Cost allocation is a highly important topic for any company seeking to understand its true profitability. However, it’s common to see businesses relying on generalist ERP systems or solutions focused on tax and accounting management to monitor their costs.

This is a critical mistake. While these systems are excellent for managing tax obligations or providing an overview of financial performance, they are not designed to track and allocate costs with the level of detail necessary for efficient management. As a result, strategic areas such as FP&A (Financial Planning & Analysis) are limited in their ability to deliver accurate insights for financial planning and decision-making. Additionally, products and services that appear to be profitable may end up generating losses, while others considered unprofitable might actually be sustaining important margins for the company.

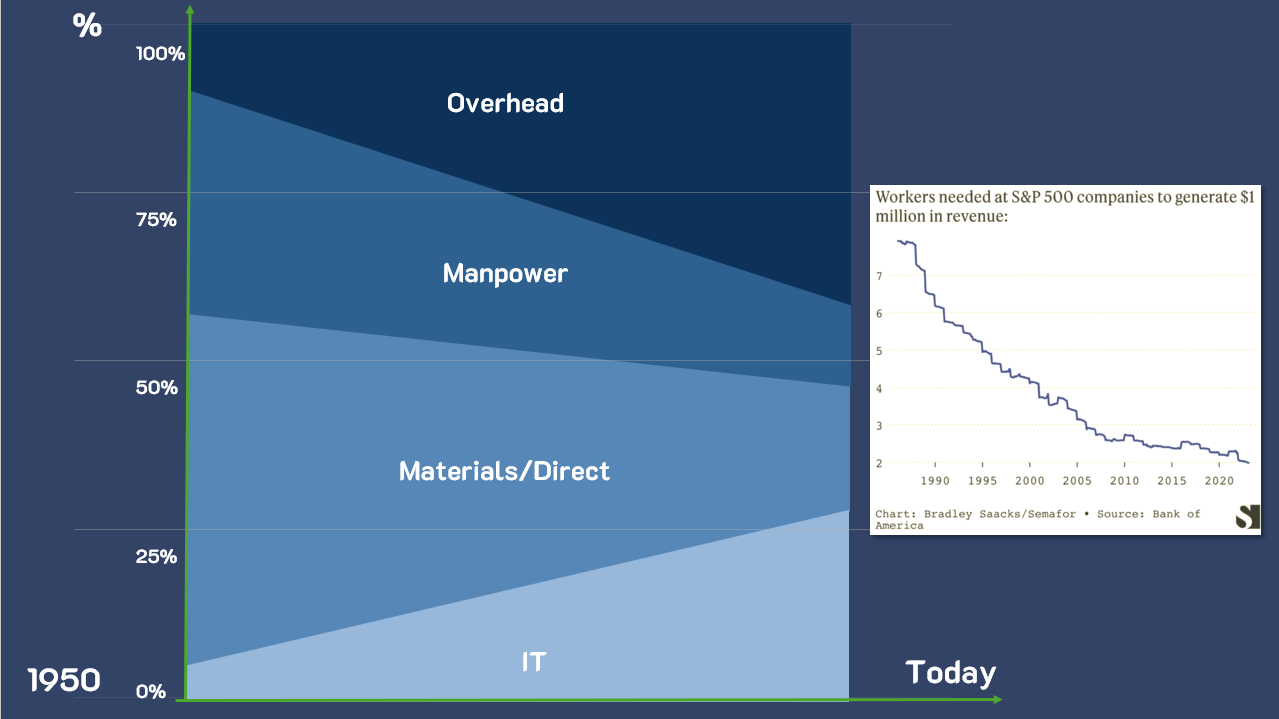

The composition of costs has changed dramatically over the past few decades. In the 1920s, every dollar spent on administrative areas corresponded to an investment five to ten times higher in operations. Today, the situation has reversed: administrative costs can be double or even triple the amount spent directly on operations.

Moreover, technological advances have transformed the costs of materials and direct labor. With automation and the introduction of artificial intelligence systems, technology expenses have skyrocketed, while direct labor costs have proportionally decreased. This has further increased the complexity and impact of indirect costs on the overall cost structure.

Many companies still rely solely on generalist management systems, which centralize business administration but cannot handle the complexity of cost allocation. Furthermore, according to a PwC study, 31% of companies do not allocate costs at all, while 69% do allocate costs but based on simplified criteria such as sales volume or revenue, often leading to inconsistencies.

Without a specialized tool, it is impossible to identify the true costs of departments like IT, HR, legal, and logistics, which support operations but are not directly tied to them. Additionally, the diversity of products, services, channels, and processes only increases the need for a system capable of detailing these costs and providing reliable analyses for strategic decisions.

In this context, ABC costing stands out as an effective solution for managing the complexity of different cost sources, enabling more accurate allocation based on appropriate drivers. A practical example of this is the story of one of our clients who, before implementing MyABCM, used imprecise methods to allocate about 35% of their costs. This caused serious inconsistencies in their management. After adopting a more precise approach, the company was able to redefine its strategies and optimize its net margin, even while operating with tight numbers.

A specialized approach to tracking and allocating costs allows you to turn assumptions into concrete data, creating a clearer scenario for decision-making. This not only increases operational efficiency but also helps identify improvement opportunities that might go unnoticed in generalist systems.

It’s time to reevaluate how your company views costs. Fill out the form below and discover how our software can transform your management and maximize your profitability.

Imagine being able to simulate every strategic decision before implementing it. This is a reality for an American oil company that is transforming its business approach with the support of MyABCM.

An American oil company with a global presence, project conducted at its headquarters in the United States.

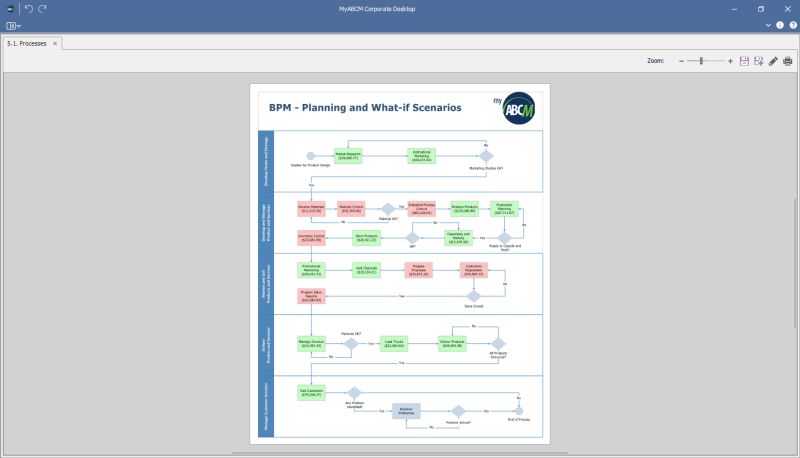

Simulation of cost scenarios for processes and identification of bottlenecks and capacity overruns in the native BPM module of MyABCM.

To understand the impacts of business decisions such as machinery replacement, creating a third shift in production, make or buy decisions, setting up new Distribution Centers, partial fleet outsourcing, and much more…

Development of a cost modeling by process with detailed analysis of the P&L by products, channels, customers, routes, and Distribution Centers—using allocation criteria that respect cause-and-effect relationships and minimize arbitrary allocations. Identification of installed capacities in production and back-office, allowing for sophisticated planning analyses. 🚛

Agility in decision-making processes, simultaneous analysis of multiple business scenarios, and their respective impacts on the company’s global results.

By simulating scenarios BEFORE actual implementation, the company was able to make strategic decisions based on facts and mitigated the risk of decisions based on assumptions. With the ability to compare multiple scenarios simultaneously in the tool within a BPM view, the decision-making process was made easier.

In the image from MyABCM, you can see the cost modeling done with the mapping of business and back-office processes and respective costs for a specific scenario. Note that the activities in red are those that, after running the simulation scenario, will have bottlenecks — either due to a lack of installed capacity, a shortage of people, or excessive effort. In less than 10 minutes, the company was able to discard 7 proposed scenarios and choose a more favorable scenario for implementation.

The MyABCM solution is essential for any organization to make the best decisions, improve efficiency, and responsibly manage its costs. 🎯

How is your company using data to improve operational efficiency?

Many managers still consider Activity-Based Costing (ABC) to be something complex and challenging to implement. However, if your company has been facing financial difficulties for years and struggling to control costs efficiently, could the real challenge lie in adopting ABC or in continuing to ignore the need for precise cost control? When implemented correctly, ABC can be the differentiator your company needs to leave behind past inefficiencies.

In the 1990s, Activity-Based Costing became a true craze, much like we see today with the popularity of Artificial Intelligence. The concept, created by Robert Kaplan, was inspired by work already done by General Electric in the 1950s, but due to the lack of technology at the time, implementing it was extremely challenging.

The major breakthrough came with the rise of personal computers and the creation of specialized software in the 1990s. It was during this period that Activity-Based Costing gained popularity and started being used by companies of various sizes. The software became accessible, and businesses realized its importance for improving financial control and internal processes.

Three suppliers stood out during this historic moment:

In the late 1990s, with the approaching “Y2K bug” and the growing popularity of ERP systems, Activity-Based Costing took a backseat. The priority for companies was to ensure their ERPs could handle everyday problems, while ABC was left aside. Over the years, the dependency on ERPs and the combination of tools like Excel and BI prevailed, but the issue of cost management remained unresolved.

Despite market changes, the need for an effective system to accurately cost processes, products, services, and customers remained. Companies that did not adapt to this reality ended up facing financial and operational difficulties.

It is in this scenario that MyABCM emerges, a modern and effective tool for implementing Activity-Based Costing. It combines the best of historical solutions with current technology, offering a fully integrated platform with corporate systems. MyABCM allows companies of various sizes to adopt a robust cost management system that is easy to implement.

Contrary to what many think, Activity-Based Costing doesn’t have to be a complex task. MyABCM makes the solution accessible, efficient, and adaptable to the needs of each company. Don’t be fooled by the apparent complexity. Accurate measurement is the key to efficient management and successful financial control.

Ready to transform your company’s cost management? Fill out the form below and learn how MyABCM can be the solution you need to optimize your results.

Cost optimization is one of the keys to transforming operations and achieving better results. A great example comes from UPS, a logistics giant, which implemented a surprising policy to reduce costs: avoid turning left whenever possible.

Since 2004, the company has been implementing this curious strategy in its U.S. operations. In the country, drivers can turn right, even when the light is red, as long as the road is clear. On the other hand, turning left usually means more time in traffic, higher fuel consumption, and an increased risk of collisions.

By eliminating most left turns, even if the route became longer, UPS optimized routes and saved 38 million liters of fuel. This led to a reduction of 20,000 tons of CO2 emissions and saved more than R$ 200 million annually. Additionally, with this simple and unusual change, the company was able to make 350,000 additional deliveries every year.

Many MyABCM clients, including major names in the logistics sector such as Correios do Brasil (Brazilian Post), OPT Nouvelle-Calédonie (New Caledonia Post), and Poste Maroc (Barid Al Maghrib – Moroccan Post), know that efficient management starts with the ability to measure and understand every detail of costs. With MyABCM, these companies can map costs in a granular way, identify bottlenecks, and create strategies that maximize efficiency.

UPS’s case highlights the importance of evaluating every operational decision with precision. The “right turn” policy was even validated by the “MythBusters” TV show, which compared two vehicles: one following the rule and the other ignoring it. The vehicle that avoided left turns consumed less fuel, proving the strategy’s effectiveness.

Detailed simulations, such as those offered by MyABCM, allow companies to go beyond simply looking for the shortest path and focus on the most efficient one. This level of detailed analysis can lead to significant savings and optimize operations on a large scale.

Small adjustments, like UPS’s “right turn” policy, show how seemingly simple and even odd decisions can have a transformative impact on costs and sustainability. Is your company also prepared to identify these opportunities and optimize results?

Fill out the form below to learn how MyABCM can help your organization reach a new era of operational efficiency.

Installed capacity is an essential concept for the sustainable growth of any company and ignoring it can lead to significant problems. This is exactly what almost happened to one of our clients when they considered a major investment in a Big Brother Brasil campaign to reverse a failed product launch.

It all began when this client faced challenges with the launch of a new product. The initial campaign was designed to target major urban centers, using various media channels. Despite investments in radio, newspapers, and TV, sales numbers were disappointing, and the company even considered discontinuing the product.

Seeking a turnaround, the marketing team proposed a bold idea to save the product and the company’s results: advertise on Big Brother Brasil. The proposal included an investment of R$30 million, with the promise of tripling sales within three months.

Certainly, an attractive prospect, but that’s where the data came in. While the idea was enticing, the CFO raised a critical question: could the company’s installed capacity handle this surge in sales?

Since MyABCM had recently been implemented within the organization, the FP&A and Controllership teams were able to perform detailed simulations to answer this question. The analysis uncovered significant bottlenecks in several areas, including production, logistics, and IT. The system revealed that without structural adjustments, tripling sales could lead to operational collapses severe enough to bankrupt the company!

This case clearly illustrates that ignoring installed capacity during periods of growth can be disastrous. This concept goes beyond simply measuring available production resources; it involves understanding bottlenecks and limitations throughout the workflow, from production to customer service. Companies that conduct detailed analyses of their processes, like those using MyABCM, can anticipate problems and prepare adequately for new challenges.

For our client, the insights provided by MyABCM were decisive. Using the ABC costing methodology, they identified the bottlenecks that needed to be resolved and reorganized their internal processes. This way, the company avoided a potential crisis by recognizing that it lacked the structure to support the sudden increase in demand that the campaign would generate.

After adjustments and improvements, the scenario completely changed. With its installed capacity reviewed and optimized, the company was finally able to invest in a Big Brother Brasil campaign in a subsequent season. This time, the results were an absolute success: sales volumes more than tripled, and all departments were prepared for the new reality.

This story highlights the importance of planning based on robust data and analysis. Tools like MyABCM provide not only a detailed view of costs and processes but also the ability to simulate scenarios and anticipate challenges. This allows companies to turn risks into real growth opportunities.

Discover how MyABCM can help your company identify bottlenecks, optimize processes, and grow sustainably. Fill out the form below and start planning the future of your business with confidence.

Idle assets are a recurring problem in companies across various sectors. When resources like machinery, space, or servers are underutilized, production costs rise, compromising profitability. Identifying and managing these idle assets is essential to avoid financial distortions and optimize operational performance.

One of our clients, a national leader in the Brazilian paper reel industry, faced an unusual situation. MyABCM identified that the unit cost of a reel had skyrocketed from R$1.50 to R$700 in a single month.

Understandably, they contacted us, suspecting an error in cost calculation. However, upon drilling down into the cost structure, we discovered the issue lay in production volume. The usual production of 20,000 boxes of reels had dropped to just 150 boxes.

Despite the reduced production, the factory’s structure remained unchanged, resulting in high fixed costs being spread across a much smaller number of produced units. This underutilization of machinery and space drastically increased the unit cost—a problem many organizations face without even realizing it.

Idle assets aren’t exclusive to the industrial sector. Service companies also deal with underutilized resources like servers and unused contracts. Below are some recommended practices to manage this issue:

In our client’s case, after confirming that production wouldn’t return to previous levels, the solution was to lease part of the factory to another company. As a result, those previously idle assets started generating revenue instead of costs. But this was only possible because the cost source was correctly identified.

Idle assets represent a silent cost that can significantly impact a company’s profitability. Underutilized resources distort unit costs, and if left unmanaged, they can jeopardize financial health. The key to avoiding this issue is adopting data-driven management and closely monitoring resource usage, with methods such as activity-based costing.

With MyABCM’s support, your company can identify and address idle assets and other potential cost generators, optimizing resources and making well-informed decisions. Fill out the form below and speak with our specialists!

Economies of scale are a decisive factor for companies aiming to improve operational efficiency and profitability. They occur when large-scale production or operations reduce unit costs, boosting margins and maximizing results. However, poorly managed scaling can become a significant issue, leading to hidden costs and negatively affecting financial performance.

One example of economies of scale comes from the Brazilian company Chilli Beans, which sells around 5 million pairs of glasses annually. If the company were to reduce production costs by R$1 per unit, it would see a R$5 million increase in profitability. Conversely, a R$1 increase in costs would result in a loss of the same magnitude. This logic applies to many companies across diverse sectors, including air transportation and the automotive industry.

Companies from various industries have implemented creative strategies to leverage the benefits of economies of scale. A notable example is American Airlines, which saved $40,000 annually by removing a single olive from in-flight meals. Meanwhile, Southwest Airlines streamlined operations by exclusively operating Boeing 737 aircraft, cutting maintenance and training costs.

Another reference is Toyota Motor Corporation, which employs meticulous adjustments in its production lines to maximize efficiency. The precise positioning of tools, used globally and continuously, generates significant gains over time. These examples demonstrate that small changes, when multiplied on a large scale, can yield substantial results.

On the flip side, not all clients contribute positively to economies of scale. A practical example involves one of our clients in Asia, which made significant adjustments to cater exclusively to a single customer. The company established a new distribution center, developed specific routes, and invested in electric trucks to meet this demand. However, after implementing our system, it became evident that this client had been unprofitable from the start. A detailed cost analysis revealed that the more products sold to this client, the greater the financial losses.

Understanding the impact of economies of scale on clients and products is crucial to avoiding financial pitfalls. Companies that accurately measure their costs can make strategic decisions about resource allocation, eliminating unprofitable operations, and strengthening areas with higher return potential.

Just as a clear vision allows Chilli Beans to spot cost-saving opportunities, companies across all sectors must adjust their focus to maximize economies of scale. Seemingly insignificant details, such as removing an olive or choosing a single aircraft model, can be decisive for financial health.

Want to learn how to apply economies of scale in practice and turn your company’s costs into a competitive advantage? Fill out the form below and discover how MyABCM can help your business achieve remarkable results.

Business cost analysis is essential for organizations aiming to grow sustainably and efficiently. Without accurately measuring costs, many organizations end up making intuition-based decisions, which can compromise results.

A great example of the importance of analyzing metrics to ensure results comes from the music world. Before every show, the band Metallica uses Spotify data to select the most popular songs in each city. This way, they create a personalized setlist for that audience, ensuring performances that deeply connect with their fans. This process exemplifies the importance of measuring data to better manage results. It’s no coincidence that the band remains active more than 40 years after its formation, adapting to changes in the entertainment industry and attracting audiences to all their shows.

In the business environment, cost management requires the same level of precision. Knowing exactly how to allocate indirect costs, understand idle resources, and identify the most profitable clients are fundamental steps to building solid growth strategies.

Just as Metallica uses data to shape their performances, companies that invest in business cost analysis can identify the greatest opportunities for improvement. For instance, fixed costs are often allocated generically, leading to distortions and impairing a true view of profitability. Similarly, companies that fail to adequately measure their processes, activities, and business often manage based on feeling, assigning costs as they see fit to each activity, product, or process.

By detailing costs such as sales, marketing, or back-office expenses, these can be directly allocated to the activities and clients consuming them. This brings clarity and allows for precise adjustments in pricing and service strategies, enhancing operational efficiency and profits.

Accurate data as the foundation for strategic decisions

Companies that use advanced tools like MyABCM can transform complex metrics into strategic decisions. The software acts as a “Spotify for cost management,” offering a detailed view of processes, enabling adjustments, and promoting greater profitability.

Just as a band tailors its setlist to deliver an unforgettable show, companies that continuously measure and adjust their costs are better equipped to stand out in the market and serve their clients more effectively.

If you want to transform your management and increase profitability, fill out the form below to learn how MyABCM can help your company measure and manage costs with precision.

Customer portfolio management is essential for ensuring strategic decisions that maximize your business’s profitability. Many companies still associate customer success with generated revenue, but this view can obscure critical improvement opportunities. After all, customers with high purchase volumes may be less profitable when the costs associated with serving them are analyzed.

A detailed analysis of service costs reveals that not all customers contribute positively to the company’s financial health. According to studies from Harvard Business Review, the distribution of customer profitability is as follows:

Identifying which customers demand more effort and resources enables more precise decisions regarding pricing and discounts. Companies that neglect this cost evaluation often face distortions. This happens because fixed costs are poorly distributed among the remaining customers, which can turn neutral customers into unprofitable ones.

It might seem like the best solution is to “fire” an unprofitable customer. However, without proper cost evaluation, the company could face an unexpected impact: fixed costs, previously allocated across all customers, would now be redistributed among the remaining ones. As a result, customers that were once neutral or profitable may begin generating losses, shifting the problem rather than solving it and harming profitability further.

Solutions such as our profitability calculator can help you identify each customer’s true situation and make more confident decisions.

Effective customer portfolio management is a key step in improving business results. It provides valuable insights into which customers to prioritize and which need specific strategies to become profitable. One efficient method for this analysis is activity-based costing (ABC), which allows costs from sales, marketing, and logistics to be directly assigned to the customers consuming them.

With this approach, decisions such as adjusting contracts, redefining discount policies, and even discontinuing unprofitable relationships (while understanding how this decision impacts the company’s finances) become more strategic. This ensures the organization maintains a balance between profitable customers and those that can be optimized, driving sustainable growth.

Investing in customer portfolio management is a way to transform how you view your business. By focusing more clearly on the 20% to 30% of highly profitable customers and employing specific strategies for others, you can enhance profitability and reduce inefficient costs.

Want to better understand how to improve customer management and boost your results? Fill out the form below and discover how we can help your company grow smarter and more profitably.

Discovering how to increase profitability is a key concern for any company, especially in increasingly competitive markets facing growing management challenges. One of the keys to achieving this goal lies in the efficient handling of indirect costs, eliminating distortions that can compromise margins and strategic decisions.

Between 20% and 40% of a company’s products or services can incur losses without it being noticed. This often happens due to failures in allocating indirect costs, which are becoming increasingly significant in diversified organizations.

Studies show that many companies rely on methods such as volume- or revenue-based allocations, while others skip allocation altogether, relying solely on gross margin. Worse still, many times the distribution is based on feeling, depending on what managers believe should be assigned to each product, service, or activity. This approach leads to inaccurate decisions affecting pricing, commercial discounts, and even strategic direction.

Management based on feeling may seem adequate but often results in distortions that harm profitability. Common surprises include discovering that the company’s most profitable client is undervalued, or that the best-selling product generates losses. These issues are prevalent in businesses that neglect analytical methods for cost allocation.

Surprisingly, this doesn’t just happen in small businesses. We’ve implemented projects for a multinational with billions in revenue, where almost 30% of costs were allocated based on the feeling of managers.

Relying on intuition can mask the true efficiency of processes, increasing the costs of activities that don’t add value to customers and reducing competitiveness in the market.

Adopting a data-driven approach is crucial to optimizing costs and finding ways to increase profitability in your company. Analytical tools and structured methods reveal the reality of every aspect of the organization, enabling the elimination of non-value-adding activities, precise resource redistribution, and maximized net margins.

This transformation allows companies to identify their most profitable products, services, and clients, redefine commercial policies, and direct investments toward areas with the highest return potential.

Keeping your company competitive and profitable requires moving away from intuition-based methods and adopting a management approach focused on efficiency. Now that you know how to increase profitability, it’s time to take the next step.

Fill out the form below and find out how we can implement a strategic management approach that transforms your business results. We’re ready to help you reach new heights of success.