Cost allocation is a highly important topic for any company seeking to understand its true profitability. However, it’s common to see businesses relying on generalist ERP systems or solutions focused on tax and accounting management to monitor their costs.

This is a critical mistake. While these systems are excellent for managing tax obligations or providing an overview of financial performance, they are not designed to track and allocate costs with the level of detail necessary for efficient management. As a result, strategic areas such as FP&A (Financial Planning & Analysis) are limited in their ability to deliver accurate insights for financial planning and decision-making. Additionally, products and services that appear to be profitable may end up generating losses, while others considered unprofitable might actually be sustaining important margins for the company.

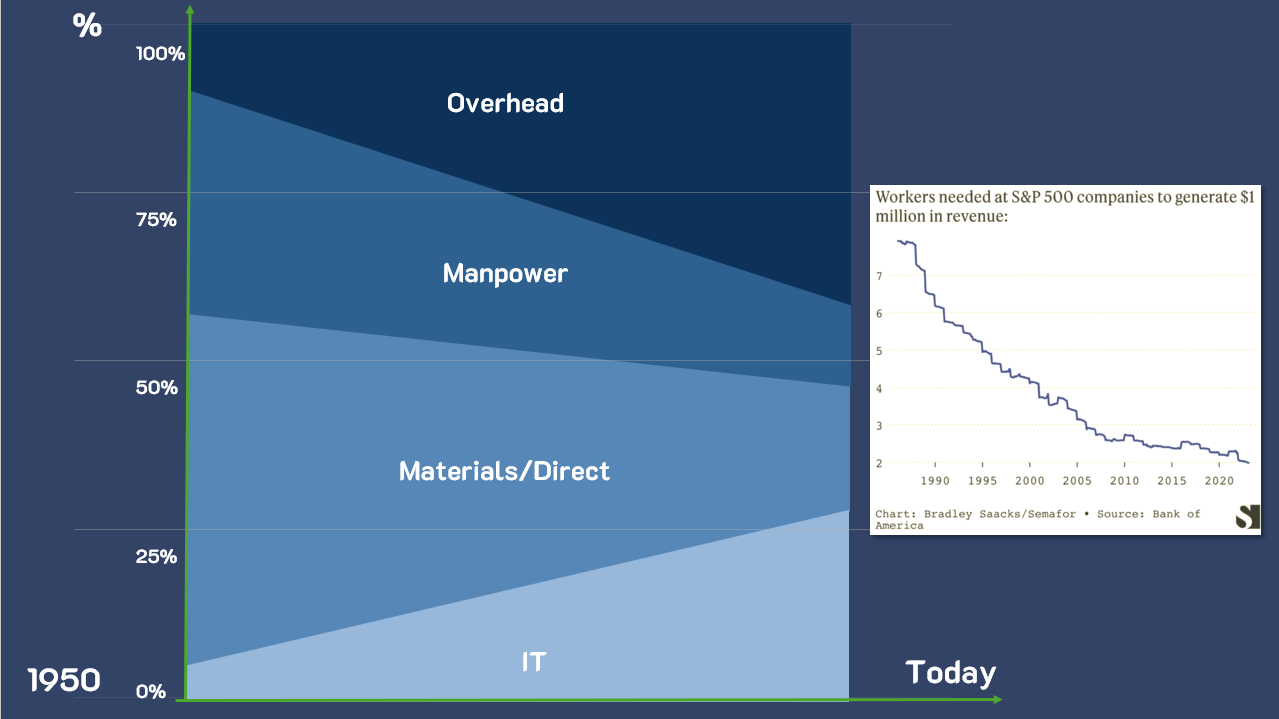

The composition of costs has changed dramatically over the past few decades. In the 1920s, every dollar spent on administrative areas corresponded to an investment five to ten times higher in operations. Today, the situation has reversed: administrative costs can be double or even triple the amount spent directly on operations.

Moreover, technological advances have transformed the costs of materials and direct labor. With automation and the introduction of artificial intelligence systems, technology expenses have skyrocketed, while direct labor costs have proportionally decreased. This has further increased the complexity and impact of indirect costs on the overall cost structure.

Many companies still rely solely on generalist management systems, which centralize business administration but cannot handle the complexity of cost allocation. Furthermore, according to a PwC study, 31% of companies do not allocate costs at all, while 69% do allocate costs but based on simplified criteria such as sales volume or revenue, often leading to inconsistencies.

Without a specialized tool, it is impossible to identify the true costs of departments like IT, HR, legal, and logistics, which support operations but are not directly tied to them. Additionally, the diversity of products, services, channels, and processes only increases the need for a system capable of detailing these costs and providing reliable analyses for strategic decisions.

In this context, ABC costing stands out as an effective solution for managing the complexity of different cost sources, enabling more accurate allocation based on appropriate drivers. A practical example of this is the story of one of our clients who, before implementing MyABCM, used imprecise methods to allocate about 35% of their costs. This caused serious inconsistencies in their management. After adopting a more precise approach, the company was able to redefine its strategies and optimize its net margin, even while operating with tight numbers.

A specialized approach to tracking and allocating costs allows you to turn assumptions into concrete data, creating a clearer scenario for decision-making. This not only increases operational efficiency but also helps identify improvement opportunities that might go unnoticed in generalist systems.

It’s time to reevaluate how your company views costs. Fill out the form below and discover how our software can transform your management and maximize your profitability.

Request a demo bellow and know what MyABCM can do for your company.

If you are interested in MyABCM solutions and need more information, please send us a message.