Customer portfolio management is essential for ensuring strategic decisions that maximize your business’s profitability. Many companies still associate customer success with generated revenue, but this view can obscure critical improvement opportunities. After all, customers with high purchase volumes may be less profitable when the costs associated with serving them are analyzed.

A detailed analysis of service costs reveals that not all customers contribute positively to the company’s financial health. According to studies from Harvard Business Review, the distribution of customer profitability is as follows:

Identifying which customers demand more effort and resources enables more precise decisions regarding pricing and discounts. Companies that neglect this cost evaluation often face distortions. This happens because fixed costs are poorly distributed among the remaining customers, which can turn neutral customers into unprofitable ones.

It might seem like the best solution is to “fire” an unprofitable customer. However, without proper cost evaluation, the company could face an unexpected impact: fixed costs, previously allocated across all customers, would now be redistributed among the remaining ones. As a result, customers that were once neutral or profitable may begin generating losses, shifting the problem rather than solving it and harming profitability further.

Solutions such as our profitability calculator can help you identify each customer’s true situation and make more confident decisions.

Effective customer portfolio management is a key step in improving business results. It provides valuable insights into which customers to prioritize and which need specific strategies to become profitable. One efficient method for this analysis is activity-based costing (ABC), which allows costs from sales, marketing, and logistics to be directly assigned to the customers consuming them.

With this approach, decisions such as adjusting contracts, redefining discount policies, and even discontinuing unprofitable relationships (while understanding how this decision impacts the company’s finances) become more strategic. This ensures the organization maintains a balance between profitable customers and those that can be optimized, driving sustainable growth.

Investing in customer portfolio management is a way to transform how you view your business. By focusing more clearly on the 20% to 30% of highly profitable customers and employing specific strategies for others, you can enhance profitability and reduce inefficient costs.

Want to better understand how to improve customer management and boost your results? Fill out the form below and discover how we can help your company grow smarter and more profitably.

Entel, a leading technology and telecommunications company, is transforming its cost management with the assistance of MyABCM. The organization, with operations in Chile and Peru, is renowned for its more than 20 million mobile subscribers and an extensive fiber optic infrastructure spanning approximately 11,000 kilometers, ensuring the continuity of interurban and international communications in both countries.

With the growing expansion of its services, technologies, and coverage areas in recent years, Entel has faced significant challenges. Managing an increasingly vast volume of cost information became essential, as well as providing an integrated and agile view of this data for relevant departments and decision-makers.

In response to this need, the company sought a solution capable of optimizing cost management and enhancing the traceability of cost information across its various activities.

The solution came in the form of MyABCM, chosen by Entel for meeting its specific needs. Firstly, it offered the ability to trace costs to the most granular levels, providing a detailed view of cost sources in all company operations, linking them to relevant service revenues and offering a precise visualization of the organization’s cost structure.

Furthermore, the tool provided users with the autonomy to explore and use its functionalities. This reduced dependence on external support and facilitated integration with other technologies used by the organization.

Another benefit of MyABCM was the agility in consolidating data and generating reports. With it, Entel accelerated the processing of analyses and data availability, making access to information faster and more efficient. This provided a clear and immediate view of costs, enabling more informed and agile decision-making.

MyABCM also brought greater transparency and reliability to the obtained data. The solution eliminated dependence on spreadsheets and ensured the integrity of cost information, essential for effective management.

By centralizing cost information and reducing the time needed for analysis issuance, Entel gained greater autonomy in operating its cost model and obtaining analyses. With the support of MyABCM, the company is charting a successful path in cost management and making strategic decisions for the future of telecommunications in its coverage region.

Financial decision making is especially challenging in a business. In this context, FP&A is a valuable tool to optimize the use of resources and thus guide investments, increase profitability, and bring better results to the organization.

In practice, FP&A comprises a group of four main activities whose function is to assess and maintain the financial health of a company:

These activities collectively offer a comprehensive view of the financial situation, enabling the identification of trends and opportunities through the monitoring of the business’s financial performance.

Although the two concepts are related, they are differentiated in that they play distinct roles in a company. While financial management encompasses corporate finance activities more broadly, FP&A falls within the scope of financial management and is dedicated to strategic planning, analysis, and informed decision making.

While financial management encompasses accounting, cost control, cash flow, investments, and risk management, with a strong emphasis on documentation and operations, FP&A brings a strategic dimension to financial management. It focuses on analyzing the organization’s financial data to enable informed decision making and establish realistic, measurable goals.

In essence, while financial management aims to optimize day-to-day operations, FP&A leverages financial information to steer the company, mitigate risks, and optimize outcomes in the medium and long term.

To implement FP&A effectively, it is crucial to have accurate and reliable data sources. The financial management team should utilize data collection and consolidation tools, while also ensuring the availability of relevant accounting information for the various FP&A processes.

Some of the most relevant documents and information to support FP&A include:

It is important to highlight the existence of another strategic model called xtended Planning and Analysis (xP&A), which enriches the financial analyses performed in FP&A by incorporating additional dimensions.

It employs the best FP&A capabilities, such as forecasting, ongoing planning, and performance monitoring, and combines them with other metrics and information that are not typical of financial statements, generating a more comprehensive view. Data used includes employee turnover, customer acquisition cost, customer experience, etc.

Applying FP&A can be an important competitive differentiator. By providing detailed financial analysis, FP&A brings valuable insights that help identify savings opportunities, optimize resource allocation, and make financial decisions based on historical and predictive data, with controlled risks.

BPCE is one of the largest banking groups in Europe. For this reason, it requires cutting-edge technological support, which is provided by Informatique Banque Populaire (IBP), one of the group’s affiliated entities. IBP’s role is to create innovative technology solutions that simplify banking processes.

In addition to developing information systems for the group’s member institutions, IBP’s experts are responsible for designing, testing, and launching IT applications across various business sectors, including consumer finance, trade promotion, leasing, and other related services.

Managing the development of solutions in the banking industry, with its stringent requirements for security and usability, presents several challenges. In this context, IBP suffered from some difficulties associated with its billing model and a heavy reliance on Excel in its internal management activities.

Therefore, the institution sought a system that could meet these demands, optimize workflow, and fully automate the billing process.

Among the various options available, IBP selected MyABCM, based on its cost-effectiveness and the positive experience of BPCE in implementing the software.

Choosing MyABCM provided IBP with scalability beyond what Excel allowed. Additionally, it benefits from an optimized workflow on the platform that promotes user collaboration. Other significant benefits positively impacting the organization’s routine include scenario simulation, previously impossible with simple spreadsheets, and the ability of each operational department to analyze results confidently and reliably. Implementing MyABCM also enhanced data management security, reduced the risk of errors occurring, and increased team productivity.

Using specialized software for cost and profitability management, IBP now has a clear understanding of its costs and the impact of its business activities, linking cost sources to corresponding activities. The management team also values the increased control over refund and traceability resources, which are now acknowledged as valuable business assets, and experiences increased production capacity within the team.

ChatGPT has become a topic of discussion, especially in the business world. Entrepreneurs and professionals from various segments tirelessly debate about how it will impact the labor market and how it can help organizations lower costs thereby increasing profitability.

But the truth is that ChatGPT is only the visible portion of a large and constantly developing field that has been already in operation among us for a long time. If we investigate the history of artificial intelligence as they are known today, we will find their origins in the mid-1950s, when technologies such as the Logic Theorist, developed by Allen Newell and Herbert Simon at RAND Corporation in the United States; and the Perceptron, created by psychologist Frank Rosenblatt in 1957.

While the first reproduced human reasoning and problem-solving, even proving mathematical theorems, the second was a network of artificial neurons capable of learning, being one of the main precursors of Machine Learning, which is now the driving force of mechanisms such as ChatGPT.

ChatGPT is a technology based on natural language processing (NLP), which enables it to understand text in multiple languages and generate natural language responses, without the need for specific programming to perform each task. In other words, it literally speaks our language.

And this is part of the reason it causes such a stir. Besides optimizing Web searches (posing a threat to powerful representatives of Big Techs, such as Google), promotes a conversational experience with the machine, without requiring the user to know any programming language. With the liberated access to its technology, those who are not feeling like the protagonist of a science fiction movie are living in the past.

But countless Ais work daily in other functions. In the financial market, for example, there are systems not only based on NLP but also on machine learning, fraud detection systems, as well as robo-advisors and trading algorithms. The latter two stand out because they act directly on transactions.

While robo-advisors offer automated investment guidance based on information provided by investors (being great allies for beginners in the financial market and for those who don’t have time to monitor the scenario), trading algorithms employ market data obtained in real-time to make critical decisions to buy and sell financial assets. This is possible because they are programmed to identify price patterns and market trends, enabling traders to make data-driven decisions and execute trades with much more agility and confidence.

And those who think this is new are wrong. The use of AIs in the financial market began in the 1970s, with systems like INGRES (Intelligent Graphic Reinvestment System). Developed by the investment company Dean Witter Reynolds (now part of Morgan Stanley, a world leader in financial services) it was a pioneer in the industry. By applying neural networks (in a Perceptron-like fashion), it analyzed transaction data and predicted market trends.

INGRA is no longer in use, but today systems like Sentieo, Kavout, Kensho, and Acorns are some of the AI technologies in application in stock buying and selling and investment advice.

Amidst so many fears about information security (and even a possible machine revolution), it is difficult to predict exactly where these technologies will go and what role they will play in our daily lives soon. However, the market expectation is that their use will become more and more massive, as a tool to boost results and reduce costs in the medium and long term.

According to research by Market Data Forecast, the AI market in the financial sector is expected to grow at a compound annual growth rate of 41.2% between 2020 and 2027, jumping from $6.7 billion to $15.8 billion over the period. This is in line with research by Tractica, whose estimate is that by 2025, AI-mediated e-commerce transactions worldwide will exceed $36 billion.

This growth is a result of the increased efficiency produced by these technologies. Nasdaq itself applies AI algorithms to accelerate and reduce trading costs, taking transactions to a new level.

Of course, such an advance would not be restricted to the financial market. Research indicates that the use of these technologies can also benefit companies and that this is why they will also play a greater role in the corporate environment.

According to Accenture, the AIs applied to business management can reduce costs by up to 30% and increase revenue by up to 38% in 16 different segments, such as Education, Food Service, Hospitality, Healthcare, Wholesale, Retail, and Manufacturing, among others. A true springboard of profitability for organizations that invest in these tools.

And businessmen are already keeping an eye on this trend. From a complementary perspective, data from Forbes indicates that by the end of this year, business process automation with AI systems is expected to grow by 57%.

Looking beyond ChatGPT, it is easy to note that the use of Artificial Intelligence has already become a giant competitive advantage aggregator for businesses across all industries. Thus, it’s up to CEOs and CFOs to be on the lookout for ways to get ahead in this race, investing in solutions that can make their businesses stand out from the competition.

Providing sanitation and electricity to hundreds of thousands of people is no simple task. But it is the mission that Radees has taken on in Morocco, serving several communities with urban infrastructure solutions essential to the quality of human life.

Responsible for the distribution of drinking water and energy, Radees has just signed a contract to use the MyABCM solution in its cost and profitability management. Assisting in the software implementation process, the renowned consulting and auditing company BDO will be a strategic partner in the project.

With not only a corporate but a social commitment to provide quality drinking water and energy to over 300,000 people, the organization needed a tool to visualize the costs associated with managing miles of infrastructure equipment. Therefore, MyABCM is the chosen software to visualize the multiple sources of costs and the possible impacts of making decisions before subjecting hundreds of thousands of people to them.

The version of the software selected to serve the company offers features for flexible and intuitive multidimensional modeling with a relatively low implementation time. The system will allow allocations to be made through clear visual representations and with the application of business rules at various levels of complexity to allocate values from sources to destinations.

The organization will also benefit from advanced cost-tracking solutions that control resource consumption and pass-through to customers, as well as model summaries that allow potential distortions to be identified quickly and corrected before they damage business results.

To learn more about the solutions that serve Radees and other large companies distributed in more than 50 countries, contact us! Use the form below.

Samara Lima e Andrade

Captain Intendant

Head of the Production Division of the Pirassununga Aircraft Farm

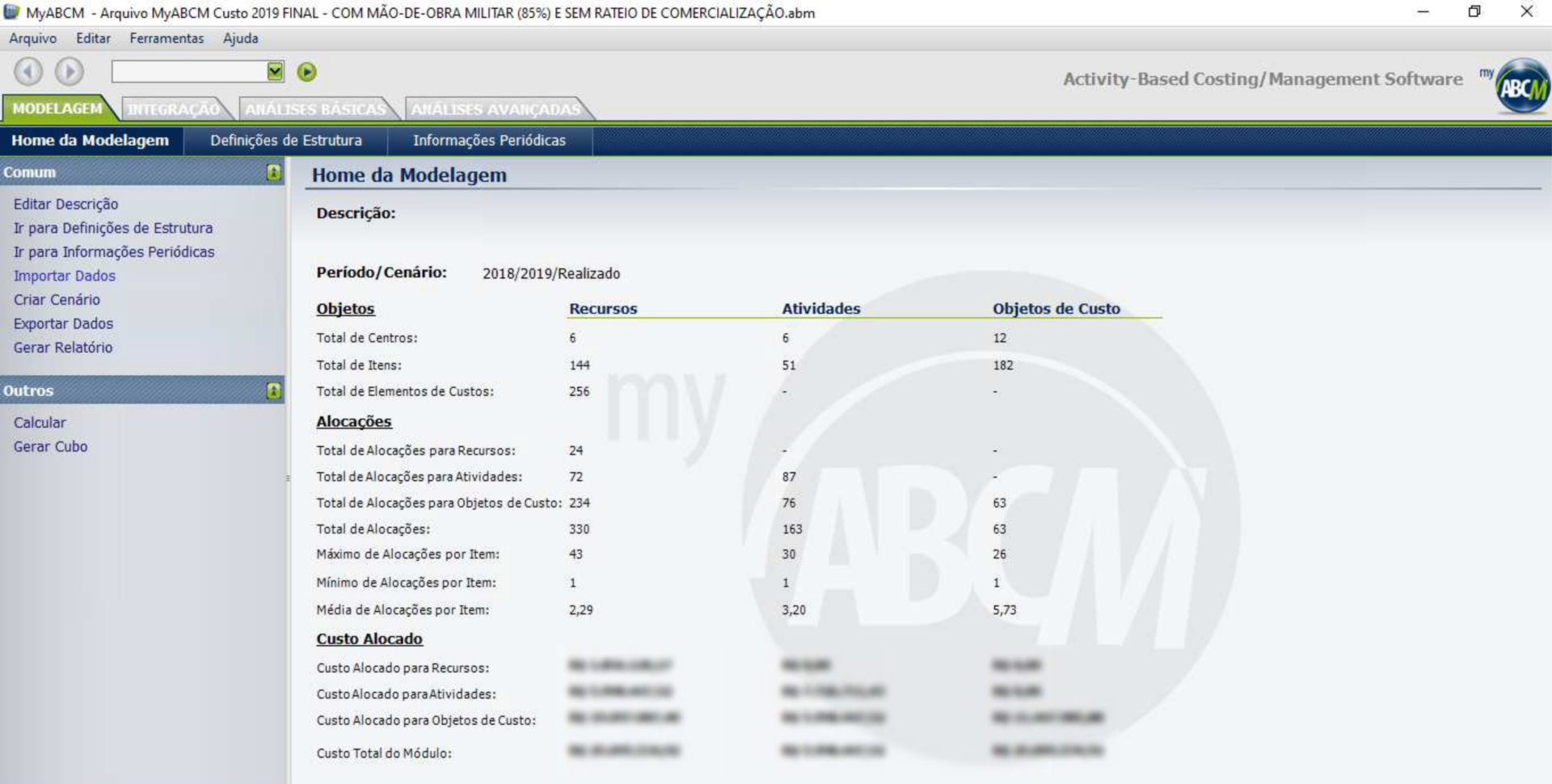

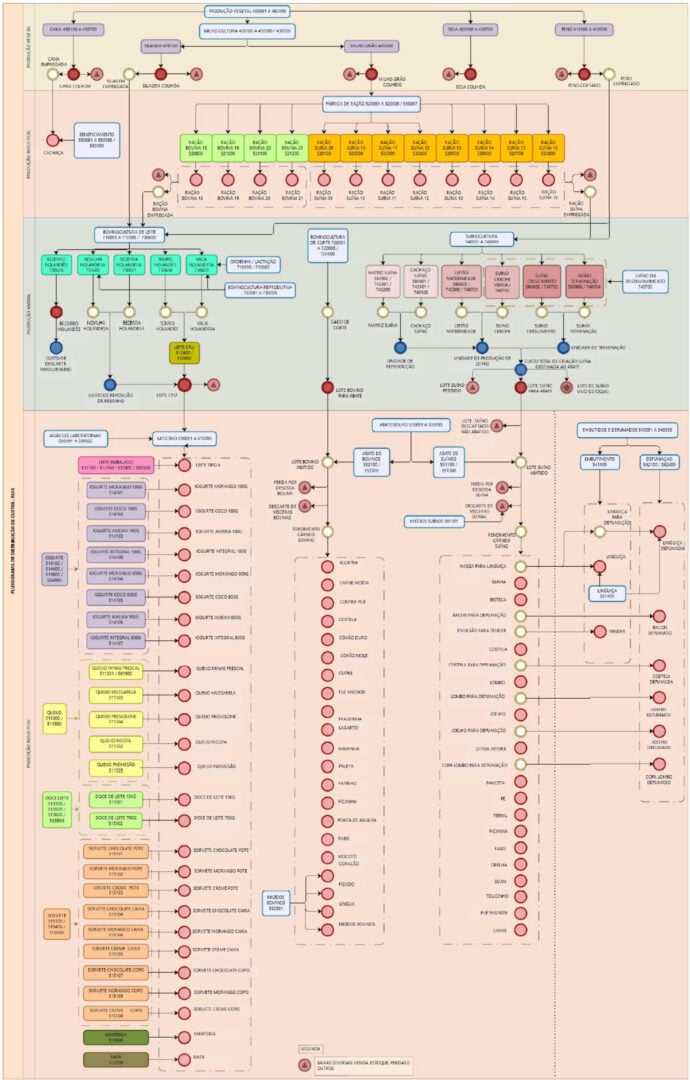

This case study aims to present how the Pirassununga Aeronautical Farm (FAYS), a Military Organization based at the Air Force Academy (AFA), employed cost analysis as a beacon for the optimization of management and public spending. The entire project aimed to meet the organizational demand of maturing public management and had as its scope the knowledge of the historical unit cost of assets produced in the fiscal year 2019. The analysis used the ABC (Activity Based Costing) method to prepare the report and sought to serve as a subsidy to assist management in making more assertive decisions to improve public spending.

Founded in 1942, FAYS has an area of 6,502 hectares in the State of São Paulo. It is a Military Organization of the Brazilian Air Force, whose mission is the productive occupation of the lands of the Pirassununga Air Force Garrison with agricultural activities, which result in the production of food products sold internally and externally to the organization, according to the Strategic Planning in force.

Public opinion has become increasingly demanding as to the efficiency of public management and the optimization and improvement of public spending, culminating in the strengthening of the cost culture as a promising solution to achieve these goals. In this context, to meet the organizational demand for knowledge of the historical unit cost of assets produced by the Treasury, FAYS has engaged in a survey of the costs of processes and macro-processes developed within the OM, studying the possibilities of tracking indirect costs, to produce useful information to assist management.

The first decision to be made for the preparation of the report was what will be the focus of the cost accumulation system, considering that it can occur either by project or by activity. Project costs must be accumulated by order, and are those related to the provision of services or production of goods linked to specific projects, with scheduled start and end dates; whereas activity costs must be accumulated by process, and refer to activities of a typical nature, which occur continuously. In the case of the FAYS project, the accumulation system by process was applied, setting as the analysis scope date of the Plant Production Unit the period from 06/01/2018 to 05/31/2019 and as the scope date of the Animal and Industrial Production Unit the period from 01/01/2019 to 12/31/2019.

Considering that, unlike the legal practices in the private sector, the choice of the public sector costing method is not restrictive, it was necessary to choose which costing method would be used in the analysis. Taking into consideration that previous FAYS projects have already used the Activity Based Costing method, the ABC method was the most favorable for the execution of this project.

With the costing method defined, the organizational structure of FAYS was analyzed and it was established that the work would be dedicated to the analysis of the primary processes of the entire organization, these being considered those essential for the fulfillment of the institutional mission, i.e., the processes that relate directly to the farm’s production complex, which is divided into three Production Units: Plant, Animal and Industrial. Along with these three units, the commercial aspect of the mission, which is the distribution of goods produced or processed on the farm, makes commercial activities also included under the list of primary processes. For the other non-primary processes, such as personnel management and infrastructure activities, the costs were registered as expenses.

Under the optics of this approach, it became essential, to ensure the continuity of the engagement in the Cost Accounting area with the desired fluidity, the acquisition of a software that could optimize the work required for the project. In this search, a temporary license of the MyABCM software was hired.

As recommended by the Cost Information Manual of the Federal Government (MIC), it is from the development of their own modeling that organizations begin to advance in the cost culture. In this sense, to optimize the analyses and understand the logic of the calculations to be performed, it became necessary to elaborate cost flowcharts (with cost sub-centers) that reflected the interrelationship between the activities that comprised the processes of the FAYS Productive Complex in the referenced scope.

Once the Cost Sub-Centers that reflect the consumption of resources by activities were known and their interrelation understood, it became necessary to calculate the monetary values cumulatively spent in the processes to calculate the unit cost of the objects of interest.

Therefore, the following order of priority was considered for the allocation of costs to the activities and objects of interest: direct allocation (when there is an objective identification of the sacrifice of resources for the development of an activity or an activity for the delivery of a product); tracing (when a cause and effect relationship is sought through the use of drivers); and apportionment (a more arbitrary criterion that should be avoided from the management point of view).

After completing the preliminary steps, the desired result was obtained by processing the application itself. This has the parameter of calculating the Unit Cost by dividing the costs that were accumulated in the allocations, by the “Volume Entered” of each verification object, i.e., by the total quantity of units produced during the period considered.

In this context, to optimize the managerial analyses, “triggers” were created along the cost modeling to enable a certain roll of results based on the same input. Thus, it was decided to name the different compositions to improve the understanding of the coming analyses, which are Basic Cost, Budgeted Cost, Production Cost and Cost Price.

Basic Cost:

Comprised of the consumption of materials used in production, and the settlement of services applied in production activities.

Budgeted Cost:

Comprised by the consumption of materials used in production; the settlement of services applied in productive activities; and the depreciation of permanent assets allocated to productive sectors in the asset controls of SILOMS (Integrated System of Logistics of Material and Services).

Production Cost:

Composed by the consumption of materials used in production; the settlement of services used in productive activities; the depreciation of permanent material allocated to productive sectors in SILOMS; and the labor allocated in productive sectors in SIGPES (Personnel Management Information System).

Its main application is the optimization of the Organization’s horizontal vision, providing an opportunity for process analysis and improvement, using activity performance improvement, and it can also be used as a benchmark for pricing items intended for external sale and the Reimbursable Section.

Cost Price:

Composed of the consumption of materials used in production; the settlement of services applied in production activities; the depreciation of permanent material allocated to productive sectors in the asset controls of SILOMS; the military manpower allocated to productive sectors in SIGPES; and the commercialization expenses.

With this in mind, in addition to guiding public pricing, the valuation of production stocks, the retro-analysis of operational practices employed in the production chain, the promotion of improved performance by managers through benchmarking actions, product reengineering, waste reduction, as well as the feasibility of changes to the current portfolio, the practice of measuring unit costs of goods produced by the Treasury can certainly be employed as a continuous improvement tool for the organization.

From the theoretical approach and the analysis of the results obtained through the implementation of a cost management model using the ABC methodology, it is expected that the proposed objective has been achieved and it is suggested that FAYS continues to pursue continuous improvement in terms of Cost Accounting, focusing on the goals of quality public spending.

After several public and private investments directed to the waterway sector, the ports have increased their activities regarding the displacement of products and services in recent years. According to Statista data, world seaborne trade has been growing in volume since 1990. Between 1990 and 2020, the volume of cargo transported by ships has more than doubled, from 4 to nearly 10.7 billion tons.

However, this intensification of activities in the sector makes a challenge evident: the ports still lack skilled and instrumented leaders to develop good port management and logistics.

For this reason, the results obtained end up being lower than expected, even in an optimistic scenario. In this context, it is essential for companies in the segment to develop actions to improve their management, to provide the extraction of the best possible results.

And this is exactly the theme of our article today. Read on to understand the importance of technology in port management!

Maritime transport was the first mode of international trade on a global scale. With hundreds of years of history, port management techniques have evolved as new naval and communication technologies have developed.

However, factors associated with the intensification of trade and the leadership of certain nations in the imports and exports of certain products are also determining factors for the establishment of techniques capable of producing the best results. In this scenario, modern port management must rely on systems capable of collecting, managing, and reporting an unprecedented volume of data from the various administrative and operational fronts of the business.

The first step towards more efficient port management is to implement good planning of the organizational processes. In other words, it is necessary to map all the information and operations that are involved in port activities and outline the best strategies and action plans to adapt the business model and prepare the company for constant market transformations.

In this context, it is essential to have well-defined objectives concerning the goals and development plans of the port. This allows efforts to always be directed in the right direction of growth, besides foreseeing potential problems and simulating scenarios to guide decision-making.

And that is where technology comes into play in port management. Having tools that record and automate processes makes the visualization of the history of transactions and operations more efficient, basing the management on real and objective data that help in determining the next steps.

The port challenges are many. Bureaucracy to adapt to government requirements, maintenance and improvement of infrastructure, legal issues specific to the goods transported, implementation of intermodal infrastructure, training and safety of teams, storage of assets, transport logistics, and environmental issues are among some of the most latent problems faced daily.

Recording the actions taken to intervene in each of these areas and understanding how they impact the health of the business is indispensable for port development. And by having specific software and systems to monitor activities, it is possible to optimize the resolution of these and other vital issues.

Firstly, because the technologies allow all the information relevant to port management to be concentrated in a single place. Second, having a system that automates processes and integrates workflows helps reduce the error rate and increase the productivity of the teams.

Another crucial factor is that the implementation of technologies to improve port management is a crucial step toward visualizing how resources are applied. This makes it possible to direct investments to priority areas, enhancing their returns.

In this scenario, one of the most prominent technological solutions is a software specialized in cost and profitability management. They create the basis to make the port more efficient and attract investments and business through the allocation of resources in an intelligent way, capable of propitiating the development of the port.

MyABCM has a solution focused on the port segment that can offer several functionalities to the manager:

Find out about My Ports.

Want to know how a system like this can transform the results of port management? Contact our consultants using the form below.

In case you’ve just stumbled in here, read our full article that explains how the ABC costing method works by clicking here.

Let’s recapitulate some trivial points that underlie “Activity-Based Costing”.

If you are already familiar with the term, let’s go ahead and discuss why ABC (activity-based costing) has the power to increase your profitability.

Let’s get right to the point.

The focus of the ABC method is to have maximum control over the indirect costs (also called overhead) as well as the direct costs associated with a product, service, customer, or channel.

Through a costing system using drivers that respect a cause-and-effect relationship and aiming to bring an advanced analysis of the costs per activity within the operation.

And with this dense range of data, intelligently filter the numbers and transform them into strategic decisions.

The first step comes from what we call “data-driven culture”.

This is the natural habit of ALWAYS making decisions based on collected data and not on a gut feeling.

It all starts by identifying the main KPIs (key performance indicators), which are our key performance indicators.

If you intend to make decisions based on data and not just intuition, yes.

Performance indicators make it possible to measure how much a strategy is generating the expected result or not.

It is important to mention that KPIs are always measurable and concrete.

Analyzing data is something automatic in large companies, however, not always creating strategies and defining next steps is provided by a study on top of what has already been collected and digested.

The ABC costing method is useful for companies that already have this data-driven culture and are looking for optimizations through detailed data analysis.

The more knowledge you have about how much and where your resources are being spent, the more precise your improvements associated with cost management will be.

And that is what we at MyABCM offer.

The ABC method results in an advanced costing analysis based on each activity involved in producing some product, providing some service, or serving some customer or channel.

This is where pricing comes in.

One of the biggest challenges within a business can be made easier by applying the ABC method.

Keep in mind that failing to calculate your total costs can result in sub-optimal pricing, resulting in an unfavorable profit margin for the company.

With all the control of segmented expenses in the palm of your hand, pricing becomes clearer and effectively correct. The consequence of this is the real impact on negotiations with customers, discount policies and commissioning of salespeople, resulting in the end in greater profit for the company!

The option of being able to precisely manage all the organization’s costs. This opens up the possibility of making more assertive decisions about where to act to reduce costs, invest, and even serve the best channels and customers from a profitability standpoint.

2. Associate overhead costs with the products, services, channels, and clients that actually consume it

Instead of associating the same cost to all products, services, customers, and channels, you can allocate the fair value consumed by each.

This also helps identify costs that apply to more than one segment, making this feature more valuable because it potentially eliminates distortions in cost calculations.

3. Evaluate production efficiency and apply improvements

The ABC method makes it possible to assign value to overhead costs by working the data as if it were direct costs. By breaking down overhead costs and assigning them by activity, we can look for breakthroughs with precision.

In the same way, we can make processes more efficient and correctly monitor the key KPIs for each activity in the organization.

4. Accurate data to obtain the desired profit margin

Having accurate data will directly impact a leader’s decision making. It opens up the possibility to reduce or shift production costs and apply effective pricing strategies to obtain an adequate profit margin.

5. Unique Benefits

Other methods cannot cover what the ABC costing method provides.

Directly related to the particularity of activity-based costing, it can measure expenses related to activities, however small they may be.

All the questions below must be answered with a yes.

Then you are prepared.

To be clear, there are not only advantages.

But it is the solution to a number of complex problems for those seeking cost optimization through a robust system.

After you have finished reading this post, you certainly have the clear answers as to how ABC cost management can increase your profits.

To begin, let’s briefly clarify what cost-to-serve is.

Cost-to-serve, widely referred to as CTS, is the sum of all the costs required to provide a product or service to your customer.

The fact that all costs are fully considered is what makes this analysis a high-performance strategy when looking at a customer’s profitability.

We usually associate a good customer with a customer who buys a lot from us – or with the one where we have a significant volume of services and transactions. But this only shows the one where we have had the most sales, not the one where we have made the most money, i.e. the most profitable! A customer with high turnover certainly requires a series of trade-offs and efforts that are often “expensive” to meet.

A study published in the Harvard Business Review showed that on average 20% to 30% of customers are very good from a profitability point of view – bringing between 150% and 300% of the company’s total profitability; on the other hand, between 50% and 60% are neutral (i.e., we do not make or lose money) and approximately 20% are unprofitable.

The big challenge is to understand which ones they are, and in which layer each one is located. Eliminating the clients that we lose money is not enough, as by doing this immediately other clients that are neutral and even those that make some profit start to become unprofitable – after all, our fixed costs don’t disappear, requiring us to make some adjustments in our installed capacity.

Now when we bring into the equation, in addition to the cost of serving each client, the profitability we have with each one and the time we will be serving to this client, we will certainly find situations in which that extremely profitable client will migrate to the competition in the short term; others that are extremely loss-making will continue to drain the organization’s resources. Bad scenario, isn’t it?

The question is, “what should we do?” The first thing to do is to be aware of the need to measure things. As we know, it is impossible to manage what you cannot measure – so measuring and then deciding is key!

“Firing clients”, + the end: those clients who are loss-making often help pay the fixed costs, and if there is no change in the structure of the organization, their “firing” may bring a terrible consequence, which is that clients who are neutral today may start to be unprofitable (and the very profitable ones may become not so profitable). There are companies that have already bankrupted just because of failure in this criterion, and they were excellent “producers”, with well-rounded production lines, equally good product costs, but they neglected this very important detail, which is to understand and act correctly with the costs-to-serve.

During the development phase, it is determined what the cost object is, what the cost of meeting this object will be and how it will be mapped, what the drivers for allocating the aggregate cost will be, and what IT systems will be used to calculate and maintain the analysis of its operation after the development of the customer’s profitability.

On one occasion a large national bank did a project and discovered that it had loss-making clients: What did they do? They eliminated these clients from their portfolio. The result: the clients that were neutral became unprofitable. What did they do then? They eliminated these new unprofitable clients, resulting in a huge loss with this operation. The issue of capacity/idleness must ALWAYS be taken into consideration for cost analysis!

It is also important to know that it is not by firing employees that we reduce costs – at least not indiscriminately. In fact, there are studies that show exactly the opposite: according to the US Conference Board, of the companies that tried to reduce costs, 30% actually had higher costs! Another study by Deloitte showed that 75% of the companies that laid off employees to reduce costs had to rehire others for the same positions within 1 year. And finally, McKinsey showed in a survey that only 10% of cost reduction projects are successful within 3 years of its implementation. Reducing costs is not simple, it demands effort and measurement (measure!) to make the best decisions afterwards.

Check out our content that fully explains the Activity-Based Costing system

The first step is to understand how the organization’s efforts are aimed at serving the various customers and channels; this includes information that must necessarily come from the CRM, but also from interviews with the sales and customer service areas.

Through the metrication of the main activities involved in serving these customers and channels it is possible to understand the effort spent to serve them individually and therefore make specific analyses that allow the understanding of cost and result, customer by customer, channel by channel.

For example: a very common activity of the commercial team is “Meet with Customers”. The cost of this activity is the sum of the commercial area’s efforts (salaries plus salespeople’s benefits and the whole area) including the support areas such as HR (that last month hired 2 new salespeople), the IT area (that this month gave 5 supports related to the new HR system) and also the value of the internal support systems (such as CRM itself); that said, now it’s time to allocate these costs of Meeting with clients – which are not necessarily Product and Service related costs but rather Client related costs (as a periodic maintenance and follow-up activity for these clients); this allocation should be done using the criteria “number of meetings with clients” (assuming that these meetings have an average time approximately equal to each other) or ” meeting hours” if this value varies a lot.

Of course, this allocation must be done taking into consideration the materiality of what is being allocated (that is, many times the effort in collecting and applying this information is not worth it, given the small costs of this activity compared to the other activities of the company) but in many cases it is very well worth it!

This done we have the cost of each customer only with the activity “Meet with Customers” – if we do that with all the activities of the Commercial and Customer Service areas, we will have an interesting suggestion of efforts to be analyzed and surely many surprises will appear, with activities that we never imagined would be so expensive and that would influence so much the costs of each Customer and Channel, and even others that we thought would be expensive, but that in the end turned out to be not very significant.

The set of mapped activities, on one hand their interconnections with the chart of accounts, cost centers, and areas, and on the other hand with the various Products, Services, Clients, and Channels, is called a cost model – and this modeling, if well executed with method and process, allows a vision never before seen in organization!

Access our profitability calculator!