptual sense for the business. Today, we have everything tied to MyABCM: understanding key business dimensions, individual goal analysis… I can say that without MyABCM, it would be extremely difficult today to manage the organization with the agility that it demands.”

It is also important to note that the support of the MyABCM support team was evaluated by Quatá’s board as fundamental throughout this process. Not only for their experience with the platform itself and its tools but also their knowledge in the implementation of the activity-based costing method and expertise with 100% dedication focused on the topic.