Universidad Alberto Hurtado is a public, non-profit institution of higher education with its primary campus in Santiago, Chile. Member of AUSJAL and FLACSI, two large groups consisting of over 200 educational organizations in Latin America, the university has great prestige and offers undergraduate and graduate programs in more than 20 areas of disciplinary areas in the humanities and exact sciences, as well as exchange programs.

Throughout its structure, the institution employs around 500 teachers and serves a community of more than 6 thousand students across its multiple faculties located on two campuses. Confronted with the challenge of providing quality education by effectively managing the resources received from its benefactors, Universidad Alberto Hurtado was looking for a solution to identify the primary cost drivers and allocate investments to strategic areas of the institution.

MyABCM arrives at Universidad Alberto Hurtado at a very special moment. With a structured strategic plan consisting of 13 goals to be achieved by 2030, the institution has chosen our solutions to manage resource allocation and facilitate the achievement of its plans. The goals for the near future include topics in the educational and administrative spheres, such as:

In this context, comprehending the financial collection process and which of your activities consume the most resources “is the initial step in balancing investment distribution and achieving all the strategic objectives within the designated timeframe.

Using MyABCM, Universidad Alberto Hurtado will be able to have a clear view of how resources are utilized in each teaching and research activity. In this way, it can confidently make critical decisions and strategic allocations, investing in resource-needy areas that provide growth potential for the institution and its activities.

It will be possible, for example, to understand how much investment is needed to achieve the goals of new students and campus expansion and to eliminate or adjust possible deficit activities to reallocate resources to them and obtain better results. These resources are expected to support the institution in providing high-quality education while expanding its operations into essential areas.

Samara Lima e Andrade

Captain Intendant

Head of the Production Division of the Pirassununga Aircraft Farm

This case study aims to present how the Pirassununga Aeronautical Farm (FAYS), a Military Organization based at the Air Force Academy (AFA), employed cost analysis as a beacon for the optimization of management and public spending. The entire project aimed to meet the organizational demand of maturing public management and had as its scope the knowledge of the historical unit cost of assets produced in the fiscal year 2019. The analysis used the ABC (Activity Based Costing) method to prepare the report and sought to serve as a subsidy to assist management in making more assertive decisions to improve public spending.

Founded in 1942, FAYS has an area of 6,502 hectares in the State of São Paulo. It is a Military Organization of the Brazilian Air Force, whose mission is the productive occupation of the lands of the Pirassununga Air Force Garrison with agricultural activities, which result in the production of food products sold internally and externally to the organization, according to the Strategic Planning in force.

Public opinion has become increasingly demanding as to the efficiency of public management and the optimization and improvement of public spending, culminating in the strengthening of the cost culture as a promising solution to achieve these goals. In this context, to meet the organizational demand for knowledge of the historical unit cost of assets produced by the Treasury, FAYS has engaged in a survey of the costs of processes and macro-processes developed within the OM, studying the possibilities of tracking indirect costs, to produce useful information to assist management.

The first decision to be made for the preparation of the report was what will be the focus of the cost accumulation system, considering that it can occur either by project or by activity. Project costs must be accumulated by order, and are those related to the provision of services or production of goods linked to specific projects, with scheduled start and end dates; whereas activity costs must be accumulated by process, and refer to activities of a typical nature, which occur continuously. In the case of the FAYS project, the accumulation system by process was applied, setting as the analysis scope date of the Plant Production Unit the period from 06/01/2018 to 05/31/2019 and as the scope date of the Animal and Industrial Production Unit the period from 01/01/2019 to 12/31/2019.

Considering that, unlike the legal practices in the private sector, the choice of the public sector costing method is not restrictive, it was necessary to choose which costing method would be used in the analysis. Taking into consideration that previous FAYS projects have already used the Activity Based Costing method, the ABC method was the most favorable for the execution of this project.

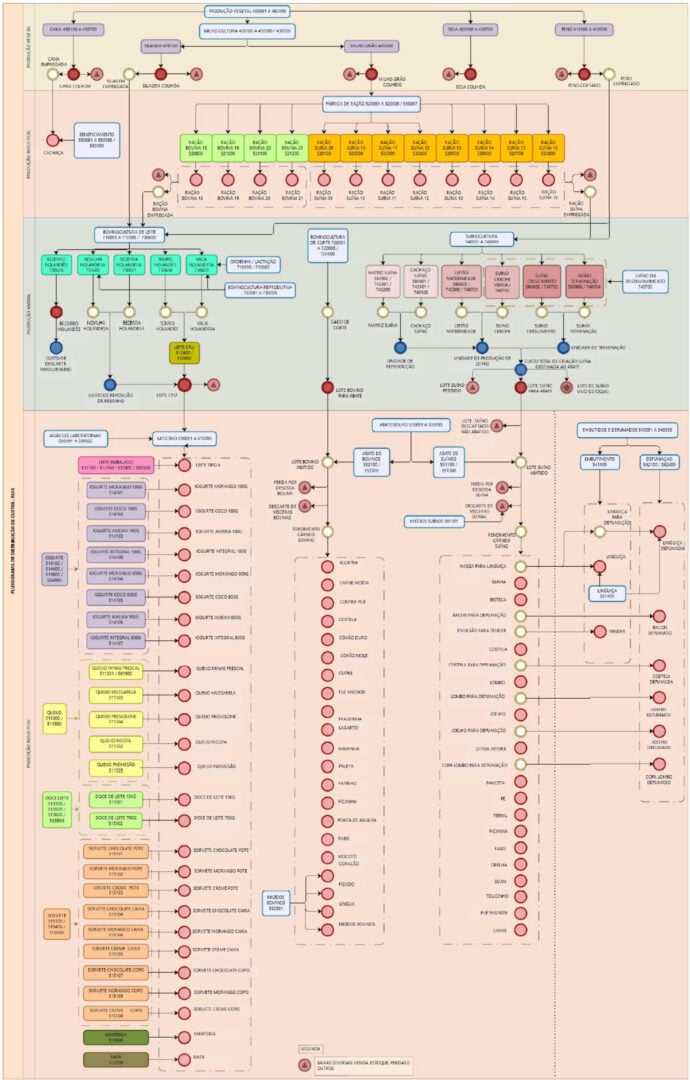

With the costing method defined, the organizational structure of FAYS was analyzed and it was established that the work would be dedicated to the analysis of the primary processes of the entire organization, these being considered those essential for the fulfillment of the institutional mission, i.e., the processes that relate directly to the farm’s production complex, which is divided into three Production Units: Plant, Animal and Industrial. Along with these three units, the commercial aspect of the mission, which is the distribution of goods produced or processed on the farm, makes commercial activities also included under the list of primary processes. For the other non-primary processes, such as personnel management and infrastructure activities, the costs were registered as expenses.

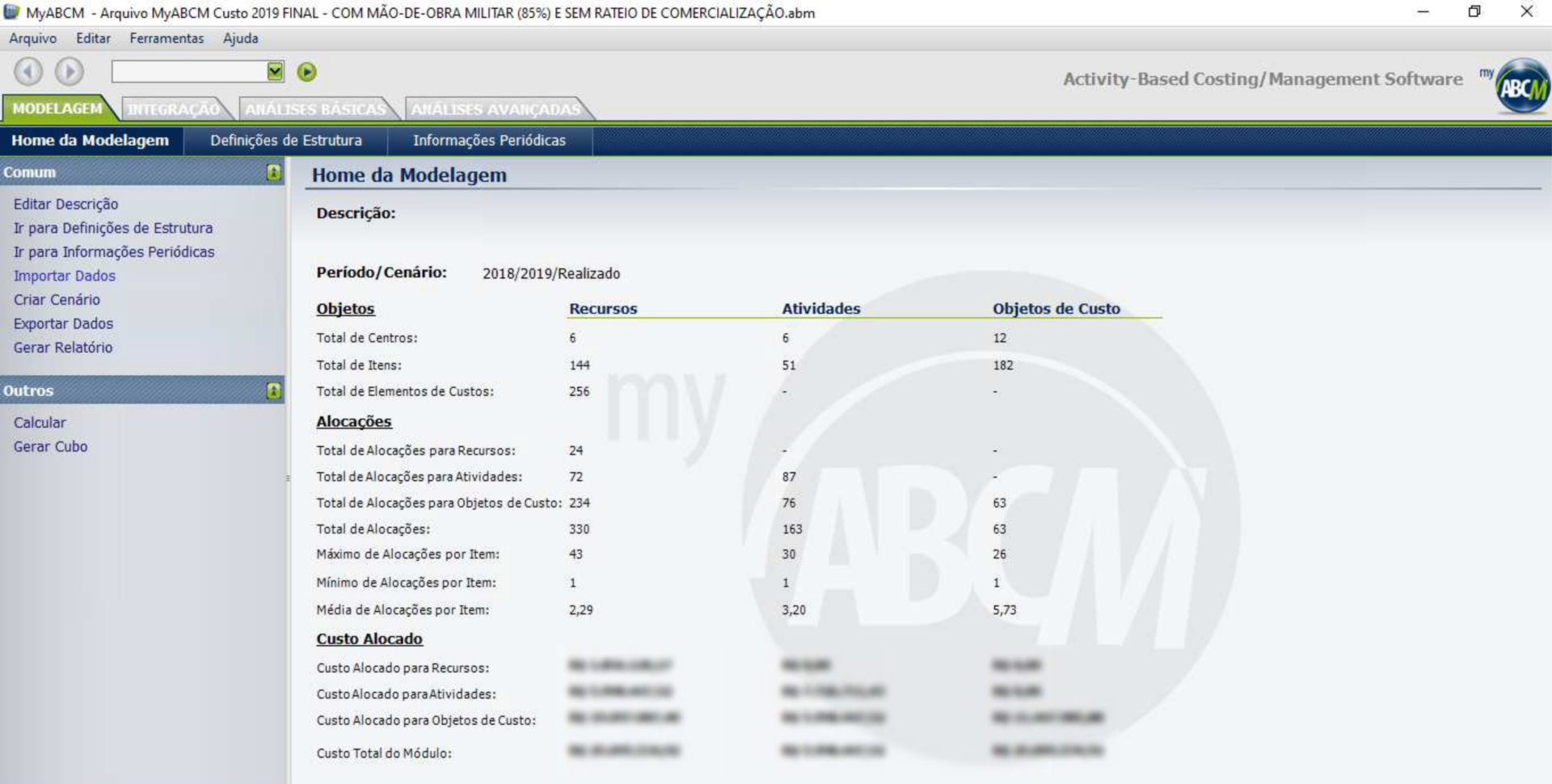

Under the optics of this approach, it became essential, to ensure the continuity of the engagement in the Cost Accounting area with the desired fluidity, the acquisition of a software that could optimize the work required for the project. In this search, a temporary license of the MyABCM software was hired.

As recommended by the Cost Information Manual of the Federal Government (MIC), it is from the development of their own modeling that organizations begin to advance in the cost culture. In this sense, to optimize the analyses and understand the logic of the calculations to be performed, it became necessary to elaborate cost flowcharts (with cost sub-centers) that reflected the interrelationship between the activities that comprised the processes of the FAYS Productive Complex in the referenced scope.

Once the Cost Sub-Centers that reflect the consumption of resources by activities were known and their interrelation understood, it became necessary to calculate the monetary values cumulatively spent in the processes to calculate the unit cost of the objects of interest.

Therefore, the following order of priority was considered for the allocation of costs to the activities and objects of interest: direct allocation (when there is an objective identification of the sacrifice of resources for the development of an activity or an activity for the delivery of a product); tracing (when a cause and effect relationship is sought through the use of drivers); and apportionment (a more arbitrary criterion that should be avoided from the management point of view).

After completing the preliminary steps, the desired result was obtained by processing the application itself. This has the parameter of calculating the Unit Cost by dividing the costs that were accumulated in the allocations, by the “Volume Entered” of each verification object, i.e., by the total quantity of units produced during the period considered.

In this context, to optimize the managerial analyses, “triggers” were created along the cost modeling to enable a certain roll of results based on the same input. Thus, it was decided to name the different compositions to improve the understanding of the coming analyses, which are Basic Cost, Budgeted Cost, Production Cost and Cost Price.

Basic Cost:

Comprised of the consumption of materials used in production, and the settlement of services applied in production activities.

Budgeted Cost:

Comprised by the consumption of materials used in production; the settlement of services applied in productive activities; and the depreciation of permanent assets allocated to productive sectors in the asset controls of SILOMS (Integrated System of Logistics of Material and Services).

Production Cost:

Composed by the consumption of materials used in production; the settlement of services used in productive activities; the depreciation of permanent material allocated to productive sectors in SILOMS; and the labor allocated in productive sectors in SIGPES (Personnel Management Information System).

Its main application is the optimization of the Organization’s horizontal vision, providing an opportunity for process analysis and improvement, using activity performance improvement, and it can also be used as a benchmark for pricing items intended for external sale and the Reimbursable Section.

Cost Price:

Composed of the consumption of materials used in production; the settlement of services applied in production activities; the depreciation of permanent material allocated to productive sectors in the asset controls of SILOMS; the military manpower allocated to productive sectors in SIGPES; and the commercialization expenses.

With this in mind, in addition to guiding public pricing, the valuation of production stocks, the retro-analysis of operational practices employed in the production chain, the promotion of improved performance by managers through benchmarking actions, product reengineering, waste reduction, as well as the feasibility of changes to the current portfolio, the practice of measuring unit costs of goods produced by the Treasury can certainly be employed as a continuous improvement tool for the organization.

From the theoretical approach and the analysis of the results obtained through the implementation of a cost management model using the ABC methodology, it is expected that the proposed objective has been achieved and it is suggested that FAYS continues to pursue continuous improvement in terms of Cost Accounting, focusing on the goals of quality public spending.

To begin, let’s briefly clarify what cost-to-serve is.

Cost-to-serve, widely referred to as CTS, is the sum of all the costs required to provide a product or service to your customer.

The fact that all costs are fully considered is what makes this analysis a high-performance strategy when looking at a customer’s profitability.

We usually associate a good customer with a customer who buys a lot from us – or with the one where we have a significant volume of services and transactions. But this only shows the one where we have had the most sales, not the one where we have made the most money, i.e. the most profitable! A customer with high turnover certainly requires a series of trade-offs and efforts that are often “expensive” to meet.

A study published in the Harvard Business Review showed that on average 20% to 30% of customers are very good from a profitability point of view – bringing between 150% and 300% of the company’s total profitability; on the other hand, between 50% and 60% are neutral (i.e., we do not make or lose money) and approximately 20% are unprofitable.

The big challenge is to understand which ones they are, and in which layer each one is located. Eliminating the clients that we lose money is not enough, as by doing this immediately other clients that are neutral and even those that make some profit start to become unprofitable – after all, our fixed costs don’t disappear, requiring us to make some adjustments in our installed capacity.

Now when we bring into the equation, in addition to the cost of serving each client, the profitability we have with each one and the time we will be serving to this client, we will certainly find situations in which that extremely profitable client will migrate to the competition in the short term; others that are extremely loss-making will continue to drain the organization’s resources. Bad scenario, isn’t it?

The question is, “what should we do?” The first thing to do is to be aware of the need to measure things. As we know, it is impossible to manage what you cannot measure – so measuring and then deciding is key!

“Firing clients”, + the end: those clients who are loss-making often help pay the fixed costs, and if there is no change in the structure of the organization, their “firing” may bring a terrible consequence, which is that clients who are neutral today may start to be unprofitable (and the very profitable ones may become not so profitable). There are companies that have already bankrupted just because of failure in this criterion, and they were excellent “producers”, with well-rounded production lines, equally good product costs, but they neglected this very important detail, which is to understand and act correctly with the costs-to-serve.

During the development phase, it is determined what the cost object is, what the cost of meeting this object will be and how it will be mapped, what the drivers for allocating the aggregate cost will be, and what IT systems will be used to calculate and maintain the analysis of its operation after the development of the customer’s profitability.

On one occasion a large national bank did a project and discovered that it had loss-making clients: What did they do? They eliminated these clients from their portfolio. The result: the clients that were neutral became unprofitable. What did they do then? They eliminated these new unprofitable clients, resulting in a huge loss with this operation. The issue of capacity/idleness must ALWAYS be taken into consideration for cost analysis!

It is also important to know that it is not by firing employees that we reduce costs – at least not indiscriminately. In fact, there are studies that show exactly the opposite: according to the US Conference Board, of the companies that tried to reduce costs, 30% actually had higher costs! Another study by Deloitte showed that 75% of the companies that laid off employees to reduce costs had to rehire others for the same positions within 1 year. And finally, McKinsey showed in a survey that only 10% of cost reduction projects are successful within 3 years of its implementation. Reducing costs is not simple, it demands effort and measurement (measure!) to make the best decisions afterwards.

Check out our content that fully explains the Activity-Based Costing system

The first step is to understand how the organization’s efforts are aimed at serving the various customers and channels; this includes information that must necessarily come from the CRM, but also from interviews with the sales and customer service areas.

Through the metrication of the main activities involved in serving these customers and channels it is possible to understand the effort spent to serve them individually and therefore make specific analyses that allow the understanding of cost and result, customer by customer, channel by channel.

For example: a very common activity of the commercial team is “Meet with Customers”. The cost of this activity is the sum of the commercial area’s efforts (salaries plus salespeople’s benefits and the whole area) including the support areas such as HR (that last month hired 2 new salespeople), the IT area (that this month gave 5 supports related to the new HR system) and also the value of the internal support systems (such as CRM itself); that said, now it’s time to allocate these costs of Meeting with clients – which are not necessarily Product and Service related costs but rather Client related costs (as a periodic maintenance and follow-up activity for these clients); this allocation should be done using the criteria “number of meetings with clients” (assuming that these meetings have an average time approximately equal to each other) or ” meeting hours” if this value varies a lot.

Of course, this allocation must be done taking into consideration the materiality of what is being allocated (that is, many times the effort in collecting and applying this information is not worth it, given the small costs of this activity compared to the other activities of the company) but in many cases it is very well worth it!

This done we have the cost of each customer only with the activity “Meet with Customers” – if we do that with all the activities of the Commercial and Customer Service areas, we will have an interesting suggestion of efforts to be analyzed and surely many surprises will appear, with activities that we never imagined would be so expensive and that would influence so much the costs of each Customer and Channel, and even others that we thought would be expensive, but that in the end turned out to be not very significant.

The set of mapped activities, on one hand their interconnections with the chart of accounts, cost centers, and areas, and on the other hand with the various Products, Services, Clients, and Channels, is called a cost model – and this modeling, if well executed with method and process, allows a vision never before seen in organization!

Access our profitability calculator!

Cost analysis in the IT sector basically consists of carrying out a strategic planning whose actions are aimed at meeting specific business demands. To that end, it is essential that all departments have tools and methodologies to apply the cost reduction.

In simpler terms, we are referring to the multidisciplinary and continuous process of IT governance. Its goal is to integrate not only the expenses, but also support-related services and projects.

By employing good cost analysis practices, it is possible to add value to the business and provide unique solutions to the audience. And that is what we’ll talk about in this post, read on to check it out!

Planning the costs of a company is one of the best ways to ensure its survival and growth in the market, even when dealing with the most complex economic scenarios.

This is because the cost analysis aims to consolidate data on financial performance and the execution of corporate activities. Based on this information, managers are able to make more assertive decisions regarding the expenses that can be eliminated and what actions to take to foster the profitability of the business.

Now that you understand the importance of carrying out IT cost analysis, we’ll show you some tips on what you can put into practice in your business. Check it out below!

Determining the costs to be analyzed, that is, mapping them in an organized, functional, and intelligent way, will allow the finance department to account for expenses and investments with the infrastructure needed to carry out the business activities.

We know that much of the work done by the IT sector takes place in the digital environment and, therefore, has a series of intangible costs, such as the acquisition of ERP and CRM software, APIs, plugins, etc. In addition to these, it is necessary to consider aspects such as productive time, customer loyalty and delivery times.

When it comes to a tangible IT structure, it is no different, as it is also necessary to invest in hardware (computers, mobile devices, equipment, etc.) and labor, for example.

Finally, cost analysis can be optimized by using innovative technological tools that can automate repetitive tasks that were previously carried out by employees.

In addition to reducing the workload of IT professionals with minor issues, business management software have a wide range of resources that support the accounting and finance department.

After all, unlike human workers, these systems have algorithms that are not susceptible to failure and order issues, such as forgetfulness, fatigue, or misunderstanding. In other words, they minimize the margin of errors, rework, and productivity losses.

As you can see, cost analysis for the IT sector encompasses a series of practices and the use of technological tools that contribute to the company’s development, making it easier for managers to make strategic decisions.

Do you want to know more about the MyABCM solutions for cost analysis using technology in your company? Then contact our team so that we can show you the very best in digital innovation for your business!

Unforeseen financial events are inevitable and, in most cases, cause difficulties for the business’s management. If we consider the various obligations of the company, such as salaries of employees, suppliers and tax payments, the emergence of unplanned debt may cause indebtedness. And that is why cost mapping is so important.

In addition to making the financial organization easier, mapping strategies for the destination of the company’s capital allow managers to face economic challenges more easily.

Based on this context, we’ve prepared this post so that you can learn the best tips for mapping costs and optimizing results in the company. Read on and check it out!

Before identifying the costs, it is very important to map the processes. That way, the manager will have a broader perspective on all operational actions of the organization, which helps when identifying which one leads to little or no practical results for the business and, therefore, can be eliminated.

This strategy consists of identifying all the company’s expenses, showing the origin of each one so that the manager understands its impacts on the organization, as well as the margin obtained, among other aspects pertinent to monthly budget planning.

Promising corporate partnerships are an excellent way to map costs and reduce operating expenses in the company. Do research on organizations that offer innovative cost management solutions, review the proposals, and negotiate?

Have reliable and trustworthy partners by your side, whether they are software providers, third-party carriers or any other. In your decision-making process, take into account not only the price, but also factors such as on-time delivery, quality of inputs, special conditions, among others.

Investing in a financial management technology can make the company’s cost mapping significantly easier. As it is equipped with intelligent algorithms and process automation resources, managers can count on a multitude of solutions for the day-to-day of the company.

Among its benefits, we can mention:

Among many other functions that only a provider of innovative technological solutions for financial management can offer.

As you can see, mapping costs is a comprehensive strategy that aims to increase the managers’ knowledge of the business’s expenses and investments. Relying on technology is the best way to identify and categorize all the organization’s expenses.

Do you want to know more about the MyABCM solutions for mapping costs using technology in your company? Then contact our team so that we can show you the very best in digital innovation for your business!

Taking care of a company’s financial organization involves a series of strategic measures and the use of essential tools in order to ensure the economic health of the business. By using these practices, the enterprise is able to have good conditions to invest, funds for the working capital, among other advantages.

We’ve prepared this post so that you can learn about great ways to keep your company’s financial organization. Read the article to learn more about this topic!

One of the first steps to a good financial organization is to analyze all the inflows and outflows of funds in the enterprise (accounts payable and receivable), as well as closely monitor future transactions, as cash flow is one of the most important business tools.

With cash flow, managers are able to make projections of future scenarios and have a broader view of the company’s economic status, in addition to analyzing losses and gains and managing financial transactions.

Fortunately, to make this task easier, there are innovative resources such as the technologies developed to automate the management of financial and accounting matters in the company. We’ll talk more about this later.

Regardless of the market sector in which your company operates, and its size, having an emergency reserve is essential. In fact, this financial organization tip applies to any entrepreneur or self-employed professional.

In short, an emergency reserve should represent the amount needed for the business to maintain itself (paying its expenses and operating costs) for a period between 4 and 12 months.

In other words, it should ensure the company’s survival even when faced with the worst economic scenarios, crises and unforeseen events. The idea is to prevent the enterprise from resorting to loans at exorbitant interest rates and ending up in a debt “limbo”.

In the era of digital transformation, companies can count on innovative solutions for the most diverse operational needs, such as technologies for financial organization, which have become increasingly present in the corporate environment.

These software are capable of automating a wide variety of processes and tasks in the accounting department, making the access to accurate information on cash flow and working capital easier, as they provide thorough reports with detailed data for strategic decision-making.

It is also possible to check expense and revenue graphs, daily balances, and even make future debit and credit projections, separating them by periods, which is essential for a good financial organization.

As you can see, maintaining the business’s financial organization involves using a series of good practices and innovative tools to ensure the good economic health and survival of the company, in addition to maintaining its competitiveness, even in delicate scenarios.

Do you want to keep up with all the informational materials, tips and news posted on our communication channels? Then subscribe to our newsletter right now to receive MyABCM content directly in your email!

What is telehealth? In short, it is another technological advance that emerged with the purpose of offering more convenience to both physicians and patients. Boosted by the advance of the COVID-19 pandemic, this type of service is increasingly on the rise.

When used wisely, telehealth can become a very valuable resource, as it makes it possible to reach more clients, delivering a quality service. If you want to know how telehealth works and what its advantages are, keep reading!

Telehealth is a trend in telemedicine. It is an application that allows the exchange of information between the doctor (and other health professionals) and the patient by video calls.

Thus, this service has multiple functions such as basic clinical appointment, checking test results, providing accurate diagnoses, transferring knowledge between specialists, and prescribing medications.

Through Telehealth, a patient can make an appointment with a physician without having to go to a clinic or hospital. This possibility allows obtaining medical care, in real time or asynchronously, in situations where this would be difficult.

This kind of remote care service can be classified into two types, each one with its characteristics and benefits. To learn more about them, check out below!

Synchronous telehealth is defined as a service in which the physician sees the patient in real time. In this situation, the appointment has to be scheduled and the client can quickly access the diagnosis, so that they can ask questions and receive answers immediately.

It is the procedure that is most similar to the already known face-to-face appointments. It can be done by videoconferences, voice calls and message exchanges, although this last option is not considered very efficient.

On the other hand, asynchronous telehealth is characterized by the fact that the service is not provided live. The hospital or clinic sends questionnaires and forms to the patient, who sends them back to the physician. This procedure is indicated for non-urgent cases – those that do not need direct interaction between the professional and the client.

This new form of care is a technological innovation that is changing the traditional way healthcare professionals and patients meet. Although some experts are wary of these transformations, it is important to know and keep up to date about them. Check out some advantages of implementing telehealth:

By reducing the distance between healthcare specialists and patients, this form of remote service allows providing care to more people, so as to increase the potential practice of the professionals involved. Therefore, knowing about telehealth is essential for the smooth running of the businesses.

Did you find this content educational and interesting? Then share it on your social media so that more people can stay on top of it!

In order to have an excellent hospital care and achieve patient satisfaction, extraordinary measures are not necessary. Not even high investments and expenses.

Understand that, in many cases, poor service can be as costly as a good service. In this article, we’ve listed six of the main practices for hospital care that provides well-being to patients in hospitals and clinics.

Read on!

Know that no matter how efficient the doctors and employees of a hospital are, it can go bankrupt if there is no control over the finances. Manual processes and the use of basic electronic spreadsheets can no longer keep up with the demand for care.

That is why financial management software has become a trend in healthcare institutions. To streamline processes, these solutions have interfaces that help in various procedures, including during the service.

Valuing the human being must be one of the most important missions to be followed by hospital networks. Therefore, full attention must be paid, from the clinical care to the physical conditions of the environments.

Knowing how to listen is an art that, in most appointments, is as important as the prescription of medications. In some cases, certain patients develop certain pathologies for reasons that arise from their own affective need.

We know that the body also suffers if the head is not doing well. In these moments, the professional who is prepared to listen can determine more assertive diagnoses. This avoids the use of too many medications and gives the patient more confidence.

Even though it is an essential service that deals with life, hospital managers who think they can charge high fees for their care are mistaken. Competition exists n all sectors of the economy.

Know that even the public system competes with the private network. Therefore, the practice of fair prices, in addition to being important for the institution’s permanence in the market, is a matter of humanity.

In addition to being mandatory to comply with the legislation, compliance with sanitary requirements is a matter of quality and safety of services. Therefore, following legal requirements is one way to provide adequate hospital care.

Note that the provisions contained in the law are the minimum parameters. If the hospital thinks it can carry out one or more procedures that are better than the one provided for in the legislation, it will be able to do them.

Investing in education is one of the best things an entrepreneur can do with their money. Well-trained employees return the investment to the organization in short periods of time.

Some business owners don’t realize this, so it is up to department managers to show them the advantages of this initiative. After all, these leaders are the ones doing the service on a daily basis.

So, do you see how practicing good hospital care is a strategy that can be simple? Focus on everyday humanitarian gestures, take advantage of technology, and follow the legislation.

Financial technology is one of the most efficient solutions made available by the digital world to companies. Through it, managers and entrepreneurs can have the enterprise’s financial situation literally in their hands, at any time.

Considering the speed in which businesses are carried out today, taking advantage of time with the least possible error is essential for companies. Thus, those who intend to remain competitive in the market need to take advantage of the benefits of technology.

Due to the relevance of this subject, we’ve prepared this article and listed the four most important advantages that financial technology offers for your business. Let’s do this!

Real-time data tracking is undoubtedly an essential benefit of financial technology. With it, managers are able to have the situation of the company’s finances in the palm of their hands. Know that this can prevent the loss of great businesses.

Imagine a scenario in which the opportunity for an investment or partnership in a business comes up, and it must be decided immediately. Due to a lack of quick knowledge of the financial radar, managers may decline the negotiation and hand it over to the competition.

In addition, financial data can be accessed from anywhere. There is no need for the manager to be present at the company’s premises or at a desktop computer.

Concentrating information in one place is not just an administrator’s dream – it is actually possible. Financial management software allows managers and auditors to access several data in a fully centralized way.

With these digital technological tools, audits can be performed faster and with data security, as there is no risk of duplicated information and no need to access various platforms, spreadsheets and company employees.

The best financial management solutions available on the market allow for the integration of the various sectors of the company. That way, it is possible to have a more comprehensive knowledge about the organization’s costs.

This globalized view offered by software helps leaders, allowing them to make more assertive decisions. This is because they will be carried out based on a variety of data, thus, their analyses become strategic.

Financial management software allows managers to find out where their companies’ biggest expenses are. This enables them to look for alternatives that can reduce their costs, changing executive processes or searching for new inputs.

We know that payrolls increase company costs, making entrepreneurs aim at leaner companies. Due to its processing speed, the software can reduce the costs of hiring employees.

With all that said, we believe that there is no doubt that financial technology is beneficial to any company. Implementing this solution will bring greater efficiency not only to the finance team, but to the entire enterprise.

In order to obtain all the advantages of financial technology, we recommend hiring companies that are recognized in the market. MyABCM is a global company with over 25 years of experience that operates in over 50 countries.

Did you like this subject? If you have any questions or want more information, don’t hesitate to contact us.

The routine in a hospital is characterized by several demands in different sectors, from initial care to surgical procedures. For everything to be synchronized, hospital cost management needs innovations. Among them, the installation of software is one of the main needs.

This system controls data and provides complete information about all sectors. Do you want to learn how to improve the results in your hospital or clinic? Then keep reading!

The use of technologies is a trend that is here to stay in the management of any business. Due to the current high level of competitiveness, software is essential to organize finances.

With it, it is possible to gather all departments in the same system; in other words, there is space for patient control, electronic forms, entries and exits, quantity of materials in stock, among other features.

That way, there is a systematization of data, an essential aspect to assist in decision-making and improve the level of customer satisfaction. After all, care will be faster, and diagnoses will be more accurate.

Next, see more benefits of cost management software for hospitals!

By installing a management system, your hospital will have technological resources to map all processes, such as material costs, patients’ payment, in addition to all financial demands.

It is also possible to organize data about patients, with a specific field for personal information and the causes of diseases or illnesses. Thus, professionals from different sectors are able to obtain better performances.

As decision-making is more accurate when using the data presented by the system’s reports, the analyses are essential for cutting superfluous expenses or even reducing employees or redirecting them to sectors that need them most.

That way, the hospital is able to save money, a very important aspect to keep up to date with payments. Moreover, it is possible to study potential investments more effectively, whether in purchasing new equipment, remodeling a wing, or launching an awareness campaign.

As an example, we can mention the assistance protocols. With them, it is possible to check whether the tests are excessive or not, thus having a clear understanding of the cost per patient.

By streamlining processes, employees will consequently be more productive. This is because technology contributes to the most sought-after prerequisite on the market today: doing more with less.

This is a positive aspect that optimizes time and contributes to improving the employees’ level of motivation.

By having software as a complement to manage hospital costs, the sectors will be integrated. As a result, communication will be more efficient, and the financial sector will always have the data needed to avoid setbacks.

With cost management, the financial sector will have enough strength to face crises and moments of prosperity.

Given the advantages presented throughout this post, you might be wondering: but how do I know which software is ideal for my hospital? At this point, the tip is to choose a company that already has the expertise in the sector, with success stories and solutions that are in tune with your company’s reality.

That way, the hospital cost management will certainly be well executed, with professionalism and all the protocols that will ensure quality of care and customer satisfaction.

Are you interested in learning about our hospital management software? Then take the opportunity and contact our team right now!