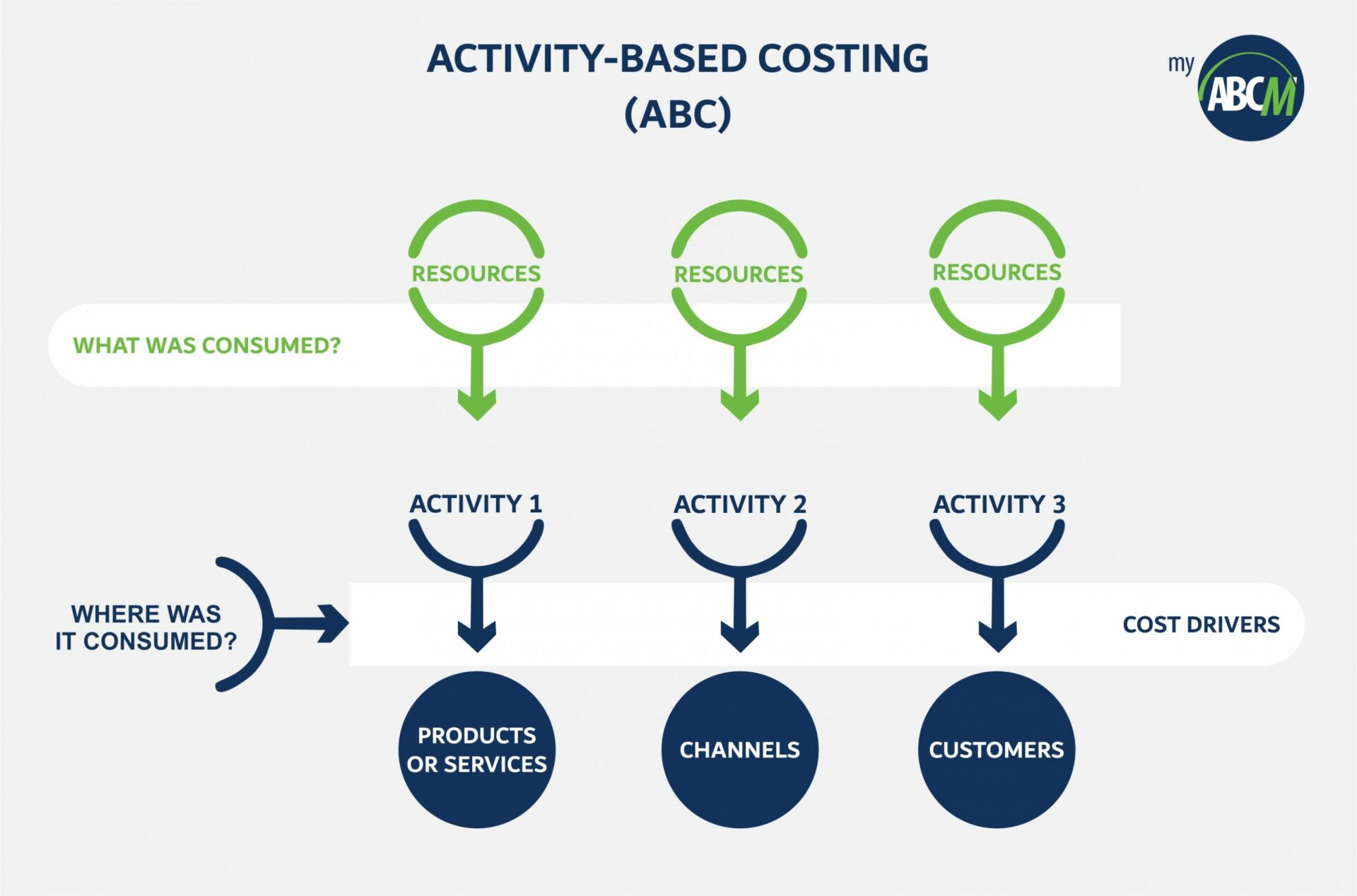

ABC costing analyzes costs related to each activity in product manufacturing or service execution. Resources are allocated based on these activities to different products, services, markets, etc., providing a clear view of the company’s costs. In this way the company gains a more precise understanding of how each activity impacts operating costs, enabling better profitability management.

Studies and documentation indicate that large US industries used some form of ABC costing in the 1950s. However, the methodology only really became known with the dissemination and popularization of the studies of Professors Robert Kaplan and Robin Cooper in the United States in the early 90s.

These two professors identified that, for several reasons that we will present later, the method used to cost the various products and services no longer reflected the reality of what occurred in organizations, causing great distortions and greatly damaging the results of companies.

In their studies, Prof. Kaplan and Cooper identified 3 independent and simultaneous factors that justified the implementation of ABC costing:

Previously, direct labor accounted for around 50% of total product costs, with materials and raw materials at 35%, and overhead at 15%.

Nowadays, overhead can reach up to 60% of product costs, with raw materials at approximately 30%, and direct labor below 10% (in Service and Government organizations, overhead is even higher).

While using direct labor hours for cost allocation might have been acceptable until the mid-20th century, it no longer makes sense in today’s cost structure.

The number and level of competitors have changed significantly over time. Consequently, many organizations have experienced declining margins year after year, making efficient cost control extremely important.

In this context, implementing the ABC costing methodology enhances cost control, leading to increased competitiveness and improved profit projections.

The cost of implementation and measurement has significantly decreased due to the advancement and widespread accessibility of information technology. In the past, implementing an effective ABC costing system was prohibitively expensive and feasible only for companies with access to large applications running exclusively on mainframes and large computers.

As computer technologies advanced, the methodology became accessible to a broad range of organizations. Thus, the main reason why this costing system only became popular at the time of the publications of professors Kaplan and Cooper was the advance of computer resources (hardware and software). These technological advances allowed the system to move from theory to practice, especially in the implementation of cost models in more complex organizations that required greater detail.

The missing trigger for this popularization coincides with the emergence of mini and microcomputers in the late 1980s and the development of graphical software interfaces through the Windows (Microsoft), OS/2 (IBM), and Mac (Apple) operating systems.

In this way, applications that had previously been intended only for use on mainframes and large computers could be implemented in any organization, making them accessible to the various users and departments of a company.

Thus, today, many organizations have successfully used ABC costing in various segments, such as manufacturing, government, services, telecommunications, banking, logistics, etc. Its use, contrary to what many imagine, is not limited to large corporations, but can also be implemented in medium and small companies, whether public or private. Here, we’ll provide you with comprehensive information about this system, its benefits, and the implementation process. Take a look!

Traditional costing systems have emerged mainly to meet tax and inventory valuation requirements. However, these systems have several flaws, especially if used as management tools.

Traditional costing methodologies focus on the company’s various products, apportioning total costs to them based on the assumption that each item/SKU consumes organization resources in proportion to the volume produced.

In this way, the various “volumetric” drivers such as a number of direct labor hours, machine hours, and raw material value are used as cost allocation criteria to settle overhead costs.

However, this approach results in figures that only reflect an average estimate. Despite the complexity of the calculation, it doesn’t precisely align with the specific characteristics and processes of each company.

These volume-based drivers also fail when dealing with diverse product shapes, sizes, and complexities. Additionally, there is no direct relationship between production volume and the efforts or costs consumed by the organization.

As a result, many managers of companies providing diversified products and services, when applying these traditional models, are making extremely wrong decisions regarding prices, product and service mix, and even processes.

Unlike traditional costing systems, activity-based costing centers on the organization’s processes and activities. It also provides special attention to often overlooked aspects in companies, such as the cost of different customers, channels, markets, and regions – essential for making accurate decisions.

In the beginning, costs from each activity are tracked within the company. Then, these costs are allocated and analyzed to determine how each activity impacts the final costs, enabling a precise assignment of expenses.

Thus, the various costs are allocated from the various activities to the various Products, Customers, Channels, etc. based on the use of these by each activity of the organization. In this way, overhead is allocated appropriately, always respecting a cause-and-effect relationship and not using “volumes” as the basic apportionment criterion.

Once the activities have been costed, the organization can begin to manage them, frequently questioning why each one is influencing or impacting the costs of the various products, customers, channels, and services in the company. With this system, the costing process becomes more accurate and precise at the same time.

What makes this costing model an extremely efficient methodology is something that starts with the way of thinking about cost. What was treated by other models as an indirect expense linked to a product becomes a direct expense. The focus then becomes the activities performed, not the products that come from them.

The crucial aspect lies in recognizing that each product, service, customer, or channel results from a variety of activities. Treating them individually enhances the description and conversion of their specificities into more accurate values.

The effectiveness of this costing methodology relies on its capacity to establish logical traceability for expenses. As it’s not bound by the temporality of each process, ABC costing can identify and assign each expense to a specific activity.

In this way, even if certain expenses are grouped under the same cost center, they will be organized according to the activity to which each one is linked.

This optimization of cost control delivers multiple benefits to the company across various sectors, as we’ll demonstrate below.

There are several advantages to implementing ABC costing in a company, extending beyond accurate cost definition for products, services, customers, and channels.

Below, we will describe some of the most important ones to highlight how this methodology enhances the company’s profitability and empowers managers in decision-making.

After creating a model with studied cost allocation criteria and defined future implementations, decision-makers gain access to better and more precise information.

This improves the company’s planning and decision-making processes. Managers gain more power in forecasting future profits and expenses and have well-founded arguments for effective decision-making, including product and service pricing, product mix, outsourcing or internalization choices, research and development investments, automation, marketing, campaigns, and more!

In this item, we can mention not only the collection of more transparent data on expenses in each sector but also a review of internal controls and greater visibility of each process.

With comprehensive information about various processes and their impact on Products, Services, Customers, and Channels, the company can make more confident decisions. Managers gain additional tools to manage team expenses and access data for auditing and expense analysis.

With a clear understanding of activity costs, managers can base decisions on business processes and activities. Moreover, by assigning “labels” to mapped activities, they can analyze which ones add value and which ones do not, for instance.

Describing the specificities and costs of each process enables a multidimensional analysis of expenses in each activity, from a global perspective to detailed visualization of each activity’s cost and its impact on profitability. This identification allows adjustments to reduce unnecessary expenses and revise planning to align with actual costs.

Achieving an increasing cost reduction, then, becomes only a matter of time, as each manager will have access to more accurate information to analyze these processes.

Additionally, it’s essential to note that the methodology’s effectiveness in controlling expenses makes it efficient for both small and large companies, regardless of their area of operation.

The implementation of an ABC costing system may seem complicated and will vary slightly depending on the size and complexity of each company’s activities, products, and services.

But to facilitate the process and enable the implementation of the ABC methodology to be carried out effectively, you can use the steps listed below as a reference.

They apply to all sizes of companies and business models, helping to create an activity-based budget and promoting greater control over the organization’s costs and profitability.

Sophisticated cost modeling demands a dedicated system. While some companies use spreadsheets for costing, others attempt ERP customization or believe BI can address management costing challenges.

However, the auditing and consulting company Ernst & Young (EY) does not recommend any of these options. According to EY, “Model development can be performed in Excel, Access, or even in-house development, but this can only be done for very simple models and even these simple models will present severe restrictions when more elaborate analysis is required. Not to mention specific issues of integration with existing systems, traceability, auditing of the model, and the security of the data itself.”

As for ERP implementation, we know how expensive and complicated it is to customize these systems. In addition, they provide a static and plastered view, which does not provide the flexibility required by such an implementation.

As for BI systems, these are platforms for presenting the information that already exists in the organization. But as we know, such cost modeling requires deep transformations from the point of view of allocations, including reciprocities and understanding of costs at multiple levels and dimensions, something not so easily or virtually impossible to implement in a BI.

By addressing these practical implementation issues, the MyABCM product suite stands as the global leader in managerial costing solutions. Offering multidimensional analyses, it empowers organizations to model, analyze, and simulate with great flexibility, security, and, most importantly, full integration with corporate systems.

It is crucial to determine the objectives of an ABC costing project. Does it aim to determine costs for Products only? What about Customers, Channels, Markets, Regions, or Projects? Defining clear project objectives is essential to avoid mid-project changes in assumptions.

Additionally, creating an implementation agenda is crucial, including defining the desired depth of the project, possible criteria, ideals, and implementation milestones.

Efficient implementation requires intelligent activity mapping. In such projects, managers often aim to map hundreds, thousands, and, at times, tens of thousands of activities, sometimes even at the task level.

This is an attitude of great inefficiency, since by mapping many activities, the effort will certainly be too great to result in a small benefit, especially for those activities that are not very relevant. In addition, modeling too much complexity in the first round makes the initial integration of the model with corporate systems a major challenge.

“Best practices involve modeling in stages, increasing complexity as the model evolves while considering the relevance of the mapping. As noted by Cost Management expert Gary Cokins, ‘Organizations must assess their performance in what is crucial and relevant to the business.”

Here it is necessary to define the initial costs, expenses, cost centers, accounting accounts, possible groupings (Cost Pools) to be established, and Revenues that will be the initial Resources to be allocated.

This part of the planning is important so that each Resource is linked to a process and this is identified according to its relationship with the activities linked to a product, service, customer, channel, or project.

After defining Resources and Activities, establish cost drivers and the criteria for their utilization.

In this way, the calculation process will make sense, as there will be a link that represents a cause-and-effect relationship between sources and their destinations.

Once the model is defined, it is time to calculate it, generate simple and complex cubes (which will later support the various analyzes through dynamic tables), and create a system that allows simple and advanced simulations (what-if).

By applying and analyzing reports, it is possible to evolve the system, effectively tracking an increasing number of relevant activities for the company.

Implementing an ABC costing system provides better control over the organization’s costs. The methodology develops precise cost tracking and allocation models, identifying values associated with each process and activity, and their impact on company profitability.

This enables an efficient activity-based management system, facilitating resource reallocation and structured cost reduction, promoting high profitability even in a highly competitive environment.

Moreover, the system empowers confident decision-making, providing secure pricing and comprehensive analysis and control of products, markets, channels, customers, etc.

Thus, its implementation culminates in greater profitability in the medium and long term, thanks to a detailed view of organizational processes and the resulting increase in the company’s competitiveness.

By considering the tips in this article, you can efficiently implement the activity-based costing methodology, leading to continuous growth for your company.

In this context, MyABCM software is specially designed to offer activity-based management, enhancing cost control and business profitability.

Hence, employing a system like MyABCM solution surpasses the activity and cost management capabilities of other software. The systems are tailored to address the specificities of businesses of all sizes, offering resource allocation in multidimensional analyses that cover all relevant company activities, adapting to various complexities, and ensuring the constant evolution of costing models.

Interested in learning more about our solutions and how ABC’s costing methodology can boost your business profitability? Fill out the form below to get in touch with our experts!

In case you’ve just stumbled in here, read our full article that explains how the ABC costing method works by clicking here.

Let’s recapitulate some trivial points that underlie “Activity-Based Costing”.

If you are already familiar with the term, let’s go ahead and discuss why ABC (activity-based costing) has the power to increase your profitability.

Let’s get right to the point.

The focus of the ABC method is to have maximum control over the indirect costs (also called overhead) as well as the direct costs associated with a product, service, customer, or channel.

Through a costing system using drivers that respect a cause-and-effect relationship and aiming to bring an advanced analysis of the costs per activity within the operation.

And with this dense range of data, intelligently filter the numbers and transform them into strategic decisions.

The first step comes from what we call “data-driven culture”.

This is the natural habit of ALWAYS making decisions based on collected data and not on a gut feeling.

It all starts by identifying the main KPIs (key performance indicators), which are our key performance indicators.

If you intend to make decisions based on data and not just intuition, yes.

Performance indicators make it possible to measure how much a strategy is generating the expected result or not.

It is important to mention that KPIs are always measurable and concrete.

Analyzing data is something automatic in large companies, however, not always creating strategies and defining next steps is provided by a study on top of what has already been collected and digested.

The ABC costing method is useful for companies that already have this data-driven culture and are looking for optimizations through detailed data analysis.

The more knowledge you have about how much and where your resources are being spent, the more precise your improvements associated with cost management will be.

And that is what we at MyABCM offer.

The ABC method results in an advanced costing analysis based on each activity involved in producing some product, providing some service, or serving some customer or channel.

This is where pricing comes in.

One of the biggest challenges within a business can be made easier by applying the ABC method.

Keep in mind that failing to calculate your total costs can result in sub-optimal pricing, resulting in an unfavorable profit margin for the company.

With all the control of segmented expenses in the palm of your hand, pricing becomes clearer and effectively correct. The consequence of this is the real impact on negotiations with customers, discount policies and commissioning of salespeople, resulting in the end in greater profit for the company!

The option of being able to precisely manage all the organization’s costs. This opens up the possibility of making more assertive decisions about where to act to reduce costs, invest, and even serve the best channels and customers from a profitability standpoint.

2. Associate overhead costs with the products, services, channels, and clients that actually consume it

Instead of associating the same cost to all products, services, customers, and channels, you can allocate the fair value consumed by each.

This also helps identify costs that apply to more than one segment, making this feature more valuable because it potentially eliminates distortions in cost calculations.

3. Evaluate production efficiency and apply improvements

The ABC method makes it possible to assign value to overhead costs by working the data as if it were direct costs. By breaking down overhead costs and assigning them by activity, we can look for breakthroughs with precision.

In the same way, we can make processes more efficient and correctly monitor the key KPIs for each activity in the organization.

4. Accurate data to obtain the desired profit margin

Having accurate data will directly impact a leader’s decision making. It opens up the possibility to reduce or shift production costs and apply effective pricing strategies to obtain an adequate profit margin.

5. Unique Benefits

Other methods cannot cover what the ABC costing method provides.

Directly related to the particularity of activity-based costing, it can measure expenses related to activities, however small they may be.

All the questions below must be answered with a yes.

Then you are prepared.

To be clear, there are not only advantages.

But it is the solution to a number of complex problems for those seeking cost optimization through a robust system.

After you have finished reading this post, you certainly have the clear answers as to how ABC cost management can increase your profits.