Business cost analysis is essential for organizations aiming to grow sustainably and efficiently. Without accurately measuring costs, many organizations end up making intuition-based decisions, which can compromise results.

A great example of the importance of analyzing metrics to ensure results comes from the music world. Before every show, the band Metallica uses Spotify data to select the most popular songs in each city. This way, they create a personalized setlist for that audience, ensuring performances that deeply connect with their fans. This process exemplifies the importance of measuring data to better manage results. It’s no coincidence that the band remains active more than 40 years after its formation, adapting to changes in the entertainment industry and attracting audiences to all their shows.

In the business environment, cost management requires the same level of precision. Knowing exactly how to allocate indirect costs, understand idle resources, and identify the most profitable clients are fundamental steps to building solid growth strategies.

Just as Metallica uses data to shape their performances, companies that invest in business cost analysis can identify the greatest opportunities for improvement. For instance, fixed costs are often allocated generically, leading to distortions and impairing a true view of profitability. Similarly, companies that fail to adequately measure their processes, activities, and business often manage based on feeling, assigning costs as they see fit to each activity, product, or process.

By detailing costs such as sales, marketing, or back-office expenses, these can be directly allocated to the activities and clients consuming them. This brings clarity and allows for precise adjustments in pricing and service strategies, enhancing operational efficiency and profits.

Accurate data as the foundation for strategic decisions

Companies that use advanced tools like MyABCM can transform complex metrics into strategic decisions. The software acts as a “Spotify for cost management,” offering a detailed view of processes, enabling adjustments, and promoting greater profitability.

Just as a band tailors its setlist to deliver an unforgettable show, companies that continuously measure and adjust their costs are better equipped to stand out in the market and serve their clients more effectively.

If you want to transform your management and increase profitability, fill out the form below to learn how MyABCM can help your company measure and manage costs with precision.

Many software providers try to convince managers that Excel has no place in financial operations anymore, but the truth is that it remains a powerful tool. The key isn’t choosing between Excel or cost management software but knowing how to combine the advantages of both.

In this post, we’ll show you how to merge these two tools to enhance your company’s cost management and profitability.

It’s true that Excel isn’t perfect and can lead to significant errors, as studies from major consulting firms have shown. The Association of Chartered Certified Accountants (ACCA) states that 90% of spreadsheets contain critical errors, even though 90% of users believe theirs are flawless. Similarly, PwC reports that 85% of spreadsheets have major flaws, and KPMG cites similar figures, with 90% errors.

However, despite these shortcomings, Excel remains one of the most popular and accessible tools in the business world. Its flexibility and simplicity for calculations and data organization are unmatched, especially for smaller businesses or specific tasks where speed and ease of use are crucial.

Many companies fall into the trap of thinking that adopting management software means abandoning Excel. This perspective is outdated. The ideal approach is to leverage the best of both worlds: use Excel for quick tasks, prototyping, and adjustments, and management software to ensure integrated, secure, and analysis-ready data for your company.

A cost management software like MyABCM can seamlessly integrate with Excel, allowing you to export data from spreadsheets to the system without losing accuracy. This saves time while maintaining the flexibility Excel provides, as well as contributing to an FP&A approach within the organization.

By combining Excel and cost management software, your company gains precision and flexibility. Excel enables quick data organization and ad-hoc analyses, while the software offers advanced tools to monitor financial performance and optimize costs on a scalable basis. With the integration of both tools, you can use Excel to design financial models or adjust data and then transfer the information to the management system for deeper analysis and accurate reporting.

For example, a recent client successfully structured a complete cost model in Excel and, with simple copy-and-paste commands, transferred the data to a multidimensional SQL Server database. From there, they performed more complex analyses in BI systems or OLAP cubes, benefiting from Excel’s speed for prototyping and the robustness of our cost management system for detailed and efficient analysis.

See how to integrate Excel with cost management software to create dynamic financial models and perform advanced analyses with OLAP cubes.

As we’ve seen today, there’s no need to choose between Excel or cost management software. By integrating the two tools intelligently, you can take advantage of the best of both worlds. Use Excel for quick tasks and the software for more complex and secure analyses. This combination optimizes cost management and profitability for your company, providing greater efficiency and agility in financial processes.

Fill out the form below to speak with one of our specialists and discover how integrating Excel with MyABCM can transform your company’s cost management!

If you want to keep your business on the right track, you must stay alert to the traps that can be fatal. Here are 10 foolproof tips to drive your business to bankruptcy—and how cost management can be the key to avoiding these mistakes and ensuring your company’s survival.

If you’re in manufacturing, focus solely on products; if you’re a service organization, focus exclusively on services. Channels and customers are just consequences, and measuring the cost of serving them is an unnecessary luxury.

Many business owners believe that focusing exclusively on products or services means managing their company efficiently. However, this mindset is a major mistake. Cost management also involves controlling how these products and services impact the company’s overall expenses. Effective cost management integrates all aspects of the business, including channels and customers.

These are costs you’d have anyway, so why bother with back-office expenses or indirect costs generated by operations?

Ignoring indirect operational costs may seem like a practical solution, but it’s one of the surest ways to drive your business to failure. Effective cost management must account for all costs, including overhead, and identify where waste occurs.

Buy low, sell high, and pray. Who needs strategy when you’ve got faith?

If you think gross margin is the only important metric, your business might be in danger. Focusing solely on sales while ignoring cost management can lead to misleading results. Proper cost management considers the total cost of production and operations—not just sales.

Maximize cost allocation through spreads, especially based on revenue or volume. After all, if it works to split a bar tab, why wouldn’t it work for an entire company?

Using spreads as a cost allocation method is a quick way to generate significant errors. Cost management should rely on more precise methods, such as ABC costing, analyzing activities that truly impact production and services, ensuring accurate cost distribution across the business.

Need more detail? Add another cost center to accounting. KPIs? Waste of time. Focus on selling more, and if costs become an issue, start laying off employees.

Overlooking process and activity management can be a fatal error. Effective cost management requires analyzing the profitability of each process and activity to ensure efficient allocation of capital.

Moreover, layoffs are not a sustainable cost-reduction strategy.

Cost management is just another IT project. Modeling is a minor detail, and all business rules will be defined by the Systems team.

Relying solely on an ERP for cost management is a mistake. Implementing a cost management system requires customization and cannot be entirely delegated to general management software, which often lacks specific functionality to properly track and allocate costs.

Every company has redundant activities, “inevitable rework,” or processes that “have always worked.” Why change something that’s not broken?

Failing to address duplicate tasks and ineffective processes is one of the biggest traps for a business. Cost management must critically assess and eliminate processes that create waste while focusing on those that bring real value.

Don’t create a communication plan. It’s best to keep the cost model hidden in Controllership and surprise everyone with unexpected charges.

Hiding cost models can lead to negative surprises, especially when costs spiral out of control. Good cost management practices include proper planning and transparent communication between departments, with a more strategic approach following the FP&A model.

The more detailed the cost model, the better! Tracking millions of activities seems like a great idea: you can always consolidate them later. Precision is key, even if it’s overkill.

While accuracy is essential, excessive detail can shift the focus away from what truly matters. Cost management should strike a balance, avoiding unnecessary complexity.

All that matters is being price-competitive and selling in volume. Whether you make a profit or not is just a minor detail. If the budget gets tight (and it will!), go for another round of funding or consider selling a unit, a product line, or even part of the business.

Growing without considering costs is a critical mistake. Cost management must align with pricing and volume strategies to ensure long-term profitability and protect the company’s financial health.

Don’t let your company fall into these traps! Fill out the form below to talk to one of our specialists and learn how to implement effective cost management to ensure your business’s financial health.

When it comes to cost-cutting, laying off employees might seem like a simple and immediate solution. After all, personnel expenses often represent one of the largest costs within organizations.

However, over the years, studies have shown that this practice can cause more harm than benefit in the medium to long term. Layoffs do not solve structural issues and, in many cases, may even increase a company’s costs.

According to The US Conference Board, 30% of companies that resorted to layoffs expecting cost savings saw an increase in expenses. Additionally, 22% of them ended up laying off the wrong employees, leading to the loss of valuable talent and the need to hire again.

Beyond the immediate impact, laying off and rehiring creates an expensive cycle. Deloitte indicates that 75% of companies that laid off employees to cut costs eventually had to rehire for the same positions within a year.

It’s worth noting that these costs include not only the selection and hiring processes but also the training and adaptation time for the new hire, who typically has lower productivity initially. In other words, the initial cost of a layoff (which is already not low) ends up being added to long-term investments to replace an employee who shouldn’t have left.

These figures reflect a concerning reality: layoffs may seem like a quick fix but fail to address deeper operational issues with more significant impacts on business costs, such as inefficient processes and hidden waste. In the end, they may actually generate more unnecessary costs.

McKinsey & Company points out that only 10% of attempts to cut costs through layoffs prove effective after three years. This is due to the fact that, without revising internal processes, companies end up redistributing unproductive tasks to a smaller team, potentially compromising the quality and efficiency of work.

For this reason, companies must focus on identifying which processes add value and which can be optimized or eliminated. Without this review, layoffs only exacerbate problems, placing an even greater burden on remaining employees.

A study by The Economist highlighted that companies surviving crises are those that know where not to cut costs. They prioritize strategic areas that ensure customer satisfaction and maintain processes that generate value. In other words, the secret isn’t in layoffs but in improving efficiency and ensuring that resources are being used wisely.

Instead of turning to layoffs as a cost-cutting solution, companies should focus on efficient cost management by analyzing processes, eliminating redundant activities, and keeping customer satisfaction a priority. The key to success isn’t cutting staff, but optimizing operations and allocating resources (including human resources) more strategically.

Want to find out where to cut costs without laying off employees? MyABCM can help. Fill out the form below to learn more!

Organizational management is a vast and complex field, and the diversity of software available to support operations is remarkable. Each type of software plays a unique role, serving specific needs. Therefore, MyABCM stands out as a specialized solution that excels in addressing specific challenges of cost and profitability management in companies, not as a substitute for BI tools, despite having embedded BI to benefit companies without a BI solution.

While BI generates dashboards that merely compile and display information obtained from other software and data sources, MyABCM processes and transforms information cubes, cross-referencing and calculating from various sources to then generate new data that can serve as a basis for cost and profitability management, providing vital reports for decision-making. Thus, it plays a more strategic role, offering features that enable understanding the actual costs of the business across different dimensions, such as channels, customers, activities, and specific products, etc.

In other words, the goal here is to minimize the use of cost allocations throughout the organization and, consequently, eliminate the terrible distortions linked to these allocations that can be very dangerous for companies, impacting various managerial decisions on pricing, sales commissions, discounts, etc.

A BI, on the other hand, seeks existing data in the organization such as Accounting Accounts, Production and Billing Volumes, periods, and others, and presents this information in an organized and didactic way. However, note that here there is no transformation of information, and therefore, the allocations continue to occur. For this reason, Prof. Bala Balachandran from Kellogg University in the United States often comments that “these increasingly sophisticated BI systems allow extremely misguided decisions to be made very simply and quickly!” which is a danger!

Let’s see an example:

Imagine a factory that produces various products from the same raw material: plastic. The ERP records data such as the value of input purchases, payroll, accounting entries, production and billing volumes by product and customer. Potentially, we have here a flawed cost model, since allocations were used for the costs of support areas and, although we know precisely the billing customer by customer, this information is of little use when we want to understand the result customer by customer, after all, we do not have information on the “costs of serving”, we did not allocate marketing and sales expenses for these customers and channels and we do not even know to which areas the IT expenses are being allocated in the organization.

MyABCM, in turn, allows for a sophisticated modeling of costs and profitability, which essentially consists of designing a structure where the various accounting accounts of the company are allocated using allocation criteria that make sense and respect a cause-and-effect relationship through multiple levels until reaching the dimensions necessary for the client to manage their company. These dimensions may include Products, Customers, Channels, Markets, Projects, Businesses, Segments, etc., and also include the costs of support areas. In this way, we have a complete snapshot of costs with full traceability that allows managers to make the best business decisions based on facts.

And if you already have or intend to use a BI, do not worry. MyABCM integrates with all of them.

MyABCM stands out for its ease in the process of construction and data loading in the cost modeling structure. While BI software generally requires complex and extensive configurations, MyABCM is a ready-made calculation engine that requires only parameterization, without the need for development, simplifying implementation.

MyABCM has a robust calculation engine, optimized specifically for the requirements of cost and profitability management. Designed with a specialized distribution mechanism, it is capable of in-memory calculations, optimizing appraisal time.

The scenario-building function allows users to create and explore various hypotheses, providing a broader view of the financial implications of different situations.

Within the scope of scenario simulations, we have another important differentiator of MyABCM: push and pull simulations. The push simulation involves the sequential propagation of changes in variables throughout the model, to understand what the final result would be if some variables were changed. The pull simulation, on the other hand, goes back to identify the initial conditions necessary to achieve specific results, identifying bottlenecks and capacity constraints, and acting as a true sophisticated planning component in organizations.

This approach provides a deeper insight into the financial implications of different scenarios, allowing not only to anticipate changes but also to retroactively understand the factors that led to certain outcomes. This capability goes beyond the possibilities of BI’s, which do not perform such detailed and sophisticated analyses.

MyABCM offers detailed cost monitoring in different contexts, including Actual, Budgeted, Standard, and Goal, providing a holistic view of financial performance.

MyABCM is the only solution on the market that manages reciprocal costs in all modules and with optimized performance at the computer processor instruction level, an essential resource in interdependent organizational environments. By allowing allocations between sectors that share services and resources, MyABCM offers a more accurate and realistic view of costs.

As an example, imagine here that the IT area works for HR and also for Production; already the HR area also works for IT and for Production; note that between HR and IT we have a simultaneous cost allocation that must be calculated in order to avoid distortions in costs – MyABCM deals with this transparently and with extreme agility.

This process goes beyond the cost calculation tools offered by BI’s. The ability to handle interdependencies between sectors, essential for the financial health of the business, is not contemplated in BI’s, precisely because it does not align with their objectives.

BI software is powerful in generating reports. However, they depend on other tools to generate advanced calculations for cost management. MyABCM, on the other hand, offers the ability to create specific reports, tailored to the needs of cost and profitability management of the organization. This allows for a more in-depth and targeted analysis, optimizing the decision-making process.

Moreover, MyABCM offers integrations with other systems, such as ERPs and BI’s themselves, facilitating use in conjunction with various tools employed in the organization.

Ultimately, when choosing between BI software and a specialized solution like MyABCM, organizations should consider their specific needs for cost and profitability management. With its focused approach, advanced functionalities, and ability to provide precise insights, MyABCM stands out as a strategic choice for companies seeking more accurate and efficient financial management.

Learn more about how MyABCM can help your organization. Fill out the form below and talk to our experts!

Cost management is an essential but often complex discipline that challenges both students and business administration professors. Going beyond theory and showing how the process is done in the reality of an organization may not be an easy task, but it adds value to teaching and helps prepare students for the realities of the job market.

Therefore, we have developed our academic program with the aim of promoting good practices in cost management and helping educational institutions prepare their students for professional life. See what Professor Alex, who uses MyABCM at Universidad Católica Boliviana San Pablo Regional La Paz, has to say.

“Over the past few years, I have been using MyABCM to teach cost management to my students. This program has completely transformed the way I present and analyze cost information in the classroom.”

One of the key features of MyABCM is the ability to create customized cost models that simulate real businesses. Professor Alex emphasizes, “I can configure different costing systems, such as job order costing, process costing, and activity-based costing. This allows students to experiment with different costing strategies and understand the financial impact of each decision.”

MyABCM stands out for its intuitive interface and ease of use, even for students with little experience. The Professor emphasizes, “The platform generates automated reports and charts that facilitate the analysis of results. This helps students develop critical thinking skills and interpretation of accounting data.”

In summary, MyABCM has significantly improved the effectiveness of Professor Alex’s classes. He highlights, “It allows students to learn by doing, rather than just reading texts and abstract theories. I would definitely recommend this innovative software to any cost accounting lecturer looking to make their classes more interactive and engaging.”

Professor Alex’s testimonial highlights the transformative impact of MyABCM on cost accounting teaching. By providing a practical and interactive experience, our platform not only simplifies complex concepts but also inspires critical thinking and prepares students for the challenges of the professional world. Together, we are raising the standard of cost management teaching, empowering the next generation of financial professionals.

In the dynamic landscape of education, innovative tools play a crucial role in enhancing teaching. In this article, we delve into the experience of Professor Laura Ghezzi, a Certified Public Accountant with a degree in Administration, who chose MyABCM to enrich her classes on Costing and Activity-Based Management.

Professor Laura Ghezzi shared with us why she chose MyABCM for her classes: “In the Costing and Activity-Based Management course, the professors were already familiar with the MyABCM tool from previous implementations in professional development and its previous academic use. This made it the first choice when thinking about a tool that demonstrates the application of the specific theme of the course.”

One of the main contributions of MyABCM to Professor Ghezzi’s classes is its ability to provide students with a concrete view of the implementation of ABC costing in business practice. “Being able to observe firsthand how the ABC system is implemented in real life is very enriching for students. This allows them to have a concrete idea of its application and the possibilities for subsequent analysis based on the data loaded into the software.”

When asked how MyABCM supports the teaching and learning process, the professor emphasizes: “In the course, we navigate directly through the tool in a case application in one of the classes. In another, we show the different tables and graphs obtained for the analysis of information for decision-making.”

Professor Laura Ghezzi’s experience highlights MyABCM as an essential tool in her cost management teaching process. By providing a practical perspective on ABC costing, MyABCM not only enriches students’ learning but also offers a tangible approach to understanding and applying concepts.

Professor Ghezzi’s commitment to choosing a tool that not only meets academic needs but also has practical application in the professional world positions MyABCM at the forefront of business management education.

Entel, a leading technology and telecommunications company, is transforming its cost management with the assistance of MyABCM. The organization, with operations in Chile and Peru, is renowned for its more than 20 million mobile subscribers and an extensive fiber optic infrastructure spanning approximately 11,000 kilometers, ensuring the continuity of interurban and international communications in both countries.

With the growing expansion of its services, technologies, and coverage areas in recent years, Entel has faced significant challenges. Managing an increasingly vast volume of cost information became essential, as well as providing an integrated and agile view of this data for relevant departments and decision-makers.

In response to this need, the company sought a solution capable of optimizing cost management and enhancing the traceability of cost information across its various activities.

The solution came in the form of MyABCM, chosen by Entel for meeting its specific needs. Firstly, it offered the ability to trace costs to the most granular levels, providing a detailed view of cost sources in all company operations, linking them to relevant service revenues and offering a precise visualization of the organization’s cost structure.

Furthermore, the tool provided users with the autonomy to explore and use its functionalities. This reduced dependence on external support and facilitated integration with other technologies used by the organization.

Another benefit of MyABCM was the agility in consolidating data and generating reports. With it, Entel accelerated the processing of analyses and data availability, making access to information faster and more efficient. This provided a clear and immediate view of costs, enabling more informed and agile decision-making.

MyABCM also brought greater transparency and reliability to the obtained data. The solution eliminated dependence on spreadsheets and ensured the integrity of cost information, essential for effective management.

By centralizing cost information and reducing the time needed for analysis issuance, Entel gained greater autonomy in operating its cost model and obtaining analyses. With the support of MyABCM, the company is charting a successful path in cost management and making strategic decisions for the future of telecommunications in its coverage region.

Almost 30 years ago, in February 1997, the main headline of Forbes Magazine featured an article by Prof. Srikumar S. Rao from Columbia University, which showed that the lack of control over rising indirect costs could bring organizations to an end.

In the article, Prof. Srikumar cited the real example of a giant American company that found a growth opportunity with the bankruptcy of its main competitor. However, contrary to what it expected, it started making losses instead of increased profits!

Upon further investigation, this company surprisingly discovered that its “flagship” product was unprofitable, and other products it considered unprofitable were, in fact, the most profitable ones for the organization. This happened due to a poor allocation of indirect costs.

How could such a large and intelligent company make such a basic mistake? It was revealed that the organization was allocating depreciation and other indirect costs based on the direct labor cost.

A product that consumed 20% of direct labor also ended up taking 20% of depreciation and overhead costs. However, there was a major flaw here: labor doesn’t depreciate, machines do.

In areas where there is high labor consumption, less machinery is usually required. The moral of the story: products that consumed a lot of labor should have received less depreciation and overhead costs – exactly the opposite of what was calculated.

The danger lies in the fact that direct costs are easy to appropriate: it’s straightforward to know, for example, how much raw material is used in a product or how much cash is in a specific bank account. But what about indirect costs? How do we allocate them correctly and coherently, respecting a cause-and-effect relationship?

A failure in this process, in the medium and long term, is often the cause of business ruin. Improperly allocated indirect costs can be detrimental to your business.

It’s crucial to exercise caution with any cost modeling that mechanically allocates indirect costs.

And remember: depreciation is just one of many indirect items! Indirect costs can include everything from toilet paper in the bathroom to IT, HR, and support area costs. The “lazy” solution is to allocate them proportionally to production volumes, transactions, or revenue.

To complicate matters, these indirect costs are becoming more significant for several reasons. Among them, we can mention an increase in automation, which entails a clear “replacement of people with machines.” Additionally, the growing diversity of products, services, customers, channels, suppliers, and machinery (i.e., increased business complexity) results in higher indirect costs due to the increased administrative effort – the management effort needed to handle this complexity.

Historically, these indirect costs only increase. Consequently, the distortions caused by arbitrary apportionment also increase. It is common to find situations in companies where a product, believed to be the “flagship,” is unprofitable. On the other hand, products considered unattractive are often the most profitable for the company, responsible for maintaining the company’s margins in the black.

Imagine three friends decide to go out for dinner. The first one is on a diet and orders a salad with mineral water. The second friend orders a delicious steak with wine, and the third orders lobster with sparkling wine and dessert. At the end of the dinner, they split the bill equally among the three friends.

Does this splitting seem fair to you? It is easy to identify and even find these distortions absurd. However, these distortions happen every day in many companies worldwide!

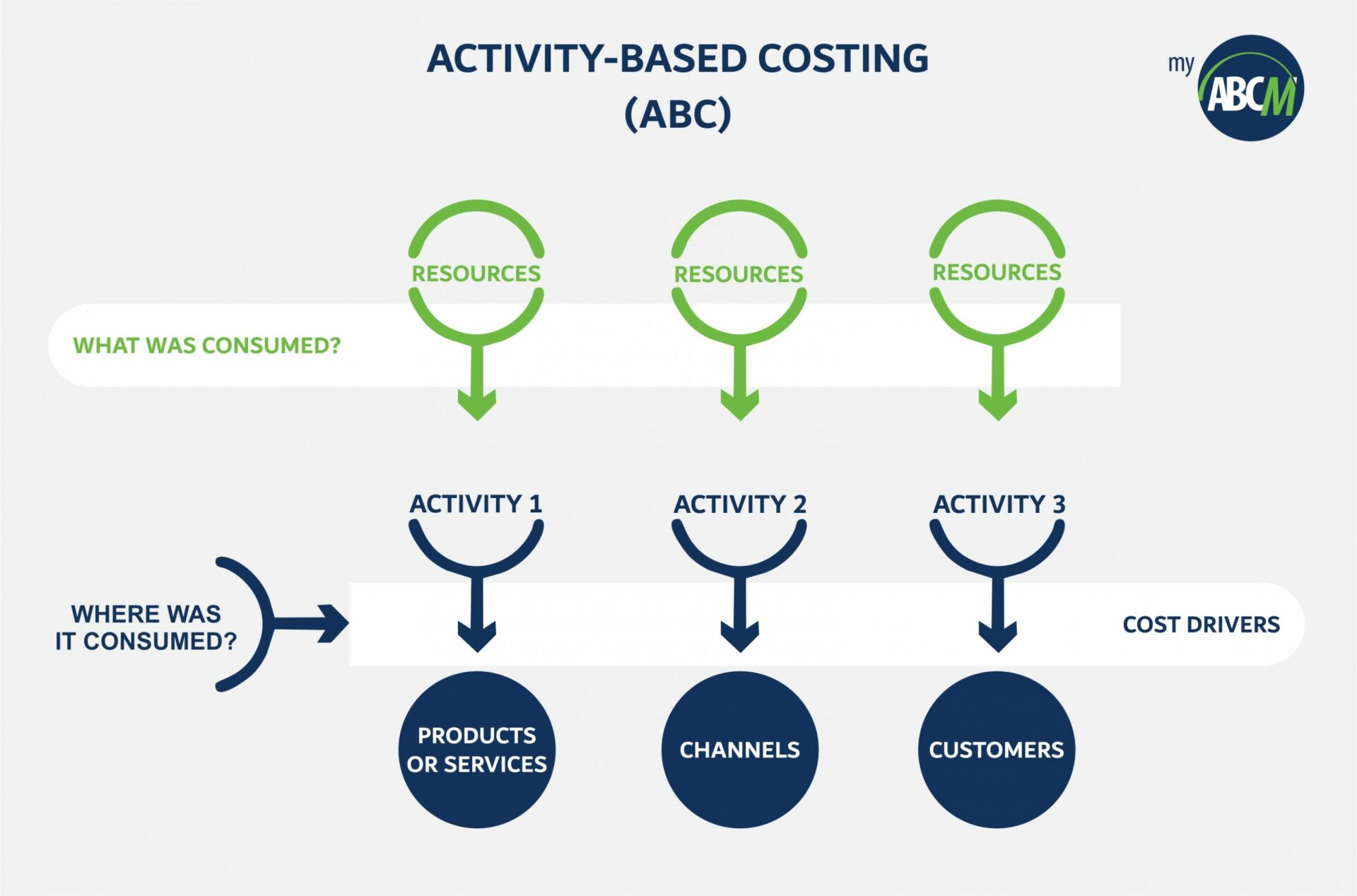

Now, if you were to ask for separate bills for each friend, where each one pays only for what they consumed, we’re talking about ABC, “activity-based costing,” which potentially eliminates these distortions in organizations and adequately addresses these indirect costs.

With some practical examples, it’s easier to visualize the weight of indirect costs and understand how activity-based costing allows us to identify and allocate them more accurately.

Take a simple billing activity: its total cost consists of the combined salaries and benefits of the people involved in this activity.

Traditionally, this total cost would have gone into a pool of “general expenses” to be arbitrarily allocated. However, with ABC, you divide this value by a non-financial measure, such as the number of invoices generated Thus, you obtain the cost per invoice. Count the number of invoices generated per product, multiply by this value, and allocate it to each product – this is the value of the “Billing” activity for each of your products. In addition to eliminating distortions, we achieve an important KPI (key performance indicator) for business management: the value of invoicing per issued invoice.

With this data, cost reduction studies, possibilities for outsourcing, and even monthly monitoring can be applied – something that simply would not be possible before activity-based costing.

The cost of this activity relates to the HR department’s effort specifically involved in hiring employees. It must be separated from other activities, such as payroll processing, employee evaluations, training, etc.

Suppose that, in a given period, 10 people were hired. Out of these, 5 were for Production, 2 for Maintenance, and 3 for Sales. Therefore, the costs of this “Employee Hiring” activity should be distributed as follows: 50% to Production (which will subsequently be allocated to products, also by activities), 20% to Maintenance, and 30% to Sales.

Apart from being able to allocate the costs of this activity, we obtain a critical KPI for decision-making: the cost of hiring per employee – this value can be compared with the monthly expenses of the previous months, the company’s target, or even the cost of outsourcing this activity.

The potential here is not limited to indirect costs! Several direct costs, for example, production or customer service costs, can (and should!) be broken down by activities, as we will see in the examples below:

Imagine you work in a manufacturing company and have been tasked with cutting costs by 10%. What would you do?

The natural path here is to try to understand which actions you would implement for this cut, and for this, it is essential to understand how costs are currently distributed.

With a lot of creativity, some possible options to reduce costs could include:

Note that all these cost reduction options are linked to the information provided by the company. And since the only managerial information we have is the amount spent on these costs and expenses, we are limited to actions related to this!

Now… imagine for a moment if these same costs were broken down by activities, considering their direct and indirect costs. Some of them would undoubtedly include:

Note that some possible actions now include:

Notice that instead of focusing on specific expenses, we are now also managing by activities, understanding how much each one contributes to the company’s results, proposing improvements, and conducting much more efficient management.

Now, imagine the same previous example, but applied to a bank and with an activity breakdown as follows:

After calculating the activities, including the correct assessment of indirect costs, it was discovered that the “Credit Analysis” activity cost $900,000 per year. If the total number of analyzed credits was 3,000, we can understand that the cost of each analysis is $300.

The first question to ask is: what is the value of each credit analysis? This is because the cost of the process is often more expensive than the actual cost of the credit being granted!

next, it is essential to consider ways to reduce these costs. Out of the $300 for each credit analysis, it was discovered that $50 was spent only on employees’ overtime while entering the credit requests into the bank’s old credit system. This specific task of entering requests could be outsourced for $10 per credit. With just this activity, a cost reduction of $120,000 is achieved.

Other options include rethinking the entire process, digitizing the requests, and even benchmarking between units to try to improve. And mind you, we are talking about a single activity. Learn more about how to develop a cost-reduction project.

Imagine this potential now applied to all the activities in your company – the possibilities are infinite!

While arbitrary allocation of indirect costs can be fatal for a company, accurate allocation can lead to significant increases in profitability through cost cuts based on precise data.

Just like the companies in our examples, your organization can also benefit from cautious and safe cost reduction by observing the costs of each activity in great detail to expand profit margins.

Fill out the form below and find out how!

ABC costing analyzes costs related to each activity in product manufacturing or service execution. Resources are allocated based on these activities to different products, services, markets, etc., providing a clear view of the company’s costs. In this way the company gains a more precise understanding of how each activity impacts operating costs, enabling better profitability management.

Studies and documentation indicate that large US industries used some form of ABC costing in the 1950s. However, the methodology only really became known with the dissemination and popularization of the studies of Professors Robert Kaplan and Robin Cooper in the United States in the early 90s.

These two professors identified that, for several reasons that we will present later, the method used to cost the various products and services no longer reflected the reality of what occurred in organizations, causing great distortions and greatly damaging the results of companies.

In their studies, Prof. Kaplan and Cooper identified 3 independent and simultaneous factors that justified the implementation of ABC costing:

Previously, direct labor accounted for around 50% of total product costs, with materials and raw materials at 35%, and overhead at 15%.

Nowadays, overhead can reach up to 60% of product costs, with raw materials at approximately 30%, and direct labor below 10% (in Service and Government organizations, overhead is even higher).

While using direct labor hours for cost allocation might have been acceptable until the mid-20th century, it no longer makes sense in today’s cost structure.

The number and level of competitors have changed significantly over time. Consequently, many organizations have experienced declining margins year after year, making efficient cost control extremely important.

In this context, implementing the ABC costing methodology enhances cost control, leading to increased competitiveness and improved profit projections.

The cost of implementation and measurement has significantly decreased due to the advancement and widespread accessibility of information technology. In the past, implementing an effective ABC costing system was prohibitively expensive and feasible only for companies with access to large applications running exclusively on mainframes and large computers.

As computer technologies advanced, the methodology became accessible to a broad range of organizations. Thus, the main reason why this costing system only became popular at the time of the publications of professors Kaplan and Cooper was the advance of computer resources (hardware and software). These technological advances allowed the system to move from theory to practice, especially in the implementation of cost models in more complex organizations that required greater detail.

The missing trigger for this popularization coincides with the emergence of mini and microcomputers in the late 1980s and the development of graphical software interfaces through the Windows (Microsoft), OS/2 (IBM), and Mac (Apple) operating systems.

In this way, applications that had previously been intended only for use on mainframes and large computers could be implemented in any organization, making them accessible to the various users and departments of a company.

Thus, today, many organizations have successfully used ABC costing in various segments, such as manufacturing, government, services, telecommunications, banking, logistics, etc. Its use, contrary to what many imagine, is not limited to large corporations, but can also be implemented in medium and small companies, whether public or private. Here, we’ll provide you with comprehensive information about this system, its benefits, and the implementation process. Take a look!

Traditional costing systems have emerged mainly to meet tax and inventory valuation requirements. However, these systems have several flaws, especially if used as management tools.

Traditional costing methodologies focus on the company’s various products, apportioning total costs to them based on the assumption that each item/SKU consumes organization resources in proportion to the volume produced.

In this way, the various “volumetric” drivers such as a number of direct labor hours, machine hours, and raw material value are used as cost allocation criteria to settle overhead costs.

However, this approach results in figures that only reflect an average estimate. Despite the complexity of the calculation, it doesn’t precisely align with the specific characteristics and processes of each company.

These volume-based drivers also fail when dealing with diverse product shapes, sizes, and complexities. Additionally, there is no direct relationship between production volume and the efforts or costs consumed by the organization.

As a result, many managers of companies providing diversified products and services, when applying these traditional models, are making extremely wrong decisions regarding prices, product and service mix, and even processes.

Unlike traditional costing systems, activity-based costing centers on the organization’s processes and activities. It also provides special attention to often overlooked aspects in companies, such as the cost of different customers, channels, markets, and regions – essential for making accurate decisions.

In the beginning, costs from each activity are tracked within the company. Then, these costs are allocated and analyzed to determine how each activity impacts the final costs, enabling a precise assignment of expenses.

Thus, the various costs are allocated from the various activities to the various Products, Customers, Channels, etc. based on the use of these by each activity of the organization. In this way, overhead is allocated appropriately, always respecting a cause-and-effect relationship and not using “volumes” as the basic apportionment criterion.

Once the activities have been costed, the organization can begin to manage them, frequently questioning why each one is influencing or impacting the costs of the various products, customers, channels, and services in the company. With this system, the costing process becomes more accurate and precise at the same time.

What makes this costing model an extremely efficient methodology is something that starts with the way of thinking about cost. What was treated by other models as an indirect expense linked to a product becomes a direct expense. The focus then becomes the activities performed, not the products that come from them.

The crucial aspect lies in recognizing that each product, service, customer, or channel results from a variety of activities. Treating them individually enhances the description and conversion of their specificities into more accurate values.

The effectiveness of this costing methodology relies on its capacity to establish logical traceability for expenses. As it’s not bound by the temporality of each process, ABC costing can identify and assign each expense to a specific activity.

In this way, even if certain expenses are grouped under the same cost center, they will be organized according to the activity to which each one is linked.

This optimization of cost control delivers multiple benefits to the company across various sectors, as we’ll demonstrate below.

There are several advantages to implementing ABC costing in a company, extending beyond accurate cost definition for products, services, customers, and channels.

Below, we will describe some of the most important ones to highlight how this methodology enhances the company’s profitability and empowers managers in decision-making.

After creating a model with studied cost allocation criteria and defined future implementations, decision-makers gain access to better and more precise information.

This improves the company’s planning and decision-making processes. Managers gain more power in forecasting future profits and expenses and have well-founded arguments for effective decision-making, including product and service pricing, product mix, outsourcing or internalization choices, research and development investments, automation, marketing, campaigns, and more!

In this item, we can mention not only the collection of more transparent data on expenses in each sector but also a review of internal controls and greater visibility of each process.

With comprehensive information about various processes and their impact on Products, Services, Customers, and Channels, the company can make more confident decisions. Managers gain additional tools to manage team expenses and access data for auditing and expense analysis.

With a clear understanding of activity costs, managers can base decisions on business processes and activities. Moreover, by assigning “labels” to mapped activities, they can analyze which ones add value and which ones do not, for instance.

Describing the specificities and costs of each process enables a multidimensional analysis of expenses in each activity, from a global perspective to detailed visualization of each activity’s cost and its impact on profitability. This identification allows adjustments to reduce unnecessary expenses and revise planning to align with actual costs.

Achieving an increasing cost reduction, then, becomes only a matter of time, as each manager will have access to more accurate information to analyze these processes.

Additionally, it’s essential to note that the methodology’s effectiveness in controlling expenses makes it efficient for both small and large companies, regardless of their area of operation.

The implementation of an ABC costing system may seem complicated and will vary slightly depending on the size and complexity of each company’s activities, products, and services.

But to facilitate the process and enable the implementation of the ABC methodology to be carried out effectively, you can use the steps listed below as a reference.

They apply to all sizes of companies and business models, helping to create an activity-based budget and promoting greater control over the organization’s costs and profitability.

Sophisticated cost modeling demands a dedicated system. While some companies use spreadsheets for costing, others attempt ERP customization or believe BI can address management costing challenges.

However, the auditing and consulting company Ernst & Young (EY) does not recommend any of these options. According to EY, “Model development can be performed in Excel, Access, or even in-house development, but this can only be done for very simple models and even these simple models will present severe restrictions when more elaborate analysis is required. Not to mention specific issues of integration with existing systems, traceability, auditing of the model, and the security of the data itself.”

As for ERP implementation, we know how expensive and complicated it is to customize these systems. In addition, they provide a static and plastered view, which does not provide the flexibility required by such an implementation.

As for BI systems, these are platforms for presenting the information that already exists in the organization. But as we know, such cost modeling requires deep transformations from the point of view of allocations, including reciprocities and understanding of costs at multiple levels and dimensions, something not so easily or virtually impossible to implement in a BI.

By addressing these practical implementation issues, the MyABCM product suite stands as the global leader in managerial costing solutions. Offering multidimensional analyses, it empowers organizations to model, analyze, and simulate with great flexibility, security, and, most importantly, full integration with corporate systems.

It is crucial to determine the objectives of an ABC costing project. Does it aim to determine costs for Products only? What about Customers, Channels, Markets, Regions, or Projects? Defining clear project objectives is essential to avoid mid-project changes in assumptions.

Additionally, creating an implementation agenda is crucial, including defining the desired depth of the project, possible criteria, ideals, and implementation milestones.

Efficient implementation requires intelligent activity mapping. In such projects, managers often aim to map hundreds, thousands, and, at times, tens of thousands of activities, sometimes even at the task level.

This is an attitude of great inefficiency, since by mapping many activities, the effort will certainly be too great to result in a small benefit, especially for those activities that are not very relevant. In addition, modeling too much complexity in the first round makes the initial integration of the model with corporate systems a major challenge.

“Best practices involve modeling in stages, increasing complexity as the model evolves while considering the relevance of the mapping. As noted by Cost Management expert Gary Cokins, ‘Organizations must assess their performance in what is crucial and relevant to the business.”

Here it is necessary to define the initial costs, expenses, cost centers, accounting accounts, possible groupings (Cost Pools) to be established, and Revenues that will be the initial Resources to be allocated.

This part of the planning is important so that each Resource is linked to a process and this is identified according to its relationship with the activities linked to a product, service, customer, channel, or project.

After defining Resources and Activities, establish cost drivers and the criteria for their utilization.

In this way, the calculation process will make sense, as there will be a link that represents a cause-and-effect relationship between sources and their destinations.

Once the model is defined, it is time to calculate it, generate simple and complex cubes (which will later support the various analyzes through dynamic tables), and create a system that allows simple and advanced simulations (what-if).

By applying and analyzing reports, it is possible to evolve the system, effectively tracking an increasing number of relevant activities for the company.

Implementing an ABC costing system provides better control over the organization’s costs. The methodology develops precise cost tracking and allocation models, identifying values associated with each process and activity, and their impact on company profitability.

This enables an efficient activity-based management system, facilitating resource reallocation and structured cost reduction, promoting high profitability even in a highly competitive environment.

Moreover, the system empowers confident decision-making, providing secure pricing and comprehensive analysis and control of products, markets, channels, customers, etc.

Thus, its implementation culminates in greater profitability in the medium and long term, thanks to a detailed view of organizational processes and the resulting increase in the company’s competitiveness.

By considering the tips in this article, you can efficiently implement the activity-based costing methodology, leading to continuous growth for your company.

In this context, MyABCM software is specially designed to offer activity-based management, enhancing cost control and business profitability.

Hence, employing a system like MyABCM solution surpasses the activity and cost management capabilities of other software. The systems are tailored to address the specificities of businesses of all sizes, offering resource allocation in multidimensional analyses that cover all relevant company activities, adapting to various complexities, and ensuring the constant evolution of costing models.

Interested in learning more about our solutions and how ABC’s costing methodology can boost your business profitability? Fill out the form below to get in touch with our experts!