Cost optimization is one of the keys to transforming operations and achieving better results. A great example comes from UPS, a logistics giant, which implemented a surprising policy to reduce costs: avoid turning left whenever possible.

Since 2004, the company has been implementing this curious strategy in its U.S. operations. In the country, drivers can turn right, even when the light is red, as long as the road is clear. On the other hand, turning left usually means more time in traffic, higher fuel consumption, and an increased risk of collisions.

By eliminating most left turns, even if the route became longer, UPS optimized routes and saved 38 million liters of fuel. This led to a reduction of 20,000 tons of CO2 emissions and saved more than R$ 200 million annually. Additionally, with this simple and unusual change, the company was able to make 350,000 additional deliveries every year.

Many MyABCM clients, including major names in the logistics sector such as Correios do Brasil (Brazilian Post), OPT Nouvelle-Calédonie (New Caledonia Post), and Poste Maroc (Barid Al Maghrib – Moroccan Post), know that efficient management starts with the ability to measure and understand every detail of costs. With MyABCM, these companies can map costs in a granular way, identify bottlenecks, and create strategies that maximize efficiency.

UPS’s case highlights the importance of evaluating every operational decision with precision. The “right turn” policy was even validated by the “MythBusters” TV show, which compared two vehicles: one following the rule and the other ignoring it. The vehicle that avoided left turns consumed less fuel, proving the strategy’s effectiveness.

Detailed simulations, such as those offered by MyABCM, allow companies to go beyond simply looking for the shortest path and focus on the most efficient one. This level of detailed analysis can lead to significant savings and optimize operations on a large scale.

Small adjustments, like UPS’s “right turn” policy, show how seemingly simple and even odd decisions can have a transformative impact on costs and sustainability. Is your company also prepared to identify these opportunities and optimize results?

Fill out the form below to learn how MyABCM can help your organization reach a new era of operational efficiency.

Idle assets are a recurring problem in companies across various sectors. When resources like machinery, space, or servers are underutilized, production costs rise, compromising profitability. Identifying and managing these idle assets is essential to avoid financial distortions and optimize operational performance.

One of our clients, a national leader in the Brazilian paper reel industry, faced an unusual situation. MyABCM identified that the unit cost of a reel had skyrocketed from R$1.50 to R$700 in a single month.

Understandably, they contacted us, suspecting an error in cost calculation. However, upon drilling down into the cost structure, we discovered the issue lay in production volume. The usual production of 20,000 boxes of reels had dropped to just 150 boxes.

Despite the reduced production, the factory’s structure remained unchanged, resulting in high fixed costs being spread across a much smaller number of produced units. This underutilization of machinery and space drastically increased the unit cost—a problem many organizations face without even realizing it.

Idle assets aren’t exclusive to the industrial sector. Service companies also deal with underutilized resources like servers and unused contracts. Below are some recommended practices to manage this issue:

In our client’s case, after confirming that production wouldn’t return to previous levels, the solution was to lease part of the factory to another company. As a result, those previously idle assets started generating revenue instead of costs. But this was only possible because the cost source was correctly identified.

Idle assets represent a silent cost that can significantly impact a company’s profitability. Underutilized resources distort unit costs, and if left unmanaged, they can jeopardize financial health. The key to avoiding this issue is adopting data-driven management and closely monitoring resource usage, with methods such as activity-based costing.

With MyABCM’s support, your company can identify and address idle assets and other potential cost generators, optimizing resources and making well-informed decisions. Fill out the form below and speak with our specialists!

Resource optimization is essential for any company seeking to reduce costs while increasing efficiency and profitability. When inefficient processes take over—like redundant activities or rework—the impacts are felt both financially and in customer satisfaction. Below, we’ll share a curious example that illustrates this issue and explain how to identify inefficient processes and correct them.

Imagine buying a new pair of shoes, only to find upon opening the box that the shoes are two different sizes. This real-life scenario happened with a renowned Brazilian shoe brand, where customers across the country started receiving mismatched pairs.

To address the issue, the company implemented a labor-intensive solution: assigning employees to manually check each pair on the production line and redirect mismatched pairs to another group for matching, which were then sent back for further inspection. While this approach “resolved” the immediate problem, it added unnecessary costs and consumed resources without providing real value.

The true solution lies not in fixing the consequences but in optimizing resources to eliminate the root cause of the problem.

According to studies by major consulting firms like McKinsey & Company and Boston Consulting Group, approximately 60% to 70% of manufacturing activities and 30% to 50% in the service sector do not add value. These include tasks like rework, unnecessary movements, and redundant checks—as in the shoe factory example.

Eliminating these activities requires a detailed analysis of operational processes. Key steps include:

For example, instead of manually checking shoe pairs, the company could investigate the root cause of size mismatches and correct it at its source.

When an organization adopts resource optimization practices, the benefits are clear:

In the case of the shoe company, optimization eliminated several unproductive activities, such as manual inspections and pair matching. It also significantly reduced costs associated with rework and unnecessary movements.

The first step in resource optimization is mapping existing processes to identify bottlenecks. To achieve this:

By optimizing resources, you not only improve financial outcomes but also position your company to compete in an increasingly dynamic and demanding market.

In the grand parade of corporate efficiency, do you want to walk confidently or trip over unproductive activities? Now that you know the benefits of resource optimization, it’s time to take action.

Fill out the form below and talk to our specialists to discover how we can help optimize your resources and drive efficiency and profitability in your business!

When it comes to cost-cutting, laying off employees might seem like a simple and immediate solution. After all, personnel expenses often represent one of the largest costs within organizations.

However, over the years, studies have shown that this practice can cause more harm than benefit in the medium to long term. Layoffs do not solve structural issues and, in many cases, may even increase a company’s costs.

According to The US Conference Board, 30% of companies that resorted to layoffs expecting cost savings saw an increase in expenses. Additionally, 22% of them ended up laying off the wrong employees, leading to the loss of valuable talent and the need to hire again.

Beyond the immediate impact, laying off and rehiring creates an expensive cycle. Deloitte indicates that 75% of companies that laid off employees to cut costs eventually had to rehire for the same positions within a year.

It’s worth noting that these costs include not only the selection and hiring processes but also the training and adaptation time for the new hire, who typically has lower productivity initially. In other words, the initial cost of a layoff (which is already not low) ends up being added to long-term investments to replace an employee who shouldn’t have left.

These figures reflect a concerning reality: layoffs may seem like a quick fix but fail to address deeper operational issues with more significant impacts on business costs, such as inefficient processes and hidden waste. In the end, they may actually generate more unnecessary costs.

McKinsey & Company points out that only 10% of attempts to cut costs through layoffs prove effective after three years. This is due to the fact that, without revising internal processes, companies end up redistributing unproductive tasks to a smaller team, potentially compromising the quality and efficiency of work.

For this reason, companies must focus on identifying which processes add value and which can be optimized or eliminated. Without this review, layoffs only exacerbate problems, placing an even greater burden on remaining employees.

A study by The Economist highlighted that companies surviving crises are those that know where not to cut costs. They prioritize strategic areas that ensure customer satisfaction and maintain processes that generate value. In other words, the secret isn’t in layoffs but in improving efficiency and ensuring that resources are being used wisely.

Instead of turning to layoffs as a cost-cutting solution, companies should focus on efficient cost management by analyzing processes, eliminating redundant activities, and keeping customer satisfaction a priority. The key to success isn’t cutting staff, but optimizing operations and allocating resources (including human resources) more strategically.

Want to find out where to cut costs without laying off employees? MyABCM can help. Fill out the form below to learn more!

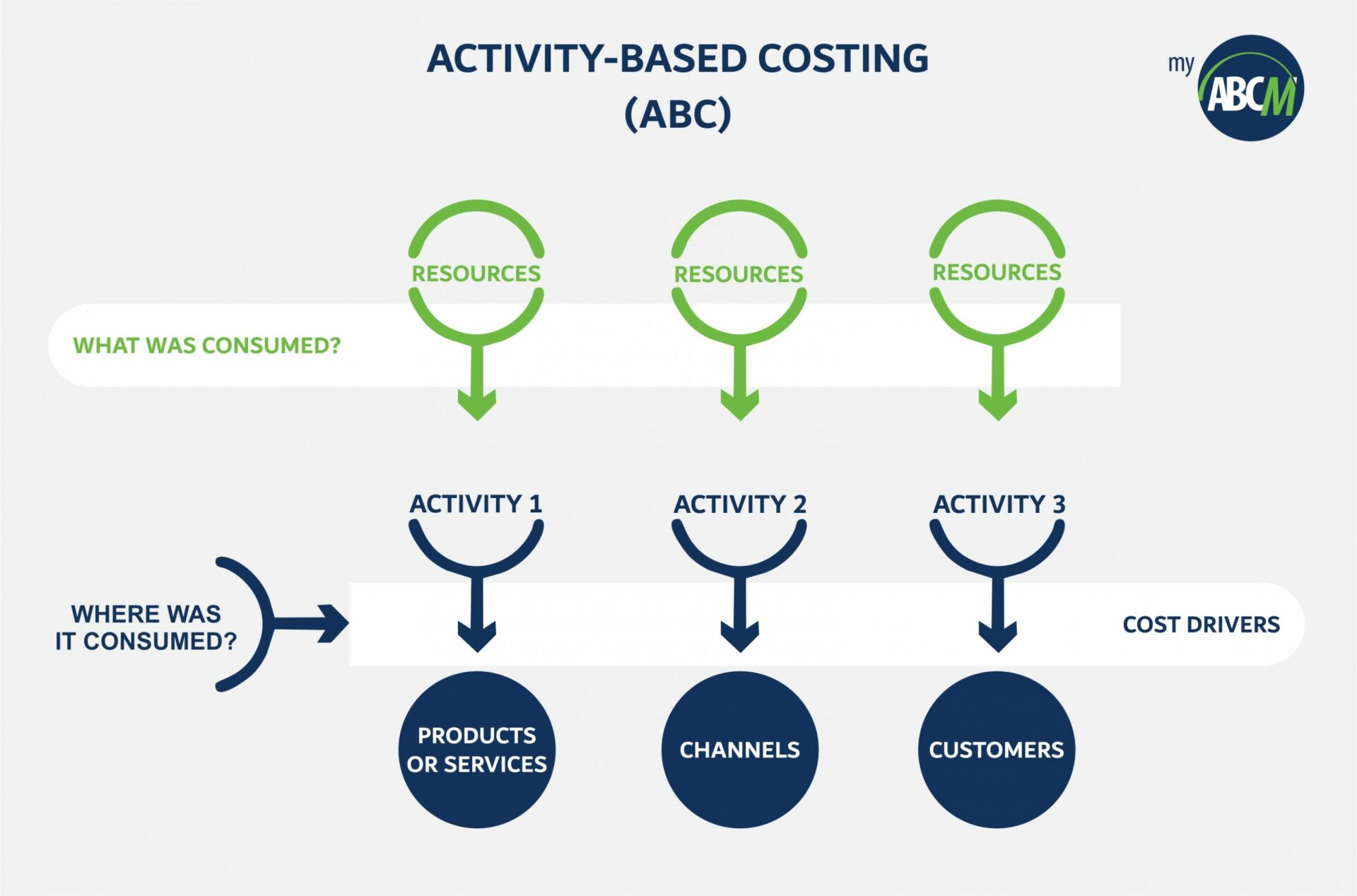

ABC costing analyzes costs related to each activity in product manufacturing or service execution. Resources are allocated based on these activities to different products, services, markets, etc., providing a clear view of the company’s costs. In this way the company gains a more precise understanding of how each activity impacts operating costs, enabling better profitability management.

Studies and documentation indicate that large US industries used some form of ABC costing in the 1950s. However, the methodology only really became known with the dissemination and popularization of the studies of Professors Robert Kaplan and Robin Cooper in the United States in the early 90s.

These two professors identified that, for several reasons that we will present later, the method used to cost the various products and services no longer reflected the reality of what occurred in organizations, causing great distortions and greatly damaging the results of companies.

In their studies, Prof. Kaplan and Cooper identified 3 independent and simultaneous factors that justified the implementation of ABC costing:

Previously, direct labor accounted for around 50% of total product costs, with materials and raw materials at 35%, and overhead at 15%.

Nowadays, overhead can reach up to 60% of product costs, with raw materials at approximately 30%, and direct labor below 10% (in Service and Government organizations, overhead is even higher).

While using direct labor hours for cost allocation might have been acceptable until the mid-20th century, it no longer makes sense in today’s cost structure.

The number and level of competitors have changed significantly over time. Consequently, many organizations have experienced declining margins year after year, making efficient cost control extremely important.

In this context, implementing the ABC costing methodology enhances cost control, leading to increased competitiveness and improved profit projections.

The cost of implementation and measurement has significantly decreased due to the advancement and widespread accessibility of information technology. In the past, implementing an effective ABC costing system was prohibitively expensive and feasible only for companies with access to large applications running exclusively on mainframes and large computers.

As computer technologies advanced, the methodology became accessible to a broad range of organizations. Thus, the main reason why this costing system only became popular at the time of the publications of professors Kaplan and Cooper was the advance of computer resources (hardware and software). These technological advances allowed the system to move from theory to practice, especially in the implementation of cost models in more complex organizations that required greater detail.

The missing trigger for this popularization coincides with the emergence of mini and microcomputers in the late 1980s and the development of graphical software interfaces through the Windows (Microsoft), OS/2 (IBM), and Mac (Apple) operating systems.

In this way, applications that had previously been intended only for use on mainframes and large computers could be implemented in any organization, making them accessible to the various users and departments of a company.

Thus, today, many organizations have successfully used ABC costing in various segments, such as manufacturing, government, services, telecommunications, banking, logistics, etc. Its use, contrary to what many imagine, is not limited to large corporations, but can also be implemented in medium and small companies, whether public or private. Here, we’ll provide you with comprehensive information about this system, its benefits, and the implementation process. Take a look!

Traditional costing systems have emerged mainly to meet tax and inventory valuation requirements. However, these systems have several flaws, especially if used as management tools.

Traditional costing methodologies focus on the company’s various products, apportioning total costs to them based on the assumption that each item/SKU consumes organization resources in proportion to the volume produced.

In this way, the various “volumetric” drivers such as a number of direct labor hours, machine hours, and raw material value are used as cost allocation criteria to settle overhead costs.

However, this approach results in figures that only reflect an average estimate. Despite the complexity of the calculation, it doesn’t precisely align with the specific characteristics and processes of each company.

These volume-based drivers also fail when dealing with diverse product shapes, sizes, and complexities. Additionally, there is no direct relationship between production volume and the efforts or costs consumed by the organization.

As a result, many managers of companies providing diversified products and services, when applying these traditional models, are making extremely wrong decisions regarding prices, product and service mix, and even processes.

Unlike traditional costing systems, activity-based costing centers on the organization’s processes and activities. It also provides special attention to often overlooked aspects in companies, such as the cost of different customers, channels, markets, and regions – essential for making accurate decisions.

In the beginning, costs from each activity are tracked within the company. Then, these costs are allocated and analyzed to determine how each activity impacts the final costs, enabling a precise assignment of expenses.

Thus, the various costs are allocated from the various activities to the various Products, Customers, Channels, etc. based on the use of these by each activity of the organization. In this way, overhead is allocated appropriately, always respecting a cause-and-effect relationship and not using “volumes” as the basic apportionment criterion.

Once the activities have been costed, the organization can begin to manage them, frequently questioning why each one is influencing or impacting the costs of the various products, customers, channels, and services in the company. With this system, the costing process becomes more accurate and precise at the same time.

What makes this costing model an extremely efficient methodology is something that starts with the way of thinking about cost. What was treated by other models as an indirect expense linked to a product becomes a direct expense. The focus then becomes the activities performed, not the products that come from them.

The crucial aspect lies in recognizing that each product, service, customer, or channel results from a variety of activities. Treating them individually enhances the description and conversion of their specificities into more accurate values.

The effectiveness of this costing methodology relies on its capacity to establish logical traceability for expenses. As it’s not bound by the temporality of each process, ABC costing can identify and assign each expense to a specific activity.

In this way, even if certain expenses are grouped under the same cost center, they will be organized according to the activity to which each one is linked.

This optimization of cost control delivers multiple benefits to the company across various sectors, as we’ll demonstrate below.

There are several advantages to implementing ABC costing in a company, extending beyond accurate cost definition for products, services, customers, and channels.

Below, we will describe some of the most important ones to highlight how this methodology enhances the company’s profitability and empowers managers in decision-making.

After creating a model with studied cost allocation criteria and defined future implementations, decision-makers gain access to better and more precise information.

This improves the company’s planning and decision-making processes. Managers gain more power in forecasting future profits and expenses and have well-founded arguments for effective decision-making, including product and service pricing, product mix, outsourcing or internalization choices, research and development investments, automation, marketing, campaigns, and more!

In this item, we can mention not only the collection of more transparent data on expenses in each sector but also a review of internal controls and greater visibility of each process.

With comprehensive information about various processes and their impact on Products, Services, Customers, and Channels, the company can make more confident decisions. Managers gain additional tools to manage team expenses and access data for auditing and expense analysis.

With a clear understanding of activity costs, managers can base decisions on business processes and activities. Moreover, by assigning “labels” to mapped activities, they can analyze which ones add value and which ones do not, for instance.

Describing the specificities and costs of each process enables a multidimensional analysis of expenses in each activity, from a global perspective to detailed visualization of each activity’s cost and its impact on profitability. This identification allows adjustments to reduce unnecessary expenses and revise planning to align with actual costs.

Achieving an increasing cost reduction, then, becomes only a matter of time, as each manager will have access to more accurate information to analyze these processes.

Additionally, it’s essential to note that the methodology’s effectiveness in controlling expenses makes it efficient for both small and large companies, regardless of their area of operation.

The implementation of an ABC costing system may seem complicated and will vary slightly depending on the size and complexity of each company’s activities, products, and services.

But to facilitate the process and enable the implementation of the ABC methodology to be carried out effectively, you can use the steps listed below as a reference.

They apply to all sizes of companies and business models, helping to create an activity-based budget and promoting greater control over the organization’s costs and profitability.

Sophisticated cost modeling demands a dedicated system. While some companies use spreadsheets for costing, others attempt ERP customization or believe BI can address management costing challenges.

However, the auditing and consulting company Ernst & Young (EY) does not recommend any of these options. According to EY, “Model development can be performed in Excel, Access, or even in-house development, but this can only be done for very simple models and even these simple models will present severe restrictions when more elaborate analysis is required. Not to mention specific issues of integration with existing systems, traceability, auditing of the model, and the security of the data itself.”

As for ERP implementation, we know how expensive and complicated it is to customize these systems. In addition, they provide a static and plastered view, which does not provide the flexibility required by such an implementation.

As for BI systems, these are platforms for presenting the information that already exists in the organization. But as we know, such cost modeling requires deep transformations from the point of view of allocations, including reciprocities and understanding of costs at multiple levels and dimensions, something not so easily or virtually impossible to implement in a BI.

By addressing these practical implementation issues, the MyABCM product suite stands as the global leader in managerial costing solutions. Offering multidimensional analyses, it empowers organizations to model, analyze, and simulate with great flexibility, security, and, most importantly, full integration with corporate systems.

It is crucial to determine the objectives of an ABC costing project. Does it aim to determine costs for Products only? What about Customers, Channels, Markets, Regions, or Projects? Defining clear project objectives is essential to avoid mid-project changes in assumptions.

Additionally, creating an implementation agenda is crucial, including defining the desired depth of the project, possible criteria, ideals, and implementation milestones.

Efficient implementation requires intelligent activity mapping. In such projects, managers often aim to map hundreds, thousands, and, at times, tens of thousands of activities, sometimes even at the task level.

This is an attitude of great inefficiency, since by mapping many activities, the effort will certainly be too great to result in a small benefit, especially for those activities that are not very relevant. In addition, modeling too much complexity in the first round makes the initial integration of the model with corporate systems a major challenge.

“Best practices involve modeling in stages, increasing complexity as the model evolves while considering the relevance of the mapping. As noted by Cost Management expert Gary Cokins, ‘Organizations must assess their performance in what is crucial and relevant to the business.”

Here it is necessary to define the initial costs, expenses, cost centers, accounting accounts, possible groupings (Cost Pools) to be established, and Revenues that will be the initial Resources to be allocated.

This part of the planning is important so that each Resource is linked to a process and this is identified according to its relationship with the activities linked to a product, service, customer, channel, or project.

After defining Resources and Activities, establish cost drivers and the criteria for their utilization.

In this way, the calculation process will make sense, as there will be a link that represents a cause-and-effect relationship between sources and their destinations.

Once the model is defined, it is time to calculate it, generate simple and complex cubes (which will later support the various analyzes through dynamic tables), and create a system that allows simple and advanced simulations (what-if).

By applying and analyzing reports, it is possible to evolve the system, effectively tracking an increasing number of relevant activities for the company.

Implementing an ABC costing system provides better control over the organization’s costs. The methodology develops precise cost tracking and allocation models, identifying values associated with each process and activity, and their impact on company profitability.

This enables an efficient activity-based management system, facilitating resource reallocation and structured cost reduction, promoting high profitability even in a highly competitive environment.

Moreover, the system empowers confident decision-making, providing secure pricing and comprehensive analysis and control of products, markets, channels, customers, etc.

Thus, its implementation culminates in greater profitability in the medium and long term, thanks to a detailed view of organizational processes and the resulting increase in the company’s competitiveness.

By considering the tips in this article, you can efficiently implement the activity-based costing methodology, leading to continuous growth for your company.

In this context, MyABCM software is specially designed to offer activity-based management, enhancing cost control and business profitability.

Hence, employing a system like MyABCM solution surpasses the activity and cost management capabilities of other software. The systems are tailored to address the specificities of businesses of all sizes, offering resource allocation in multidimensional analyses that cover all relevant company activities, adapting to various complexities, and ensuring the constant evolution of costing models.

Interested in learning more about our solutions and how ABC’s costing methodology can boost your business profitability? Fill out the form below to get in touch with our experts!

Cost reduction can be challenging, but it is often an inevitable process given the competitiveness of globalized markets. No matter how good a business or product is, no company is immune to crises or periods when demand is not exactly as expected.

To avoid mistakes in this very sensitive moment in business management, in this article we will look at five fatal mistakes in the process of cost reduction.

If the expenses with personnel are suffocating your finances in a moment of crisis, know that the dismissal of part of the staff can be disastrous for your company. In the short term, this attitude generates the discontent of those who stay on and the distrust that they could be next.

Additionally, expenses with severance pay can worsen your company’s finances, creating cascading problems by decreasing production capacity. If the intention is to get out of the crisis, you will need staff ready to work.

And rehiring after realizing that the dismissal was a mistake can significantly increase your costs. According to data from Gallup Consulting, replacing an employee can cost twice as much as keeping him.

In other words, layoffs are generally not a good way to cut costs, and you must analyze this alternative carefully before choosing it.

As sales decline, the first impulse is to cut back on advertising. Don’t give in to this impulse, because marketing is the main responsible for bringing new customers into a business, and you will need them.

Don’t think like your competitors: advertise not only your main products in the search for new customers, but keep your brand always present in the media, showing that your business was either little affected or not yet affected by the bad winds of the financial crisis.

The quality of the coffee served to employees and customers, the quality of the napkins, the plastic cups, and even the toilet paper is probably something that can be reviewed. However, it is not advisable to waste management’s precious time on expenses of minor importance and materiality for the business.

Besides generating great dissatisfaction from employees and customers, this attitude will not bring significant savings, spending management time that could be applied in other more important points.

Cost reduction can be achieved by saving money by not spending at one point, but also by reviewing processes throughout the company. If this has been an old plan, it is time to review all operational spheres.

Call managers and supervisors to discuss what can be reviewed or restructured. Everything can be reviewed from production processes, administrative processes, and even customer service, bringing more quality and less financial expenses to the company. In this scope, it is very important to pay attention to the indirect costs generated by each activity, because these often go unnoticed and can bring valuable opportunities for cost reduction.

If the idea is to try to maintain sales levels and get your brand seen more by your current customers and potential customers, quality has to be maintained. Sometimes small cost reductions will lead to very large decreases in the quality of the final product or service.

Therefore, analyze deeply your production expenses and the possibility of reducing them, because if there is one thing that cannot be changed when the demand for a market decreases, it is the quality of the product or service that you offer.

Cost reduction without Mystery

Cost reduction must be constantly analyzed by managers, and in periods of crisis the need for it becomes more latent. However, it is necessary to evaluate the feasibility and impacts of cost review actions, because they can bring more harm than financial breath to your organization.

Check out 8 tips to reduce costs efficiently!

To ensure that cutting business costs brings positive results, it is essential to have a good understanding of the sources of costs and how they relate to the organization’s activities and revenues. This can be a challenging analysis, so MyABCM is specifically designed to help organizations visualize and control their costs efficiently.

Learn how it can help you! Fill out the form below:

Cost analysis in the IT sector basically consists of carrying out a strategic planning whose actions are aimed at meeting specific business demands. To that end, it is essential that all departments have tools and methodologies to apply the cost reduction.

In simpler terms, we are referring to the multidisciplinary and continuous process of IT governance. Its goal is to integrate not only the expenses, but also support-related services and projects.

By employing good cost analysis practices, it is possible to add value to the business and provide unique solutions to the audience. And that is what we’ll talk about in this post, read on to check it out!

Planning the costs of a company is one of the best ways to ensure its survival and growth in the market, even when dealing with the most complex economic scenarios.

This is because the cost analysis aims to consolidate data on financial performance and the execution of corporate activities. Based on this information, managers are able to make more assertive decisions regarding the expenses that can be eliminated and what actions to take to foster the profitability of the business.

Now that you understand the importance of carrying out IT cost analysis, we’ll show you some tips on what you can put into practice in your business. Check it out below!

Determining the costs to be analyzed, that is, mapping them in an organized, functional, and intelligent way, will allow the finance department to account for expenses and investments with the infrastructure needed to carry out the business activities.

We know that much of the work done by the IT sector takes place in the digital environment and, therefore, has a series of intangible costs, such as the acquisition of ERP and CRM software, APIs, plugins, etc. In addition to these, it is necessary to consider aspects such as productive time, customer loyalty and delivery times.

When it comes to a tangible IT structure, it is no different, as it is also necessary to invest in hardware (computers, mobile devices, equipment, etc.) and labor, for example.

Finally, cost analysis can be optimized by using innovative technological tools that can automate repetitive tasks that were previously carried out by employees.

In addition to reducing the workload of IT professionals with minor issues, business management software have a wide range of resources that support the accounting and finance department.

After all, unlike human workers, these systems have algorithms that are not susceptible to failure and order issues, such as forgetfulness, fatigue, or misunderstanding. In other words, they minimize the margin of errors, rework, and productivity losses.

As you can see, cost analysis for the IT sector encompasses a series of practices and the use of technological tools that contribute to the company’s development, making it easier for managers to make strategic decisions.

Do you want to know more about the MyABCM solutions for cost analysis using technology in your company? Then contact our team so that we can show you the very best in digital innovation for your business!

Unforeseen financial events are inevitable and, in most cases, cause difficulties for the business’s management. If we consider the various obligations of the company, such as salaries of employees, suppliers and tax payments, the emergence of unplanned debt may cause indebtedness. And that is why cost mapping is so important.

In addition to making the financial organization easier, mapping strategies for the destination of the company’s capital allow managers to face economic challenges more easily.

Based on this context, we’ve prepared this post so that you can learn the best tips for mapping costs and optimizing results in the company. Read on and check it out!

Before identifying the costs, it is very important to map the processes. That way, the manager will have a broader perspective on all operational actions of the organization, which helps when identifying which one leads to little or no practical results for the business and, therefore, can be eliminated.

This strategy consists of identifying all the company’s expenses, showing the origin of each one so that the manager understands its impacts on the organization, as well as the margin obtained, among other aspects pertinent to monthly budget planning.

Promising corporate partnerships are an excellent way to map costs and reduce operating expenses in the company. Do research on organizations that offer innovative cost management solutions, review the proposals, and negotiate?

Have reliable and trustworthy partners by your side, whether they are software providers, third-party carriers or any other. In your decision-making process, take into account not only the price, but also factors such as on-time delivery, quality of inputs, special conditions, among others.

Investing in a financial management technology can make the company’s cost mapping significantly easier. As it is equipped with intelligent algorithms and process automation resources, managers can count on a multitude of solutions for the day-to-day of the company.

Among its benefits, we can mention:

Among many other functions that only a provider of innovative technological solutions for financial management can offer.

As you can see, mapping costs is a comprehensive strategy that aims to increase the managers’ knowledge of the business’s expenses and investments. Relying on technology is the best way to identify and categorize all the organization’s expenses.

Do you want to know more about the MyABCM solutions for mapping costs using technology in your company? Then contact our team so that we can show you the very best in digital innovation for your business!

Technology is present in all sectors of society and has been helping companies to achieve better results, with a reduction in costs. Therefore, the installation of medical software is essential in hospitals and clinics. With it, it is possible to obtain many advantages in management.

But for you to choose the ideal one, according to your demands and infrastructure, you need to follow some tips, like the ones we will show you throughout this post.

Imagine filling out medical appointments on paper, writing charts with pens, and filing documents in physical folders.

In addition to the delay in procedures, there would be an increase in costs and many security risks, not to mention even jeopardizing diagnoses.

By installing medical software, your hospital or clinic will invest in automation, being able to count on online appointments and have access to the status of customers, with all the contact information.

Thus, organization becomes a fact. Another advantage is the electronic medical record, allocating each patient’s information quickly.

As a result, the procedures are done with more quality, increasing efficiency, as the patient data can be consulted in real time, which means that numerous types of errors are avoided. But to choose the ideal software, you need to follow some tips.

Here are some that we have specially selected for your clinic or hospital.

When choosing an Information Technology (IT) service provider, the ideal is to choose a company that has experience in software management.

After all, this is a considerable investment that requires a system that is well-functioning and focused on the reality of your hospital.

Therefore, research the company’s history and consult with other customers to certify its reputation.

The interface is the users’ experience, which means it needs to be easy to understand for employees to adapt quickly.

With that in mind, run tests with the medical software and check if the navigation is smooth, if there are buttons that make the operations easier and the features needed for a hospital or clinic, such as electronic medical record, medical appointments, finances, inventory and registration, among others.

Data security is critical. The software also needs to be stable and have good servers in order to avoid errors at any some point of the day.

As a lot of important patient information is entered into the system, keeping it confidential is essential.

Therefore, in your medical software analysis, you should pay careful attention to operational security.

Throughout its use, it is common for users to have doubts and need some changes from time to time.

There is nothing better than adequate support for everything to work smoothly. Therefore, check if the service provider offers a technical team to solve some issues. Ideally, the support should be 24 hours.

That is because hospitals and clinics operate full time and need special attention with regard to IT.

As each customer has a different reality, you should have a variety of plans in order to choose the ideal one, such as storage capacity, support, features, etc.

Thus, check if the company has this diversity. By following our tips, the chosen medical software will certainly be the ideal one for your company, reducing costs by using technology.

Do you want to improve results in your hospital or clinic? Then contact our team and learn about our plans!

Carrying out a good cost management is not always a simple task for managers. (more…)