Samara Lima e Andrade

Captain Intendant

Head of the Production Division of the Pirassununga Aircraft Farm

This case study aims to present how the Pirassununga Aeronautical Farm (FAYS), a Military Organization based at the Air Force Academy (AFA), employed cost analysis as a beacon for the optimization of management and public spending. The entire project aimed to meet the organizational demand of maturing public management and had as its scope the knowledge of the historical unit cost of assets produced in the fiscal year 2019. The analysis used the ABC (Activity Based Costing) method to prepare the report and sought to serve as a subsidy to assist management in making more assertive decisions to improve public spending.

Founded in 1942, FAYS has an area of 6,502 hectares in the State of São Paulo. It is a Military Organization of the Brazilian Air Force, whose mission is the productive occupation of the lands of the Pirassununga Air Force Garrison with agricultural activities, which result in the production of food products sold internally and externally to the organization, according to the Strategic Planning in force.

Public opinion has become increasingly demanding as to the efficiency of public management and the optimization and improvement of public spending, culminating in the strengthening of the cost culture as a promising solution to achieve these goals. In this context, to meet the organizational demand for knowledge of the historical unit cost of assets produced by the Treasury, FAYS has engaged in a survey of the costs of processes and macro-processes developed within the OM, studying the possibilities of tracking indirect costs, to produce useful information to assist management.

The first decision to be made for the preparation of the report was what will be the focus of the cost accumulation system, considering that it can occur either by project or by activity. Project costs must be accumulated by order, and are those related to the provision of services or production of goods linked to specific projects, with scheduled start and end dates; whereas activity costs must be accumulated by process, and refer to activities of a typical nature, which occur continuously. In the case of the FAYS project, the accumulation system by process was applied, setting as the analysis scope date of the Plant Production Unit the period from 06/01/2018 to 05/31/2019 and as the scope date of the Animal and Industrial Production Unit the period from 01/01/2019 to 12/31/2019.

Considering that, unlike the legal practices in the private sector, the choice of the public sector costing method is not restrictive, it was necessary to choose which costing method would be used in the analysis. Taking into consideration that previous FAYS projects have already used the Activity Based Costing method, the ABC method was the most favorable for the execution of this project.

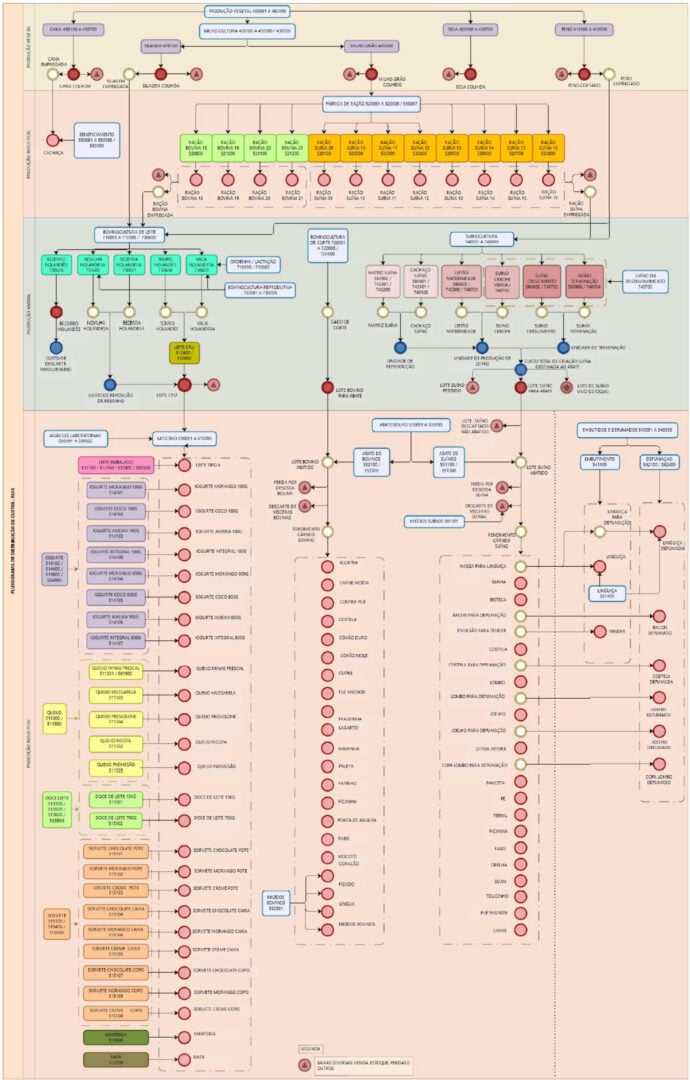

With the costing method defined, the organizational structure of FAYS was analyzed and it was established that the work would be dedicated to the analysis of the primary processes of the entire organization, these being considered those essential for the fulfillment of the institutional mission, i.e., the processes that relate directly to the farm’s production complex, which is divided into three Production Units: Plant, Animal and Industrial. Along with these three units, the commercial aspect of the mission, which is the distribution of goods produced or processed on the farm, makes commercial activities also included under the list of primary processes. For the other non-primary processes, such as personnel management and infrastructure activities, the costs were registered as expenses.

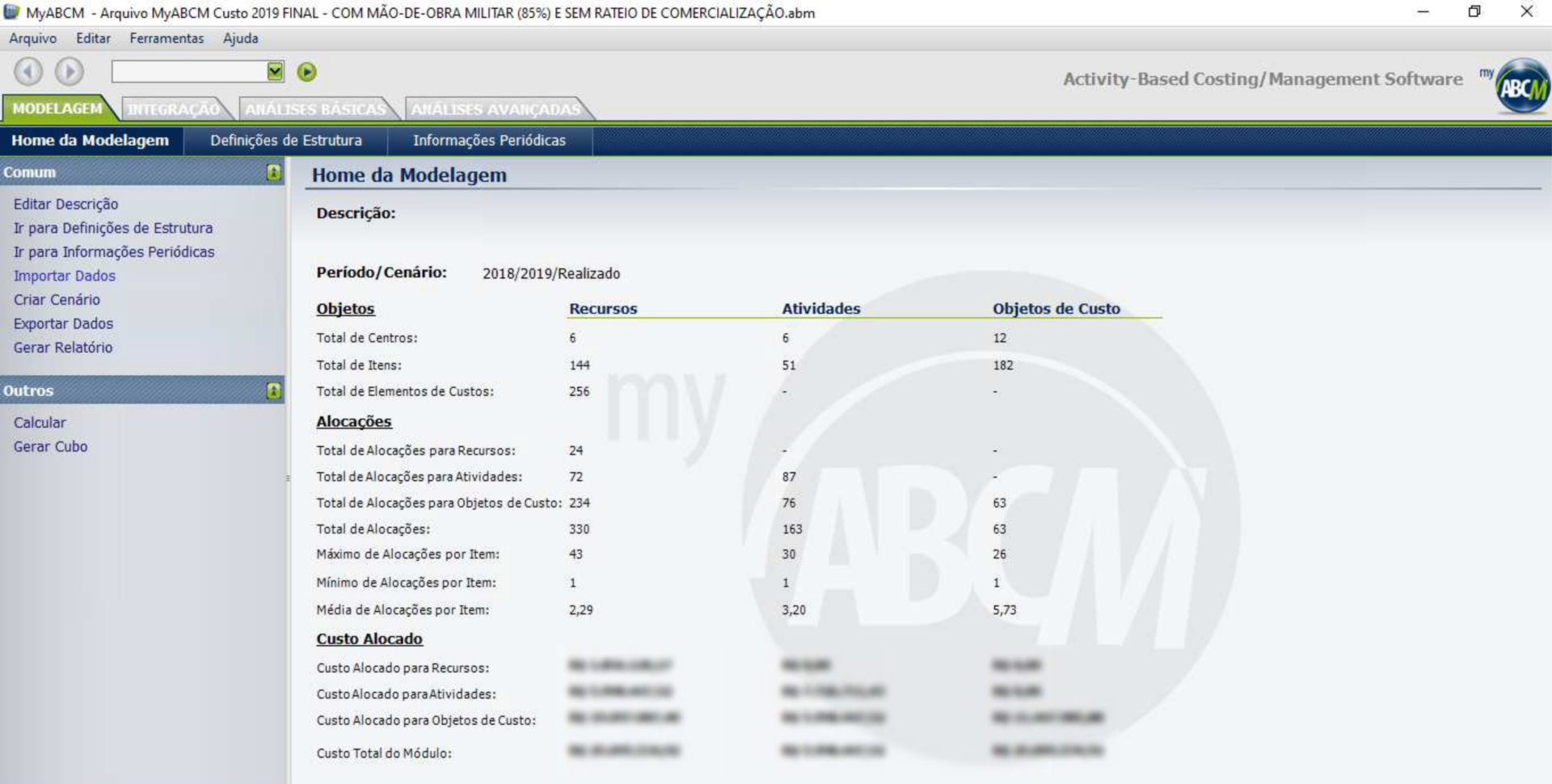

Under the optics of this approach, it became essential, to ensure the continuity of the engagement in the Cost Accounting area with the desired fluidity, the acquisition of a software that could optimize the work required for the project. In this search, a temporary license of the MyABCM software was hired.

As recommended by the Cost Information Manual of the Federal Government (MIC), it is from the development of their own modeling that organizations begin to advance in the cost culture. In this sense, to optimize the analyses and understand the logic of the calculations to be performed, it became necessary to elaborate cost flowcharts (with cost sub-centers) that reflected the interrelationship between the activities that comprised the processes of the FAYS Productive Complex in the referenced scope.

Once the Cost Sub-Centers that reflect the consumption of resources by activities were known and their interrelation understood, it became necessary to calculate the monetary values cumulatively spent in the processes to calculate the unit cost of the objects of interest.

Therefore, the following order of priority was considered for the allocation of costs to the activities and objects of interest: direct allocation (when there is an objective identification of the sacrifice of resources for the development of an activity or an activity for the delivery of a product); tracing (when a cause and effect relationship is sought through the use of drivers); and apportionment (a more arbitrary criterion that should be avoided from the management point of view).

After completing the preliminary steps, the desired result was obtained by processing the application itself. This has the parameter of calculating the Unit Cost by dividing the costs that were accumulated in the allocations, by the “Volume Entered” of each verification object, i.e., by the total quantity of units produced during the period considered.

In this context, to optimize the managerial analyses, “triggers” were created along the cost modeling to enable a certain roll of results based on the same input. Thus, it was decided to name the different compositions to improve the understanding of the coming analyses, which are Basic Cost, Budgeted Cost, Production Cost and Cost Price.

Basic Cost:

Comprised of the consumption of materials used in production, and the settlement of services applied in production activities.

Budgeted Cost:

Comprised by the consumption of materials used in production; the settlement of services applied in productive activities; and the depreciation of permanent assets allocated to productive sectors in the asset controls of SILOMS (Integrated System of Logistics of Material and Services).

Production Cost:

Composed by the consumption of materials used in production; the settlement of services used in productive activities; the depreciation of permanent material allocated to productive sectors in SILOMS; and the labor allocated in productive sectors in SIGPES (Personnel Management Information System).

Its main application is the optimization of the Organization’s horizontal vision, providing an opportunity for process analysis and improvement, using activity performance improvement, and it can also be used as a benchmark for pricing items intended for external sale and the Reimbursable Section.

Cost Price:

Composed of the consumption of materials used in production; the settlement of services applied in production activities; the depreciation of permanent material allocated to productive sectors in the asset controls of SILOMS; the military manpower allocated to productive sectors in SIGPES; and the commercialization expenses.

With this in mind, in addition to guiding public pricing, the valuation of production stocks, the retro-analysis of operational practices employed in the production chain, the promotion of improved performance by managers through benchmarking actions, product reengineering, waste reduction, as well as the feasibility of changes to the current portfolio, the practice of measuring unit costs of goods produced by the Treasury can certainly be employed as a continuous improvement tool for the organization.

From the theoretical approach and the analysis of the results obtained through the implementation of a cost management model using the ABC methodology, it is expected that the proposed objective has been achieved and it is suggested that FAYS continues to pursue continuous improvement in terms of Cost Accounting, focusing on the goals of quality public spending.