Imagine being able to simulate every strategic decision before implementing it. This is a reality for an American oil company that is transforming its business approach with the support of MyABCM.

An American oil company with a global presence, project conducted at its headquarters in the United States.

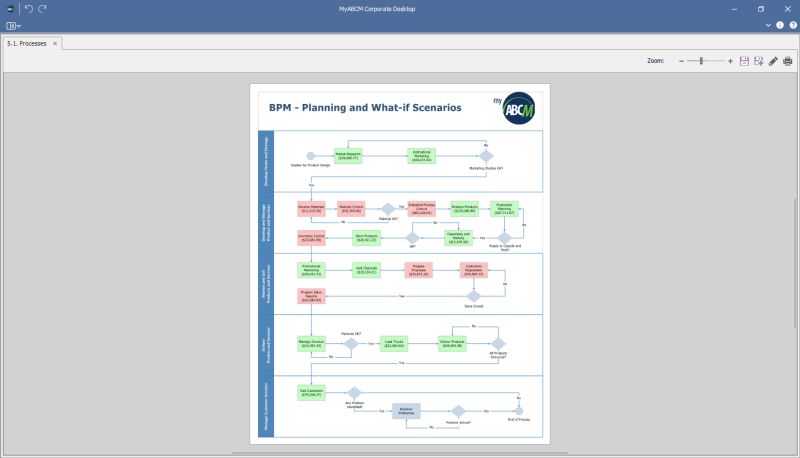

Simulation of cost scenarios for processes and identification of bottlenecks and capacity overruns in the native BPM module of MyABCM.

To understand the impacts of business decisions such as machinery replacement, creating a third shift in production, make or buy decisions, setting up new Distribution Centers, partial fleet outsourcing, and much more…

Development of a cost modeling by process with detailed analysis of the P&L by products, channels, customers, routes, and Distribution Centers—using allocation criteria that respect cause-and-effect relationships and minimize arbitrary allocations. Identification of installed capacities in production and back-office, allowing for sophisticated planning analyses. 🚛

Agility in decision-making processes, simultaneous analysis of multiple business scenarios, and their respective impacts on the company’s global results.

By simulating scenarios BEFORE actual implementation, the company was able to make strategic decisions based on facts and mitigated the risk of decisions based on assumptions. With the ability to compare multiple scenarios simultaneously in the tool within a BPM view, the decision-making process was made easier.

In the image from MyABCM, you can see the cost modeling done with the mapping of business and back-office processes and respective costs for a specific scenario. Note that the activities in red are those that, after running the simulation scenario, will have bottlenecks — either due to a lack of installed capacity, a shortage of people, or excessive effort. In less than 10 minutes, the company was able to discard 7 proposed scenarios and choose a more favorable scenario for implementation.

The MyABCM solution is essential for any organization to make the best decisions, improve efficiency, and responsibly manage its costs. 🎯

How is your company using data to improve operational efficiency?

Cost optimization is one of the keys to transforming operations and achieving better results. A great example comes from UPS, a logistics giant, which implemented a surprising policy to reduce costs: avoid turning left whenever possible.

Since 2004, the company has been implementing this curious strategy in its U.S. operations. In the country, drivers can turn right, even when the light is red, as long as the road is clear. On the other hand, turning left usually means more time in traffic, higher fuel consumption, and an increased risk of collisions.

By eliminating most left turns, even if the route became longer, UPS optimized routes and saved 38 million liters of fuel. This led to a reduction of 20,000 tons of CO2 emissions and saved more than R$ 200 million annually. Additionally, with this simple and unusual change, the company was able to make 350,000 additional deliveries every year.

Many MyABCM clients, including major names in the logistics sector such as Correios do Brasil (Brazilian Post), OPT Nouvelle-Calédonie (New Caledonia Post), and Poste Maroc (Barid Al Maghrib – Moroccan Post), know that efficient management starts with the ability to measure and understand every detail of costs. With MyABCM, these companies can map costs in a granular way, identify bottlenecks, and create strategies that maximize efficiency.

UPS’s case highlights the importance of evaluating every operational decision with precision. The “right turn” policy was even validated by the “MythBusters” TV show, which compared two vehicles: one following the rule and the other ignoring it. The vehicle that avoided left turns consumed less fuel, proving the strategy’s effectiveness.

Detailed simulations, such as those offered by MyABCM, allow companies to go beyond simply looking for the shortest path and focus on the most efficient one. This level of detailed analysis can lead to significant savings and optimize operations on a large scale.

Small adjustments, like UPS’s “right turn” policy, show how seemingly simple and even odd decisions can have a transformative impact on costs and sustainability. Is your company also prepared to identify these opportunities and optimize results?

Fill out the form below to learn how MyABCM can help your organization reach a new era of operational efficiency.

Idle assets are a recurring problem in companies across various sectors. When resources like machinery, space, or servers are underutilized, production costs rise, compromising profitability. Identifying and managing these idle assets is essential to avoid financial distortions and optimize operational performance.

One of our clients, a national leader in the Brazilian paper reel industry, faced an unusual situation. MyABCM identified that the unit cost of a reel had skyrocketed from R$1.50 to R$700 in a single month.

Understandably, they contacted us, suspecting an error in cost calculation. However, upon drilling down into the cost structure, we discovered the issue lay in production volume. The usual production of 20,000 boxes of reels had dropped to just 150 boxes.

Despite the reduced production, the factory’s structure remained unchanged, resulting in high fixed costs being spread across a much smaller number of produced units. This underutilization of machinery and space drastically increased the unit cost—a problem many organizations face without even realizing it.

Idle assets aren’t exclusive to the industrial sector. Service companies also deal with underutilized resources like servers and unused contracts. Below are some recommended practices to manage this issue:

In our client’s case, after confirming that production wouldn’t return to previous levels, the solution was to lease part of the factory to another company. As a result, those previously idle assets started generating revenue instead of costs. But this was only possible because the cost source was correctly identified.

Idle assets represent a silent cost that can significantly impact a company’s profitability. Underutilized resources distort unit costs, and if left unmanaged, they can jeopardize financial health. The key to avoiding this issue is adopting data-driven management and closely monitoring resource usage, with methods such as activity-based costing.

With MyABCM’s support, your company can identify and address idle assets and other potential cost generators, optimizing resources and making well-informed decisions. Fill out the form below and speak with our specialists!

If you want to keep your business on the right track, you must stay alert to the traps that can be fatal. Here are 10 foolproof tips to drive your business to bankruptcy—and how cost management can be the key to avoiding these mistakes and ensuring your company’s survival.

If you’re in manufacturing, focus solely on products; if you’re a service organization, focus exclusively on services. Channels and customers are just consequences, and measuring the cost of serving them is an unnecessary luxury.

Many business owners believe that focusing exclusively on products or services means managing their company efficiently. However, this mindset is a major mistake. Cost management also involves controlling how these products and services impact the company’s overall expenses. Effective cost management integrates all aspects of the business, including channels and customers.

These are costs you’d have anyway, so why bother with back-office expenses or indirect costs generated by operations?

Ignoring indirect operational costs may seem like a practical solution, but it’s one of the surest ways to drive your business to failure. Effective cost management must account for all costs, including overhead, and identify where waste occurs.

Buy low, sell high, and pray. Who needs strategy when you’ve got faith?

If you think gross margin is the only important metric, your business might be in danger. Focusing solely on sales while ignoring cost management can lead to misleading results. Proper cost management considers the total cost of production and operations—not just sales.

Maximize cost allocation through spreads, especially based on revenue or volume. After all, if it works to split a bar tab, why wouldn’t it work for an entire company?

Using spreads as a cost allocation method is a quick way to generate significant errors. Cost management should rely on more precise methods, such as ABC costing, analyzing activities that truly impact production and services, ensuring accurate cost distribution across the business.

Need more detail? Add another cost center to accounting. KPIs? Waste of time. Focus on selling more, and if costs become an issue, start laying off employees.

Overlooking process and activity management can be a fatal error. Effective cost management requires analyzing the profitability of each process and activity to ensure efficient allocation of capital.

Moreover, layoffs are not a sustainable cost-reduction strategy.

Cost management is just another IT project. Modeling is a minor detail, and all business rules will be defined by the Systems team.

Relying solely on an ERP for cost management is a mistake. Implementing a cost management system requires customization and cannot be entirely delegated to general management software, which often lacks specific functionality to properly track and allocate costs.

Every company has redundant activities, “inevitable rework,” or processes that “have always worked.” Why change something that’s not broken?

Failing to address duplicate tasks and ineffective processes is one of the biggest traps for a business. Cost management must critically assess and eliminate processes that create waste while focusing on those that bring real value.

Don’t create a communication plan. It’s best to keep the cost model hidden in Controllership and surprise everyone with unexpected charges.

Hiding cost models can lead to negative surprises, especially when costs spiral out of control. Good cost management practices include proper planning and transparent communication between departments, with a more strategic approach following the FP&A model.

The more detailed the cost model, the better! Tracking millions of activities seems like a great idea: you can always consolidate them later. Precision is key, even if it’s overkill.

While accuracy is essential, excessive detail can shift the focus away from what truly matters. Cost management should strike a balance, avoiding unnecessary complexity.

All that matters is being price-competitive and selling in volume. Whether you make a profit or not is just a minor detail. If the budget gets tight (and it will!), go for another round of funding or consider selling a unit, a product line, or even part of the business.

Growing without considering costs is a critical mistake. Cost management must align with pricing and volume strategies to ensure long-term profitability and protect the company’s financial health.

Don’t let your company fall into these traps! Fill out the form below to talk to one of our specialists and learn how to implement effective cost management to ensure your business’s financial health.

There are various system options for cost calculation in SAP, varying in value and features.

In this article, we will introduce a Brazilian alternative that not only integrates seamlessly with SAP but also specializes in cost and profitability calculation, offering numerous advantages for your organization.

For companies looking to optimize cost calculation in SAP, MyABCM stands out as a specialized option with many attractive features. Available on the SAP Store, the system integrates smoothly with SAP and offers a series of functionalities that allow companies to get a snapshot of their cost structures, simulate scenarios, and make more confident decisions.

MyABCM offers a series of advantages for companies wanting to efficiently calculate costs and profitability:

While many available solutions may represent a significant cost, MyABCM is more affordable, delivering valuable and efficient features. This makes it an attractive option for companies of various sizes, enhancing the return on investment.

MyABCM is notable for its ability to provide a high degree of cost traceability. This is essential for companies that want to understand the origin of their expenses, optimize pricing, comprehend the role of each product, service, and customer to the organization, and make informed decisions based on accurate data.

The ability to gain insights in less time is invaluable for companies that need to make agile decisions in a dynamic business environment. One of the major benefits of MyABCM is the speed of implementation, calculations, and information availability, combined with smooth data integration between SAP and its system.

MyABCM is used by large companies in more than 50 countries to calculate costs in SAP, covering a wide variety of sectors, including banking, industrial, governmental, healthcare, and many more. This global adoption is a confirmation of its effectiveness in meeting the needs of organizations of all sizes and in different segments, with flexible tools that adapt to the specifics of each business.

For companies looking for specialized solutions to enable integrated cost management within the SAP ecosystem, MyABCM stands out for being accessible and offering functionalities specifically developed to optimize the identification and calculation of costs, with excellent cost-effectiveness. Make this strategic decision: fill out the form below and speak with our experts.

Carrying out a good cost management is not always a simple task for managers. (more…)

The sustainable growth of any business is inextricably linked to good management practices that are able to provide managers with all relevant information of the business (more…)

For your company to be well-managed, it is vital that your controllers have access to accurate information about your situation. (more…)

A company needs to make investments in order to deliver a particular product or service. (more…)